Home » PSApedia

Accounts Receivable Turnover Days

Accounts Receivable Turnover Days - Essential for gauging company liquidity.

What is Accounts Receivable Turnover Days?

Accounts Receivable Turnover Days, often referred to as Days Sales Outstanding (DSO), represents the average number of days it takes a company to collect payments after a sale has been made. This metric provides insights into the effectiveness of a company’s credit and collection policies.

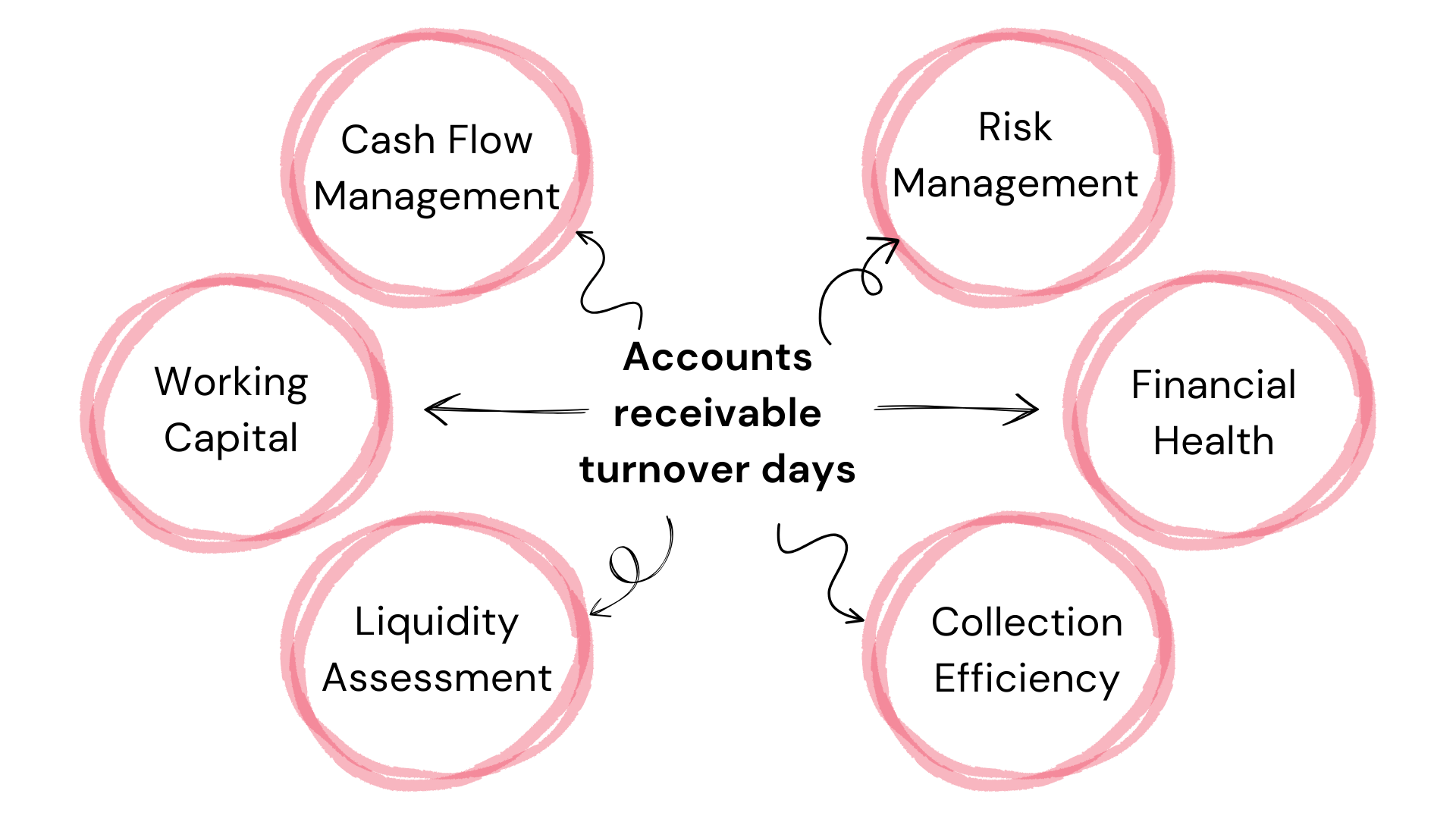

Importance of Accounts Receivable Turnover Days

Understanding and monitoring this metric is crucial for businesses for several reasons:

1. Cash Flow Management: A lower DSO indicates that a company collects its outstanding receivables more quickly, positively impacting cash flow. Efficient cash flow management is vital for sustaining operations and funding growth initiatives.

2. Credit Policies: It reflects the efficiency of a company’s credit policies. If the DSO is high, it might indicate that the company’s credit terms are too lenient.

3. Financial Health: A consistently high DSO can be a red flag, indicating potential issues with customer satisfaction or the quality of the company’s client base.

Importance of Accounts Receivable Turnover Days

How to Calculate Accounts Receivable Turnover Days

Formula:

DSO= (Accounts Receivable/Total Credit Sales) ×Number of Days

Example:

Let’s say a company has an Accounts Receivable of $5,000, Total Credit Sales of $50,000, and we’re calculating DSO for a month (30 days).

DSO= (5000/50000) ×30=3

This means it takes the company an average of 3 days to collect its receivables.

Difference Between Accounts Receivable Turnover Days and Other Metrics

Accounts Receivable Turnover Ratio: While DSO measures the number of days it takes to collect receivables, the turnover ratio indicates how many times a company can turn its receivables into cash over a period. A higher turnover ratio is preferable as it indicates that the company collects its receivables more frequently.

Cash Conversion Cycle (CCC): CCC measures the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales. DSO is a component of CCC, along with Days Inventory Outstanding and Days Payable Outstanding.

| Metric | Description | Purpose | Key Difference from AR Turnover Days |

|---|---|---|---|

| Accounts Receivable Turnover Days | Measures the average time it takes to collect payment for services rendered. | Evaluating the efficiency of cash flow and credit management. | Focuses on the payment collection process specifically. |

| Utilization Rate | Measures the percentage of billable hours used compared to the total available hours. | Assessing the productivity and efficiency of billable resources. | Centers on resource allocation and productivity, not payment collection. |

| Billable Hours | Records the total hours spent on billable client work. | Tracking the work effort and capacity utilization of the service team. | Concentrates on the actual hours worked, not payment timelines. |

| Average Revenue per User (ARPU) | Calculates the average revenue generated per client or user. | Evaluating the value of individual clients or user segments. | Reflects revenue generation but does not consider payment collection timelines. |

How Accounts Receivable Turnover Days is Used

1. Benchmarking: Companies often compare their DSO with industry averages or competitors to gauge their performance. A DSO significantly higher than the industry average might indicate inefficiencies in the collection process.

2. Financial Analysis: Investors and creditors use DSO to assess the liquidity risk associated with a company. A rising DSO can be a sign of deteriorating liquidity.

3. Operational Decisions: Based on DSO, companies might decide to revise their credit policies, enhance their collection efforts, or even re-evaluate their client base.

Ready to optimize your Accounts Receivable Turnover Days?

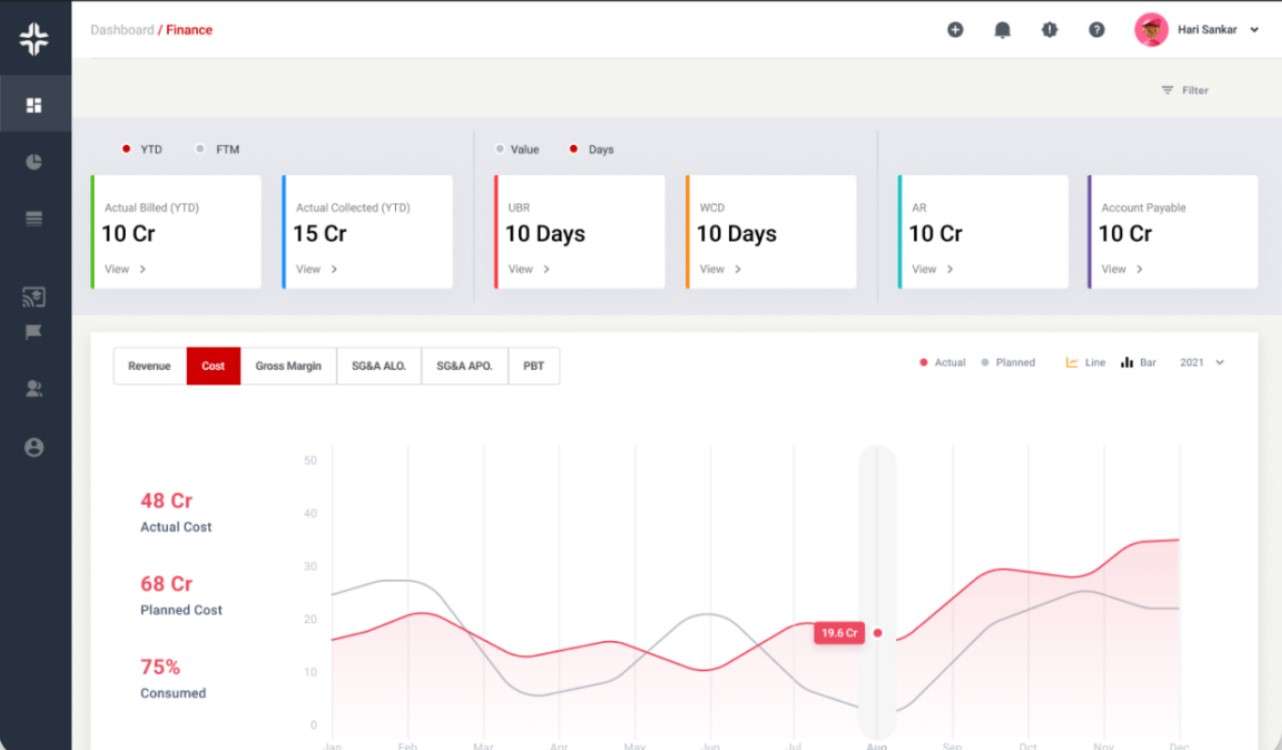

KEBS, a leading Professional Service Automation (PSA) software, offers tools that can help businesses optimize their Accounts Receivable Turnover Days. With KEBS, businesses can automate their invoicing processes, ensuring timely billing and potentially faster payments.

KEBS offers real-time reporting analytics, allowing businesses to monitor their DSO and take corrective actions promptly. By streamlining project financials, businesses can ensure that projects remain profitable and that there are no delays in billing due to project-related issues. KEBS automated revenue recognition in accounting tools ensures that there are no discrepancies in financial data, leading to accurate and timely invoicing.

KEBS Finance Management

Ready to optimize your Accounts Receivable Turnover Days? Contact KEBS today or request a demo to see how KEBS can transform your financial management processes.