What Is Account Payable Aging (APA)?

Account Payable Aging, or APA, is a financial management tool that categorizes a company’s accounts payable according to the length of time an invoice has been outstanding. It’s an essential part of financial analysis, offering a detailed look at when a company’s short-term obligations are due.

The four common categories used are: 0-30 days, 31-60 days, 61-90 days, and 90+ days.

Why Account Payable Aging is So Essential?

APA is not just an accounting term. It’s a key tool in the hands of financial managers, enabling them to manage cash flow effectively and maintain healthy relationships with suppliers. A well-monitored

APA report can alert managers to potential cash flow issues and prevent late payment penalties. Moreover, suppliers often assess a company’s creditworthiness based on their account payable aging schedule, making APA a key factor in maintaining business relationships.

How to Calculate Account Payable Aging with Formula and Example

To construct the APA report, first categorize your outstanding invoices into the four categories mentioned earlier. Then, calculate the total amount due in each category.

Here is the formula to calculate account payable aging with an example:

Account Payable Aging Formula:

Aging Bucket % = (Amount in Aging Bucket / Total Amount Payable) x 100

Example:

A company has the following account payables:

Current (0-30 days): $50,000

31-60 days: $30,000

61-90 days: $20,000

Over 90 days: $10,000

Total Amount Payable: $50,000 + $30,000 + $20,000 + $10,000 = $110,000

To calculate the aging percentages:

Current (0-30 days) Aging %

= (Amount in Bucket / Total Amount Payable) x 100

= ($50,000 / $110,000) x 100

= 45.45%

31-60 days Aging %

= ($30,000 / $110,000) x 100

= 27.27%

61-90 days Aging %

= ($20,000 / $110,000) x 100

= 18.18%

Over 90 days Aging %

= ($10,000 / $110,000) x 100

= 9.09%

So in this example, 45.45% of the total account payables are current, 27.27% are 31-60 days, and so on.

Account Payable Aging vs Account Receivable Aging

While APA focuses on the money a company owes to its suppliers, Account Receivable Aging (ARA) deals with the money owed to the company by its customers. Both are essential for effective cash flow management. While a well-maintained APA helps avoid late payment penalties and maintain supplier relationships, an effective ARA helps ensure timely collections and maintains a steady cash flow.

Accounts Payable (AP) Aging and Accounts Receivable (AR) Aging are financial management tools that monitor the timeliness of payments. AP Aging breaks down the amounts a company owes to its suppliers, indicating how long those bills have been outstanding. On the other hand, AR Aging details money owed to the company by its customers, showcasing the duration of outstanding invoices.

| Financial Metric | Definition | Purpose |

|---|---|---|

| Account Payable Aging | Explains when debts are payable. | Enables businesses to plan for short-term obligations and manage supplier relationships. |

| Cash Flow | Shows the overall cash movement in a business. | Offers insights into the inflow and outflow of cash, facilitating better financial planning. |

| Working Capital | Difference between a company’s immediate assets and immediate debts. | Assists in evaluating a company’s operational efficiency and short-term financial performance. |

How Is Account Payable Aging Used?

Account Payable Aging is used in various ways:

Cash Flow Management: By understanding when payments are due, businesses can better plan their cash outflows.

Supplier Relationship Management: Timely payments keep suppliers happy, which can lead to better terms and maintain the supply chain.

Risk Management: APA can indicate potential cash flow problems if the number of debts due in the short term is too high.

Account Payable Aging vs Cash Flow vs Working Capital

While APA, cash flow, and working capital are all crucial financial indicators, they serve different purposes. APA explains when debts are payable.

Cash flow shows the overall cash movement in a business. Working capital is the contrast between a company’s immediate assets and immediate debts. All three need to be managed effectively for business sustainability.

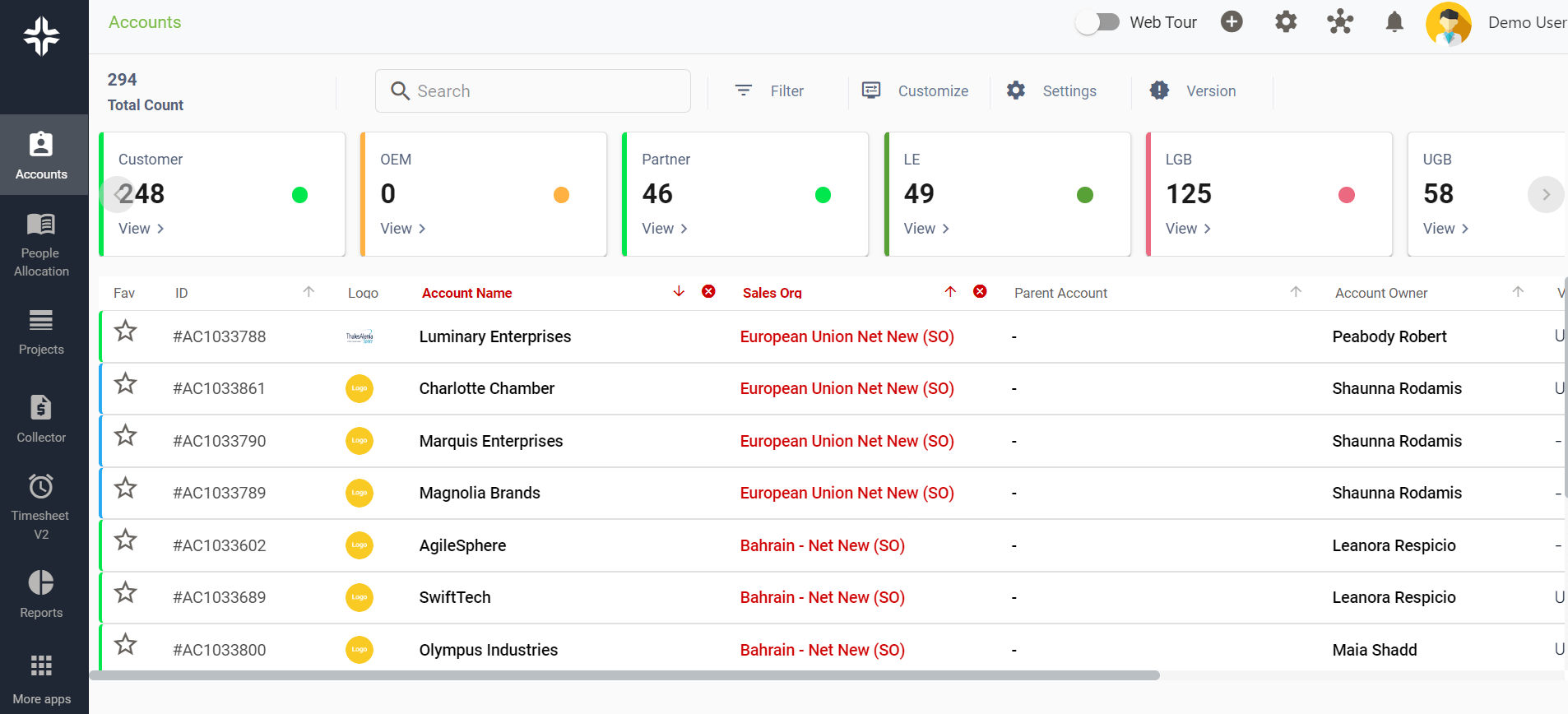

Optimize Your Account Payable Aging with KEBS

KEBS, a leading PSA software, can streamline your account payable aging process. Its advanced automation features can generate real-time APA reports, giving you a clear picture of your financial obligations. By optimizing your APA with KEBS, you can predict your future cash flow, maintain supplier relationships, and ensure your business’s financial health. Don’t just manage your APA, optimize it with KEBS!

KEBS Finance Management

Experience a KEBS Demo if you have any questions, need assistance, or want to get in touch with KEBS, don’t hesitate to contact us.