Home »

Cash Flow Management in PSA – Strategies for Financial Stability

Master cash flow management strategies in PSA for lasting financial stability.

Introduction

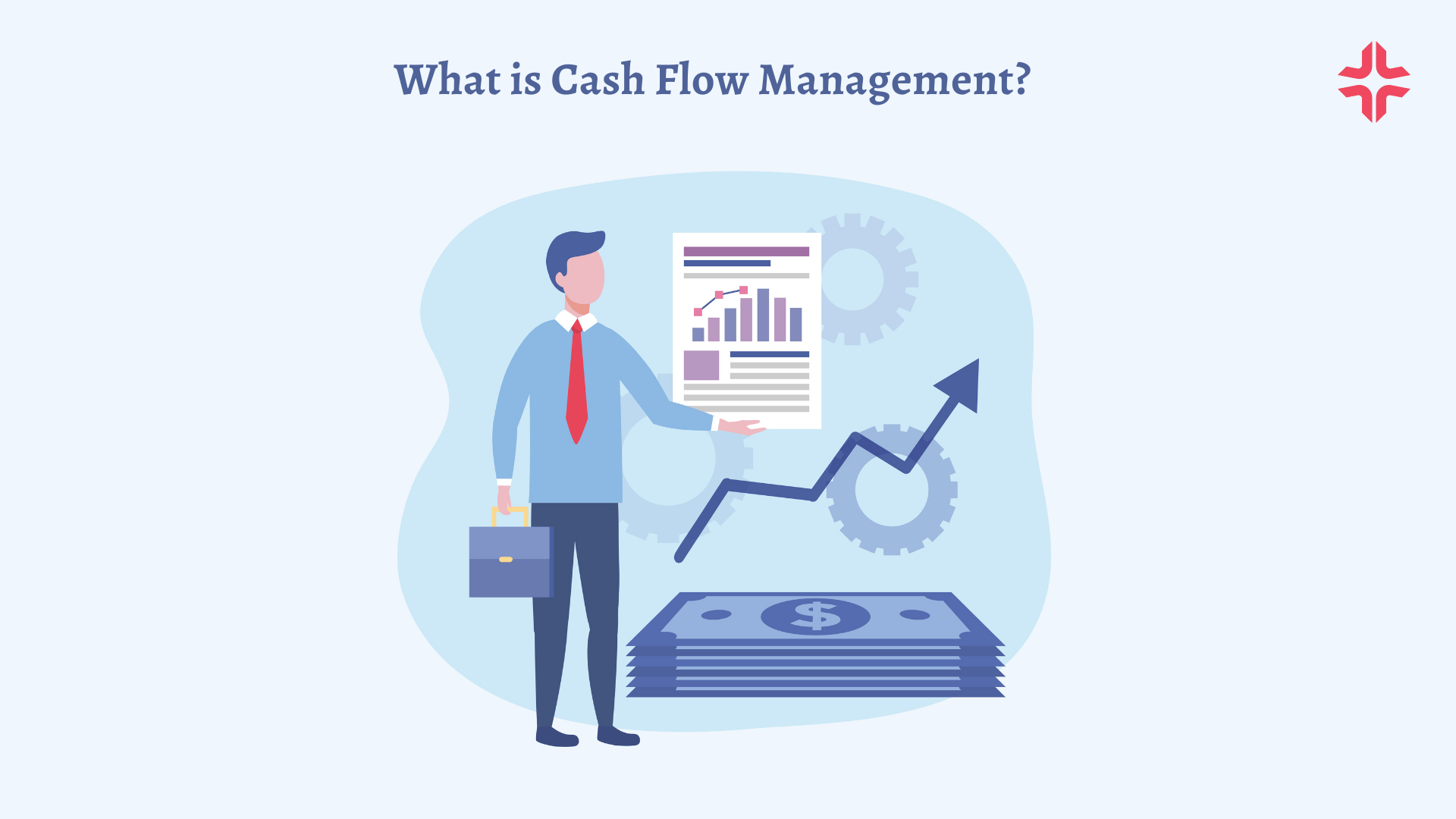

Cash flow management is the process of tracking, forecasting, and managing a company’s cash inflows and outflows. It is an important part of financial planning and helps businesses to ensure that they have enough cash on hand to meet their obligations.

In the public sector, cash flow management is even more important. This is because public sector organizations are often subject to strict regulations that limit their ability to borrow money. As a result, they must be very careful about how they manage their cash flow.

What is Cash Flow Management?

Cash flow management refers to the process of monitoring, analyzing, and controlling the movement of cash into and out of a business or organization. It involves strategically managing the timing and amounts of cash inflows and outflows to ensure a smooth and steady flow of funds. Effective cash flow management is crucial for maintaining financial stability and ensuring the long-term viability of an organization.

Cash flow management involves several key elements. Firstly, it requires accurately forecasting future cash inflows and outflows based on historical data, market trends, and business projections. This helps in identifying potential cash shortages or surpluses and allows for proactive decision-making.

Secondly, cash flow management involves implementing strategies to optimize cash inflows. This includes monitoring and expediting the collection of accounts receivable, negotiating favorable payment terms with customers, and exploring alternative funding sources such as lines of credit or loans.

On the other hand, managing cash outflows involves carefully planning and controlling expenses. This can be achieved by negotiating favorable payment terms with suppliers, streamlining operational processes to reduce costs, and closely monitoring and managing inventory levels.

Steps in Cash flow management

- Tracking cash flows: This involves collecting data on all of the company’s cash inflows and outflows. This data can be collected from a variety of sources, such as bank statements, invoices, and receipts.

- Forecasting cash flows: Once the company has a good understanding of its current cash flow, it can begin to forecast its future cash flows. This is done by projecting future cash inflows and outflows based on historical data and future plans.

- Managing cash flows: The company can then use its forecasts to develop strategies for managing its cash flow. This may involve adjusting its spending, investing in short-term assets, or borrowing money.

| Tracking Cash Flows | Collect data on all cash inflows and outflows from various sources such as bank statements, invoices, and receipts. |

| Forecasting Cash Flows | Predict future cash flows by projecting inflows and outflows using historical data and future plans. |

| Managing Cash Flows | Utilize forecasts to develop strategies for cash flow management, such as adjusting spending, investing, or borrowing. |

Why is Cash Flow Management Important?

Cash flow management is important for a number of reasons. First, it helps businesses to avoid financial problems. If a business does not have enough cash on hand to meet its obligations, it may be forced to declare bankruptcy. Second, cash flow management can help businesses to improve their profitability. By managing their cash flow effectively, businesses can reduce their costs and increase their profits. Third, cash flow management can help businesses to grow. By having a strong cash flow, businesses can invest in new products, services, and markets.

Cash flow management is a critical aspect of financial stability for any organization, including professional service firms like PSA (Professional Services Agency). It refers to the process of monitoring, analyzing, and optimizing the inflow and outflow of cash within a business.

Effective cash flow management is vital for several reasons. Firstly, it provides a clear understanding of the financial health of the organization. By closely monitoring cash flow, PSA can identify any potential cash shortages or surpluses, enabling proactive decision-making and planning.

Furthermore, cash flow management ensures that the company has enough liquidity to meet its financial obligations, such as paying employees, suppliers, and other expenses. It helps prevent cash shortages that could lead to missed payments, damaged relationships, or even bankruptcy.

Maintaining a positive cash flow also allows PSA to take advantage of growth opportunities and invest in strategic initiatives. It provides the financial flexibility to fund research and development, expand operations, hire new talent, or pursue new markets.

In addition, effective cash flow management allows for better financial forecasting and budgeting. By understanding the cash inflows and outflows, PSA can create accurate financial projections, identify potential cash gaps, and adjust spending accordingly.

Overall, cash flow management is essential for the long-term financial stability and success of PSA. It provides the necessary visibility, control, and flexibility to navigate economic uncertainties, optimize resource allocation, and sustain a healthy financial position.

Strategies for Cash Flow Management in PSA

Effective cash flow management is crucial for maintaining financial stability in any organization, and this holds true for Professional Services Automation (PSA) firms as well. PSA firms, which rely on project-based revenue streams, need to adopt strategies that optimize their cash flow to ensure smooth operations and long-term sustainability. Here are some key strategies for cash flow management in PSA:

Accurate Forecasting: Develop robust forecasting models that provide a clear picture of future cash inflows and outflows. This involves analyzing historical data, project pipelines, and client payment patterns to anticipate cash flow fluctuations accurately.

- Streamlined Invoicing: Implement streamlined invoicing processes to minimize delays in receiving payments. Ensure that invoices are promptly and accurately generated, clearly stating the terms and payment deadlines. Consider utilizing automated billing systems to streamline the invoicing process further.

- Payment Terms and Policies: Establish clear payment terms and policies with clients upfront. Negotiate shorter payment cycles and incentivize early payments with discounts or other benefits. This can help accelerate cash inflows and reduce the average collection period.

- Efficient Expense Management: Monitor and control expenses diligently to optimize cash outflows. Implement cost-saving measures, negotiate favorable vendor terms, and regularly review expenditure to identify areas for improvement.

- Cash Reserve Management: Maintain a cash reserve or contingency fund to handle unforeseen expenses or revenue shortfalls. This acts as a financial buffer during challenging times and helps mitigate cash flow disruptions.

- Working Capital Optimization: Analyze and optimize the management of working capital components, such as accounts receivable, accounts payable, and inventory. Streamline processes, negotiate extended payment terms with suppliers, and implement effective credit control measures.

| Streamlined Invoicing | Implement efficient invoicing processes to reduce delays in receiving payments. Use automated billing systems for quicker and accurate invoice generation. |

| Payment Terms and Policies | Set clear payment terms and policies with clients. Encourage early payments with discounts and negotiate shorter payment cycles to accelerate cash inflows. |

| Efficient Expense Management | Monitor and manage expenses rigorously to optimize cash outflows. Implement cost-saving measures and regularly review expenditure to identify areas for improvement. |

| Cash Reserve Management | Maintain a cash reserve or contingency fund to handle unexpected expenses or revenue shortfalls. This provides a financial buffer during challenging times. |

| Working Capital Optimization | Optimize working capital components like accounts receivable, accounts payable, and inventory. Streamline processes and negotiate favorable terms with suppliers for better cash management. |

By implementing these strategies, PSA firms can enhance their cash flow management, ensure financial stability, and position themselves for long-term success in a dynamic business environment.

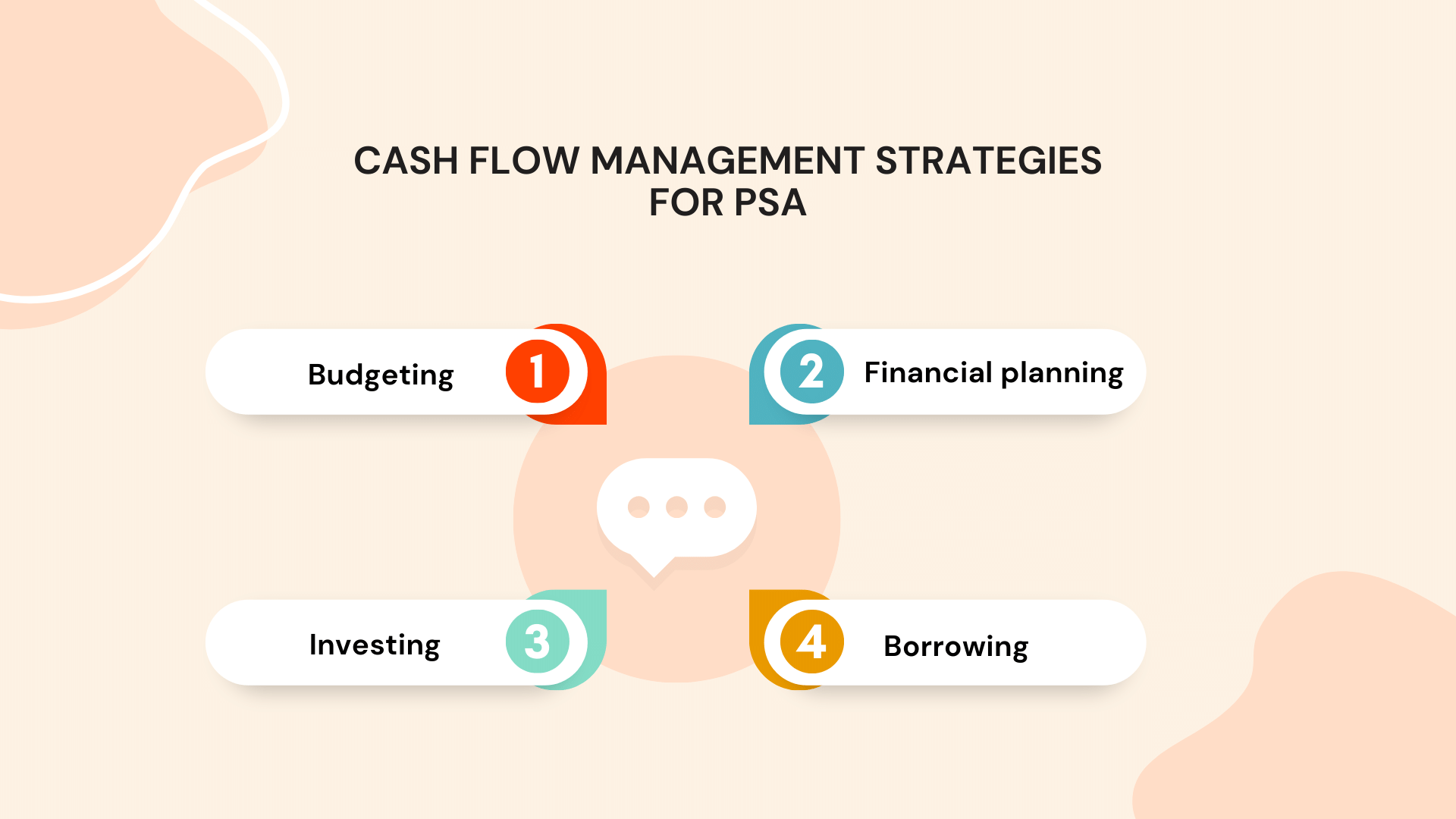

There are a number of strategies that PSAs can use to manage their cash flow. These include:

- Budgeting: PSAs should develop a budget that outlines their expected cash inflows and outflows. This will help them to track their cash flow and identify any potential problems.

- Financial planning: PSAs should develop a financial plan that outlines their long-term financial goals. This will help them to make decisions about how to manage their cash flow in order to achieve their goals.

- Investing: PSAs can invest their excess cash in short-term assets, such as treasury bills or money market funds. This will help them to earn interest on their cash and ensure that they have enough money on hand to meet their obligations.

- Borrowing: If a PSA does not have enough cash on hand to meet its obligations, it may need to borrow money. However, PSAs should only borrow money as a last resort, as this can lead to debt problems.

How to Implement Cash Flow Management Strategies

The best way to implement cash flow management strategies is to develop a comprehensive plan that outlines the specific steps that the PSA will take. This plan should be tailored to the specific needs of the PSA and should be reviewed on a regular basis to ensure that it is still effective.

Implementing effective cash flow management strategies is crucial for maintaining financial stability in any organization, including in the context of a Professional Services Automation (PSA) environment. By closely monitoring and controlling cash inflows and outflows, businesses can ensure they have sufficient funds to meet their obligations and seize growth opportunities. Here are some key steps to implement cash flow management strategies in PSA:

- Understand your cash flow: Begin by analyzing your historical cash flow data to identify patterns and trends. Evaluate the timing and magnitude of cash inflows and outflows, and categorize them into different sources and uses.

- Forecast cash flow: Develop accurate cash flow forecasts by considering factors such as revenue projections, expenses, and payment terms. Use historical data, industry benchmarks, and market trends to make reliable predictions.

- Monitor receivables and payables: Stay on top of your accounts receivable and accounts payable. Implement robust invoicing systems and ensure prompt billing and collections. Negotiate favorable payment terms with suppliers to optimize cash flow.

- Optimize working capital: Review your inventory levels, production processes, and procurement strategies to minimize tied-up capital. Streamline operations, reduce excess inventory, and negotiate extended payment terms with suppliers.

- Control expenses: Scrutinize your expenses and identify areas where cost reductions are possible without compromising quality or productivity. Implement cost-cutting measures, negotiate better vendor contracts, and consider alternative suppliers.

- Establish cash reserves: Set aside funds as a safety net for unexpected expenses or business fluctuations. Maintain an emergency fund that can cover several months’ worth of operating expenses.

- Leverage technology: Utilize PSA software tools that offer integrated financial management features. These platforms can provide real-time visibility into cash flow, automate invoicing and payment processes, and generate comprehensive reports for analysis.

By implementing these cash flow management strategies in a PSA setting, organizations can achieve financial stability, enhance decision-making, and position themselves for long-term success in a dynamic business landscape.

The Benefits of Effective Cash Flow Management

Effective cash flow management can provide a number of benefits for PSAs, including:

- Reduced financial risk: By managing their cash flow effectively, PSAs can reduce their risk of financial problems.

- Improved profitability: By reducing their costs and increasing their profits, PSAs can improve their bottom line.

- Increased growth opportunities: By having a strong cash flow, PSAs can invest in new products, services, and markets.

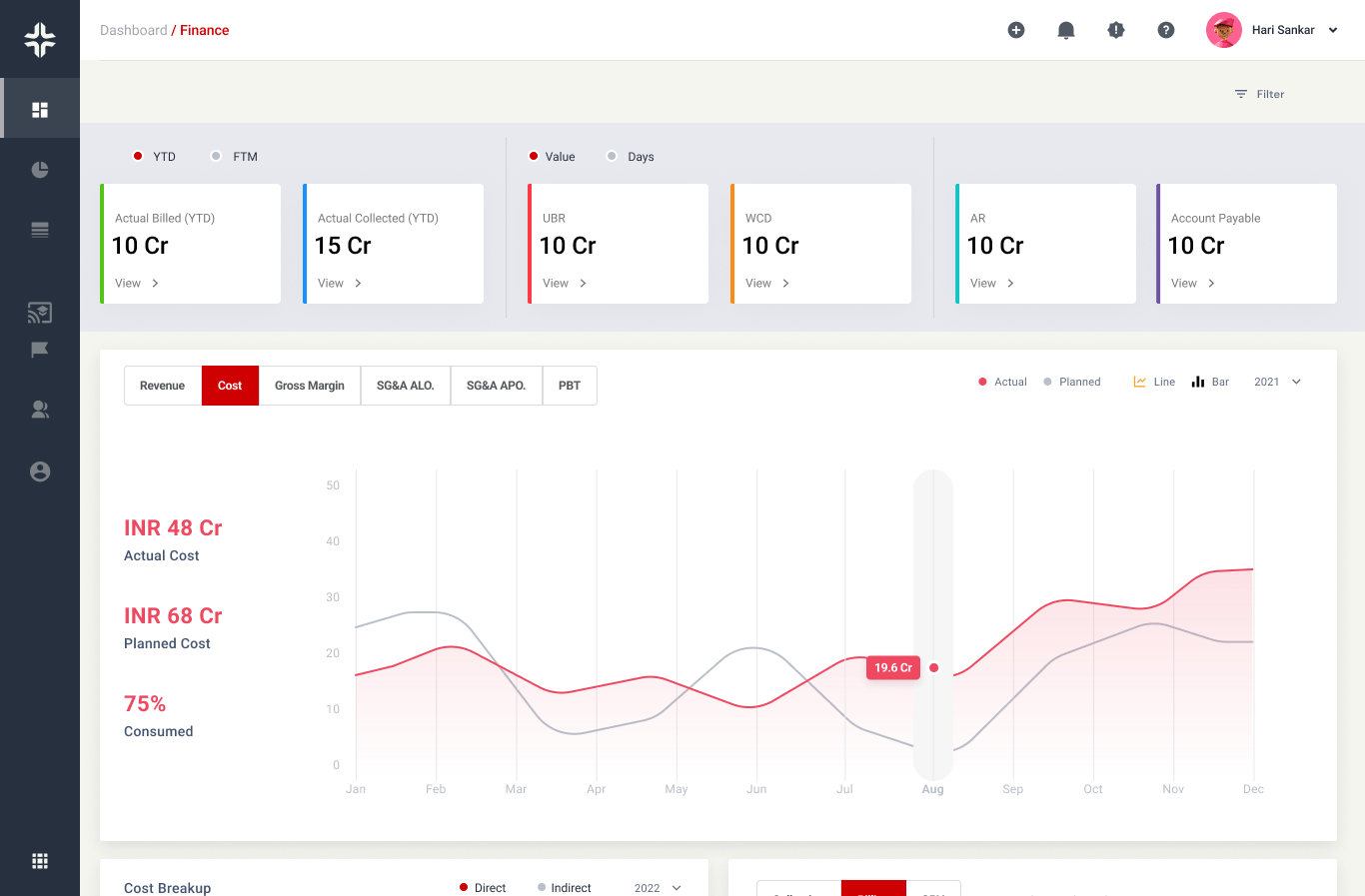

Achieve Budget Optimization & Revenue Maximization with KEBS

KEBS assesses & analyzes the financial health of your organization by generating timely reports using the Finance data.

- MIS report

- Cash flow statements

- Working capital report

- Account Payable report

- Account Receivable (AR) report

- Expense report

Conclusion

Cash flow management is an important part of financial planning for PSAs. By developing and implementing effective cash flow management strategies, PSAs can reduce their financial risk, improve their profitability, and increase their growth opportunities.

Take control of your finances and streamline financial processes using KEBS!