Home »

Financial Management in Professional Services – Strategies

Explore effective financial management strategies for professional services.

Introduction

Effective financial management is paramount for the success of any professional services organization. In today’s dynamic business landscape, where competition is fierce and clients demand exceptional value, mastering the intricacies of financial management has become more critical than ever. Professional Services Automation (PSA) plays a pivotal role in streamlining various aspects of service delivery, from project management to resource allocation. However, its impact on financial management often goes underestimated.

This comprehensive article delves into the world of Financial Management in Professional Services, shedding light on its significance and exploring the key strategies that drive success within the context of PSA.

What is Professional Services Automation (PSA)?

Professional Services Automation (PSA) is a specialized software solution designed to streamline and automate various aspects of managing professional services organizations. It serves as a central platform that integrates and optimizes critical business processes, enabling efficient service delivery, resource management, and financial oversight.

PSA is tailored for businesses that offer services such as consulting, IT services, marketing agencies, engineering firms, legal practices, and other professional services. These organizations typically deal with projects, clients, and resources in a dynamic and project-driven environment.

The core functionalities of Professional Services Automation encompass several key areas: Project Management, Resource Management, Time and Expense Tracking & Financial Management

By centralizing and automating these critical processes, Professional Services Automation empowers organizations to optimize service delivery, improve resource allocation, enhance financial control, and elevate overall operational efficiency. It allows businesses to focus on delivering high-quality services, meeting client expectations, and driving sustainable growth in a competitive market.

Understanding Financial Management in PSA

Financial Management in Professional Services Automation (PSA) refers to the process of effectively and strategically managing financial aspects within a professional services organization. It involves the systematic planning, tracking, and control of financial resources to ensure the profitability, efficiency, and sustainability of the business. Some of the key Aspects of Financial Management in PSA:

Financial management begins with creating budgets for projects and operations. Accurate forecasting helps in estimating future revenue, expenses, and resource requirements, enabling better decision-making and resource allocation.

Properly estimating the costs of projects is crucial for pricing services competitively and ensuring profitability. PSA helps in analyzing past projects’ data, considering various factors, and arriving at realistic cost estimates.

PSA streamlines the invoicing process by automating invoice generation based on project milestones or time spent. It also facilitates proper revenue recognition, ensuring that revenue is recognized in accordance with accounting principles and project completion.

Importance of Financial Management in PSA

Financial Management in Professional Services Automation (PSA) holds immense importance for the success and sustainability of professional services organizations. Here are some key reasons why financial management in PSA is crucial:

Financial management in PSA helps control costs by tracking project expenses, managing budgets, and avoiding cost overruns. It also facilitates efficient resource utilization, ensuring that the right resources are allocated to the right projects at the right time.

PSA software provides real-time financial data and reports, enabling businesses to monitor project financials, revenue streams, and expenses as they happen. This empowers decision-makers to make timely adjustments and stay on top of financial performance.

PSA streamlines the invoicing process, ensuring accurate and timely billing based on project milestones or time entries. It also helps in proper revenue recognition, aligning revenue with project completion and financial standards.

Challenges in Financial Management for Professional Services

Financial management in professional services can be complex and challenging due to the unique characteristics of the industry. Here are some common challenges that organizations may face in their financial management processes:

Project Cost Estimation: Accurately estimating project costs can be difficult, especially for complex and long-term projects. Unexpected expenses, scope changes, and evolving requirements can lead to cost overruns if not carefully managed.

Resource Allocation and Utilization: Matching the right resources with the right projects at the right time is crucial for profitability. Ineffective resource allocation can result in underutilized staff or bottlenecks, impacting project timelines and revenue.

Time and Expense Tracking: Accurately tracking time and expenses on projects can be challenging, particularly if manual processes are involved. Incomplete or inaccurate data can lead to billing errors and affect project profitability.

Revenue Recognition: Professional services revenue recognition can be intricate, especially when projects span multiple periods or involve different revenue streams. Ensuring compliance with revenue recognition standards while recognizing revenue at the appropriate time is crucial for financial reporting accuracy.

Managing Project Profitability: Projects with fixed-price contracts can pose challenges in maintaining profitability, as unexpected costs or scope changes can eat into margins. Monitoring project profitability in real-time helps identify potential issues and allows for timely corrective actions.

Key Strategies for Successful Financial Management in PSA

Successful financial management in Professional Services Automation (PSA) involves implementing a set of key strategies to optimize profitability, enhance resource utilization, and ensure financial stability. Here are some essential strategies for achieving success in financial management within the context of PSA:

- Real-Time Financial Reporting and Analysis

- Effective Project Cost Tracking and Control

- Streamlining Invoicing and Billing Processes

By implementing these key strategies, professional services organizations can improve their financial management practices, make informed decisions, and achieve long-term success in a competitive market. PSA software serves as a valuable tool in streamlining financial processes, providing real-time insights, and enabling data-driven financial management.

| Real-Time Financial Reporting and Analysis | Implement real-time financial reporting and analysis to monitor project financials, revenue streams, expenses, and profitability as they occur. This empowers informed decision-making. |

| Effective Project Cost Tracking and Control | Ensure efficient project cost tracking and control. Create comprehensive project budgets and monitor actual expenses against budgets in real-time to identify and control budget overruns. |

| Streamlining Invoicing and Billing Processes | Streamline invoicing and billing processes through automation. Utilize features in PSA software to automate invoicing based on project milestones or time entries, reducing manual effort and ensuring accuracy. |

Financial Reporting and Analysis

Real-time financial reporting and analysis is the process of accessing, interpreting, and presenting financial data as it occurs, without any delay. It enables businesses to monitor their financial performance and make informed decisions based on the most up-to-date information available. Real-time reporting and analysis offer several benefits, particularly in dynamic and fast-paced business environments.

Real-time financial reporting allows stakeholders, including executives, managers, and finance teams, to access critical financial information immediately. This enables them to respond promptly to changing market conditions, emerging opportunities, and potential risks.

With real-time reporting, financial data is continuously updated and accessible in a user-friendly format. This improved visibility enables a comprehensive understanding of the organization’s financial health at any given moment.

Real-time analysis provides accurate insights into key financial metrics, such as revenue, expenses, cash flow, and profitability. Businesses can track performance against targets and identify deviations early on.

Effective Project Cost Tracking and Control

Effective project cost tracking and control are crucial aspects of financial management in professional services organizations. Proper cost tracking and control ensure that projects are completed within budget, profitability is maximized, and financial resources are efficiently utilized.

Create detailed and accurate project budgets that encompass all direct and indirect costs associated with the project. Consider factors such as labor, materials, equipment, travel expenses, and overhead costs.

Clearly define the scope of each project to avoid scope creep, which can lead to additional costs. Scope changes should be managed through a formal change control process to assess their impact on the budget.

Implement a system for real-time time tracking to record the hours spent by employees and contractors on each project. Time tracking provides insights into resource utilization and helps monitor labor costs.

Record and track all project-related expenses, such as travel, vendor costs, and miscellaneous expenses. Accurate expense tracking ensures that all costs are accounted for and included in project budgets.

By implementing these strategies, organizations can effectively track and control project costs, ensuring projects are completed successfully, and financial objectives are met. Effective project cost tracking and control contribute to overall financial stability and long-term profitability for professional services organizations.

Streamlining Invoicing and Billing Processes

Streamlining invoicing and billing processes is essential for professional services organizations to improve cash flow, enhance client satisfaction, and optimize overall financial management. Efficient invoicing and billing procedures reduce administrative burdens, minimize errors, and ensure timely and accurate payment collection.

Implement an automated invoicing system that generates invoices automatically based on predefined rules and project milestones. Automation reduces manual effort and ensures consistency in invoice generation.

Utilize real-time time and expense tracking tools to record billable hours and project-related expenses. Accurate and timely tracking ensures that all billable items are included in the invoices.

Create clear and detailed invoices that include a breakdown of services provided, hours worked, expenses incurred, and any applicable taxes or discounts. Transparency helps clients understand the billing items.

Embracing KEBS for Enhanced Financial Management

KEBS offers a range of features and functionalities that streamline financial processes, improve data accuracy, and provide real-time insights into the organization’s financial performance. Here are some ways in which KEBS can enhance financial management:

- Integrated Financial Data: KEBS integrates financial data with project management, resource allocation, time tracking, and invoicing functionalities. This integration ensures that financial data is automatically updated and reflected accurately across the platform, eliminating the need for duplicate data entry.

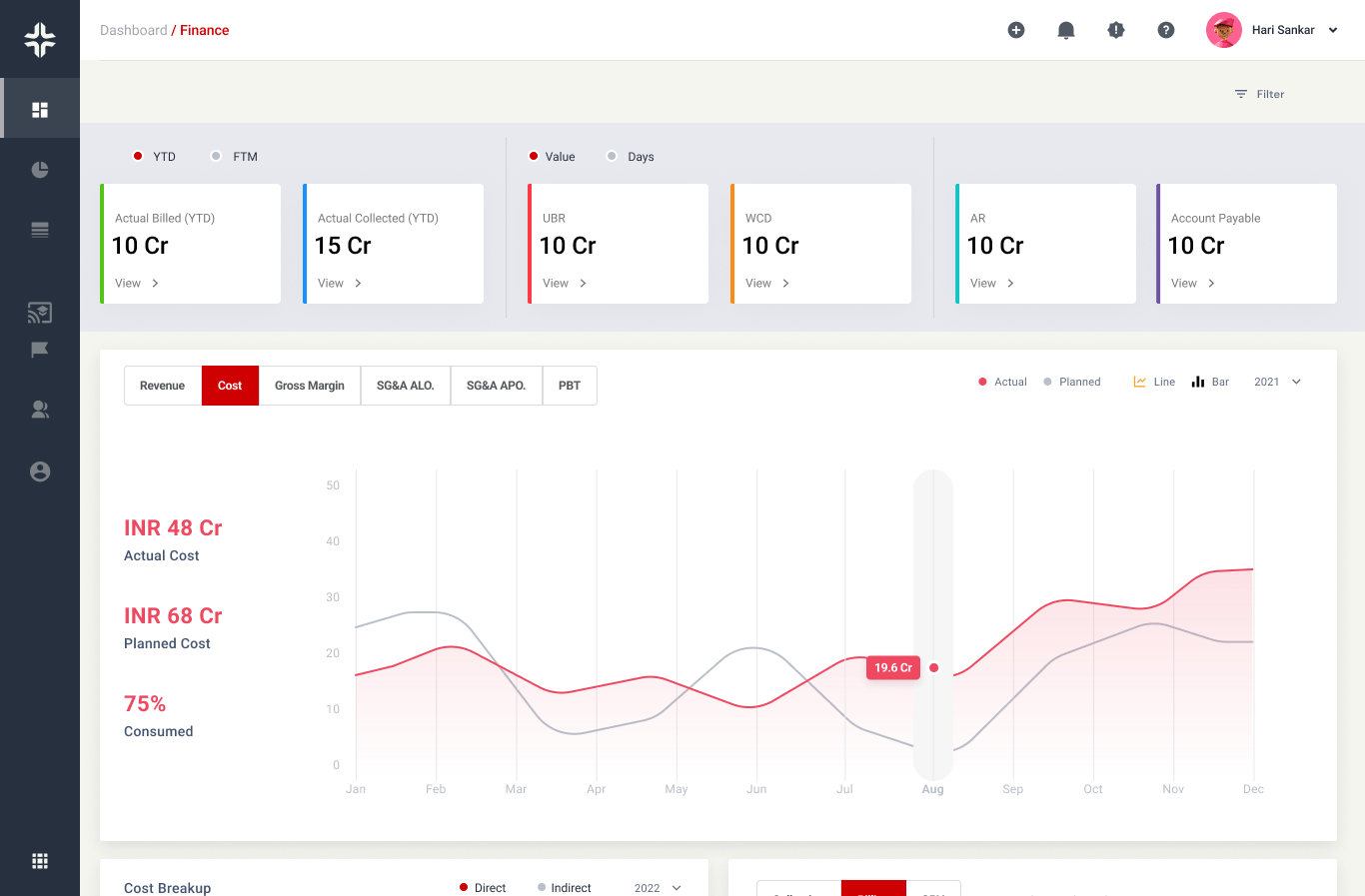

- Real-time Financial Reporting: KEBS provides real-time financial reporting and analytics, allowing stakeholders to monitor project financials, revenue streams, expenses, and profitability as they occur. This empowers decision-makers with up-to-date insights for timely and informed decision-making.

- Project Cost Tracking and Control: With KEBS, project cost tracking and control become more efficient. Comprehensive project budgets can be created, and actual expenses can be monitored against budgets in real-time, enabling effective cost control and early identification of any budget overruns.

- Automated Invoicing: KEBS offers automated invoicing capabilities based on project milestones or time entries. This automation streamlines the invoicing process, reduces manual effort, and ensures accurate and timely billing to clients.

- Resource Allocation Optimization: KEBS assists in optimizing resource allocation by matching the right resources with the right projects based on skills, availability, and project requirements. This helps improve resource utilization and project profitability.

By leveraging the capabilities of KEBS, professional services organizations can optimize financial management, enhance operational efficiency, and make data-driven decisions.

| Integrated Financial Data | KEBS integrates financial data with project management, resource allocation, time tracking, and invoicing functionalities, eliminating the need for duplicate data entry. |

| Real-time Financial Reporting | KEBS provides real-time financial reporting and analytics, empowering decision-makers with up-to-date insights for informed decision-making. |

| Project Cost Tracking and Control | KEBS enables efficient project cost tracking and control. Real-time monitoring of expenses against budgets helps identify budget overruns and control costs. |

| Automated Invoicing | KEBS offers automated invoicing based on project milestones or time entries. This streamlines invoicing, reduces manual effort, and ensures accurate billing. |

| Resource Allocation Optimization | KEBS optimizes resource allocation by matching the right resources to projects based on skills, availability, and requirements, improving utilization and profitability. |

Conclusion

In conclusion, effective financial management is a cornerstone of success for professional services organizations. It encompasses various critical aspects, such as project cost tracking, budgeting, real-time financial reporting, invoicing, and cash flow management. Embracing modern solutions like Professional Services Automation (PSA) software, such as KEBS, can significantly enhance financial management processes.

As the business environment continues to evolve, organizations that prioritize effective financial management through PSA solutions like KEBS are better equipped to navigate challenges, seize opportunities, and achieve long-term success.

Enhance financial management process with KEBS!