Home » PSApedia

Average Hourly Rate

Uncover Insights on Average Hourly Rate. Fine-Tune Your Billing and Maximize Value.

What Is Average Hourly Rate?

Average Hourly Rate is a fundamental financial metric in Professional Service Automation (PSA). It represents the average amount charged or earned per hour of service and is a key indicator of pricing efficiency and service value in a professional services firm.

It’s a pivotal figure in various sectors, especially in professional service automation (PSA), where it helps in gauging the cost-effectiveness and profitability of services rendered.

The Significance of Average Hourly Rate in PSA

Effective management of this metric is essential for maintaining financial health and competitive positioning. Understanding the average hourly rate is crucial for businesses, particularly in sectors like professional services, where labor costs significantly impact the overall financial health. It aids in:

1. Budgeting and Forecasting: Accurate hourly rates are essential for creating realistic budgets and forecasts.

2. Pricing Strategies: Businesses can set competitive prices while ensuring profitability.

3. Employee Compensation: Helps in determining fair wages and salaries.

4. Pricing Strategy: Guides the formulation of effective and competitive pricing models.

5. Profitability Assessment: A crucial indicator for evaluating the profitability of services.

The Significance of Average Hourly Rate in PSA

Calculating the Average Hourly Rate

Formula: Average Hourly Rate = Total Revenue / Total Billable Hours

Example: Suppose a consulting firm generates $30,000 from 250 billable hours. The Average Hourly Rate would be:

$30,000 / 250 hours = $120/hour

This figure indicates that the firm’s services are billed at an average of $120 per hour.

Average Hourly Rate vs Other Financial Metrics

Understanding these distinctions aids in comprehensive financial management in PSA. The average hourly rate often gets compared with metrics like annual salary and project-based fees. Unlike annual salaries, which are fixed, hourly rates offer flexibility and can be more reflective of the actual work done. In contrast to project-based fees, hourly rates provide a clear understanding of labor costs, aiding in financial management. The Average Hourly Rate should be differentiated from metrics such as:

1. Billable Utilization: This focuses on the ratio of billable hours to total available hours, not the revenue aspect.

2. Overall Revenue: It provides a global view of income but doesn’t reflect the efficiency or value per service hour.

| Financial Metric | Definition | Usefulness | Limitations/Considerations |

|---|---|---|---|

| Average Hourly Rate (AHR) | Total revenue divided by total hours worked | Helps in assessing labor efficiency and cost effectiveness | May not reflect individual employee productivity, doesn’t account for non-hourly revenue sources |

| Revenue | Total income generated by the business | Provides an overall view of business performance | Does not consider costs or profitability |

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Measures profitability after accounting for direct costs | Ignores operating expenses and other indirect costs |

| Net Profit Margin | Net Profit / Revenue | Evaluates overall profitability after all expenses | Doesn’t provide insight into the efficiency of resource utilization |

Implementing Average Hourly Rate in PSA

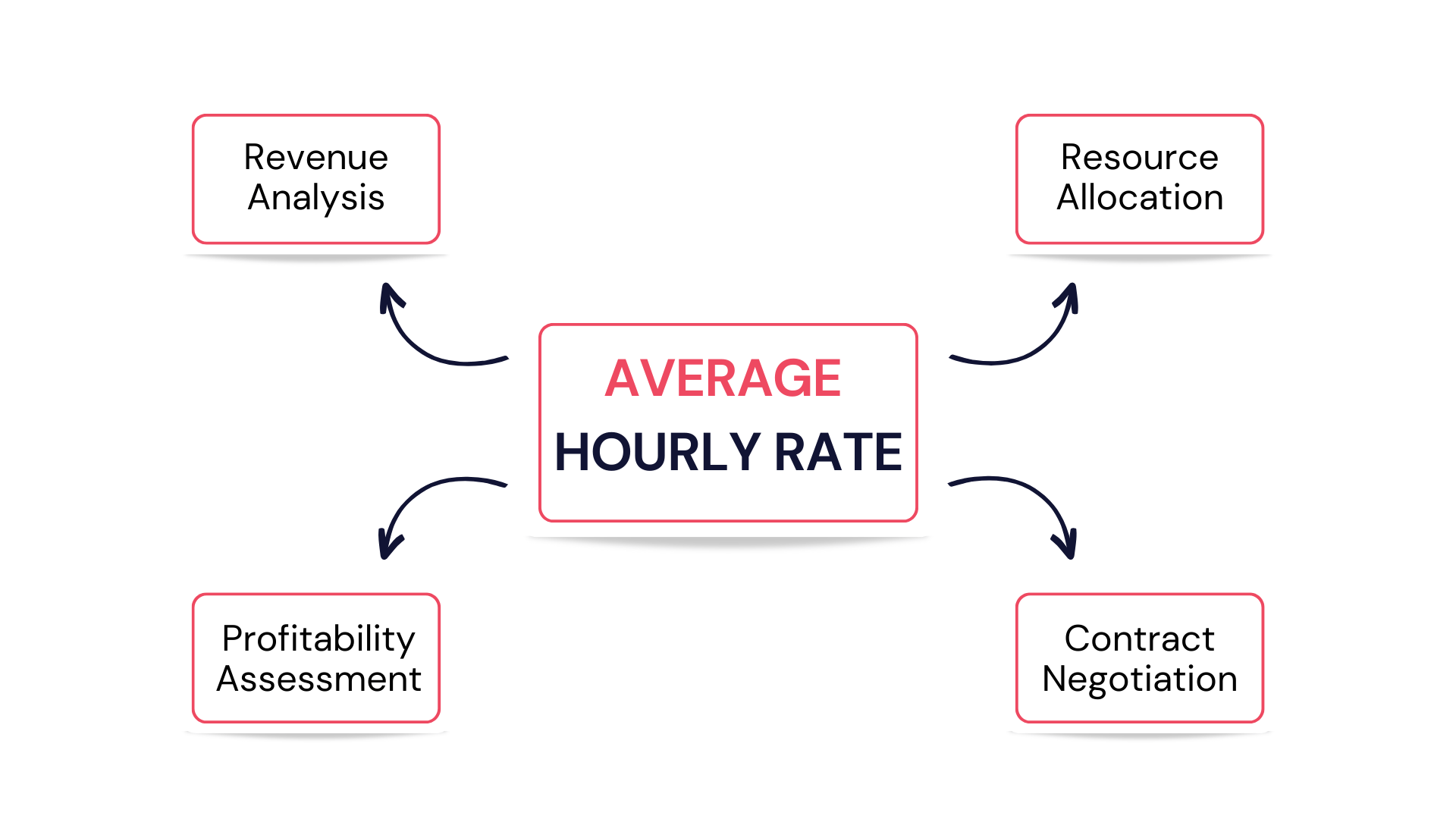

In business, particularly in service automation, the average hourly rate is used for:

1. Project Costing: Estimating the labor cost of projects.

2. Billing Clients: Setting billable rates for services.

3. Financial Analysis: Assessing the profitability of different services or departments.

4. Strategic Decisions: Aids in making informed decisions about service pricing and project planning.

5. Evaluating Service Lines: Assesses which services or professionals deliver higher profitability.

6. Client Negotiations: Provides a basis for discussions around service value and billing terms.

7. Performance Benchmarking: Facilitates setting and comparing performance standards.

Ready to Optimize Your Average Hourly Rate?

Utilizing a sophisticated tool like KEBS can greatly enhance the management of the Average Hourly Rate. KEBS Simplifies the process of tracking time and revenue, offering immediate insights. Seamlessly combines with timesheet and billing software for accurate invoicing.

Provides analytics to help develop and refine pricing strategies. Enables tailored reporting for better financial monitoring and decision-making.

KEBS Finance Management

To understand how KEBS can elevate your Average Hourly Rate strategy, feel free to contact us or experience its capabilities through a demo.