Home » PSApedia

Account Receivable Aging

Importance of Account Receivable Aging and Elevate Account Receivable.

What Is Account Receivable Aging?

Account Receivable Aging, often simply referred to as Aging, is a process in financial accounting that categorizes a company’s accounts receivable by the length of time an invoice has been outstanding.

This technique helps businesses to identify invoices that are overdue for payment.

Why Is Account Receivable Aging Important?

The relevance of Account Receivable Aging lies in its ability to pinpoint potential cash flow issues. By segregating receivables based on their age, businesses can identify customers who consistently pay late or are likely to default, enabling them to take timely action.

Regularly monitoring the aging schedule can also support the company’s credit policy adjustments and contribute to better financial health.

Importance of ARA

How to Calculate Account Receivable Aging?

Here is the formula to calculate account receivable aging with an example:

Account Receivable Aging Formula:

Aging Bucket % = (Amount in Aging Bucket / Total Amount Receivable) x 100

Example:

A company has the following account receivables:

Current (0-30 days): $50,000

31-60 days: $30,000

61-90 days: $20,000

Over 90 days: $10,000

Total Amount Receivable: $50,000 + $30,000 + $20,000 + $10,000 = $110,000

To calculate the aging percentages:

Current (0-30 days) Aging %

= (Amount in Bucket / Total Amount Receivable) x 100

= ($50,000 / $110,000) x 100

= 45.45%

31-60 days Aging %

= ($30,000 / $110,000) x 100

= 27.27%

61-90 days Aging %

= ($20,000 / $110,000) x 100

= 18.18%

Over 90 days Aging %

= ($10,000 / $110,000) x 100

= 9.09%

So in this example, 45.45% of the total account receivables are current, 27.27% are 31-60 days, and so on.

How to Create an Account Receivable Aging Report

An Account Receivable Aging Report is generally broken down into columns that represent aging periods such as 0-30 days, 31-60 days, and so on. By leveraging a clear view of your receivables age through software tools like Gantt charts or resource allocation tools, businesses can efficiently categorize and track their invoicing.

In the below example, Company B has an invoice over 90 days old, which might be a cause for concern.

| Customer | 0-30 days | 31-60 days | 61-90 days | Over 90 days |

|---|---|---|---|---|

| Company A | $2000 | $1000 | $0 | $0 |

| Company B | $3000 | $0 | $500 | $1000 |

The Difference Between Account Receivable Aging and Account Receivable Turnover

While both Account Receivable Aging and Account Receivable Turnover are methods used to manage receivables, they serve different purposes.

Aging focuses on the overdue status of specific invoices, allowing businesses to follow up on late payments using strategies like efficient project financial management. On the other hand, Account Receivable Turnover measures the effectiveness of deal management in ensuring timely payments.

How Is Account Receivable Aging Used?

Account Receivable Aging is used to manage and improve a company’s cash flow. By identifying late payers or potential defaults, companies can streamline their follow-up process using ticket management systems.

Moreover, with insights from resource management tools, companies can also ensure optimal allocation of resources towards collections.

Account Receivable Aging vs. Cash Flow vs. Profitability

| Accounts Receivable Aging | Cash Flow | Profitability |

|---|---|---|

| 30 days | $10,000 | 10% |

| 60 days | $8,000 | 8% |

| 90+ days | $5,000 | 5% |

While Account Receivable Aging, Cash Flow, and Profitability are all crucial financial aspects, they each play different roles. For instance, understanding and optimizing billable and non-billable hours can impact both cash flow and profitability.

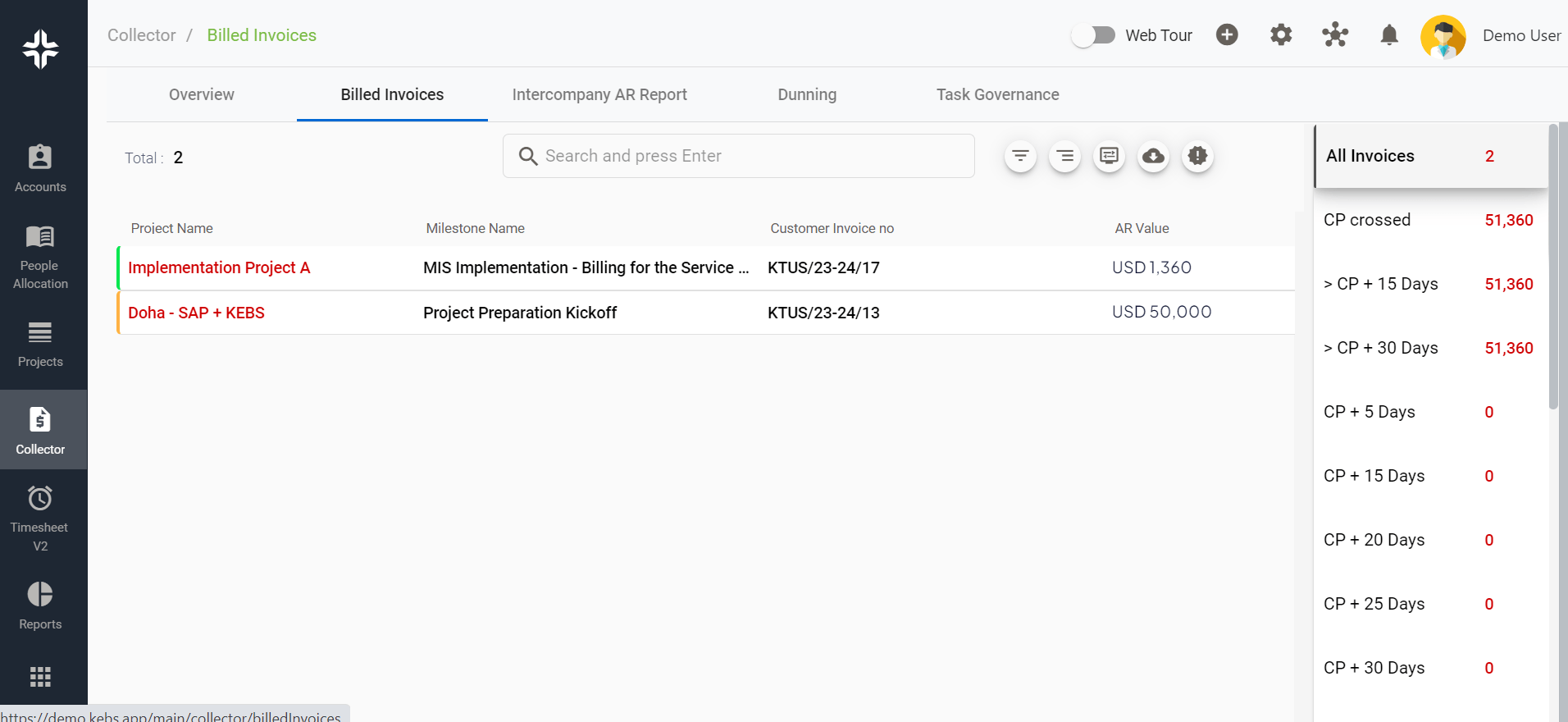

Harness Your Account Receivable Aging with KEBS

KEBS, an industry-leading PSA software, offers robust tools for managing your Account Receivable Aging. With KEBS, you can automate your aging reports, receive alerts for overdue invoices, and streamline your follow-up process.

By offering a clear view of your receivables age, KEBS helps you take control of your cash flow, reduce the risk of bad debts, and drive your business towards financial success.

KEBS Finance Management

Ready to experience the full potential of KEBS? Contact us today or schedule a demo now.