Home » PSApedia

Average Outstanding Balance

Discover Average Outstanding Balance Insights. Optimize Cash Flow and Minimize Financial Risk.

What is the Average Outstanding Balance?

The average outstanding balance refers to the average amount owed by a borrower over a specific period. It’s often used by financial institutions to gauge credit risk and by individuals or businesses to manage their finances more effectively.

Understanding this concept is crucial, as it directly impacts credit scores and financial health.

The Importance of Managing Average Outstanding Balance

Effectively managing the average outstanding balance is vital for several reasons. For individuals, it helps in maintaining a good credit score, which is essential for loan approvals at favorable interest rates. For businesses, it ensures healthy cash flow and financial stability, allowing for better planning and investment decisions. Moreover, a well-managed balance can save on interest costs and help avoid debt accumulation.

Monitoring the Average Outstanding Balance is critical for both lenders and borrowers. For lenders, it provides insights into credit risk and helps in decision-making regarding loan provisions or interest rates. For borrowers, understanding their average outstanding balance aids in better debt management and financial planning in Professional Services.

The Importance of Managing Average Outstanding Balance

How to calculate Average Outstanding Balance?

The Average Outstanding Balance can be calculated using the formula:

Average Outstanding Balance = Sum of Daily Balances / Number of Days in the Period

For example, if a borrower has balances of $1,000, $1,200, and $1,500 over a 30-day period, the average outstanding balance would be:

1000 + 1200 + 1500/30 = 3700/30 = 123.33

This means the average amount owed per day over this period is $123.33.

Differences Between Average Outstanding Balance Related Financial Metrics

The average outstanding balance differs from other financial metrics like total debt and monthly balance. Total debt refers to the total amount owed, irrespective of the period, while monthly balance is the amount owed at the end of a particular month. Understanding these differences helps in better financial planning and credit management.

Businesses use the Average Outstanding Balance to gauge the financial health of their customers, especially in sectors like banking or credit services.

| Metric | Definition | Importance/Use |

|---|---|---|

| Average Outstanding Balance | The average amount of money owed or remaining unpaid | Indicates the average level of debt or credit outstanding over a period |

| Accounts Receivable Turnover Ratio | The number of times a company collects its average accounts receivable during a period | Reflects how efficiently a company collects outstanding balances |

| Days Sales Outstanding (DSO) | Average number of days it takes to collect payment after a sale | Measures the average time taken to convert sales into cash |

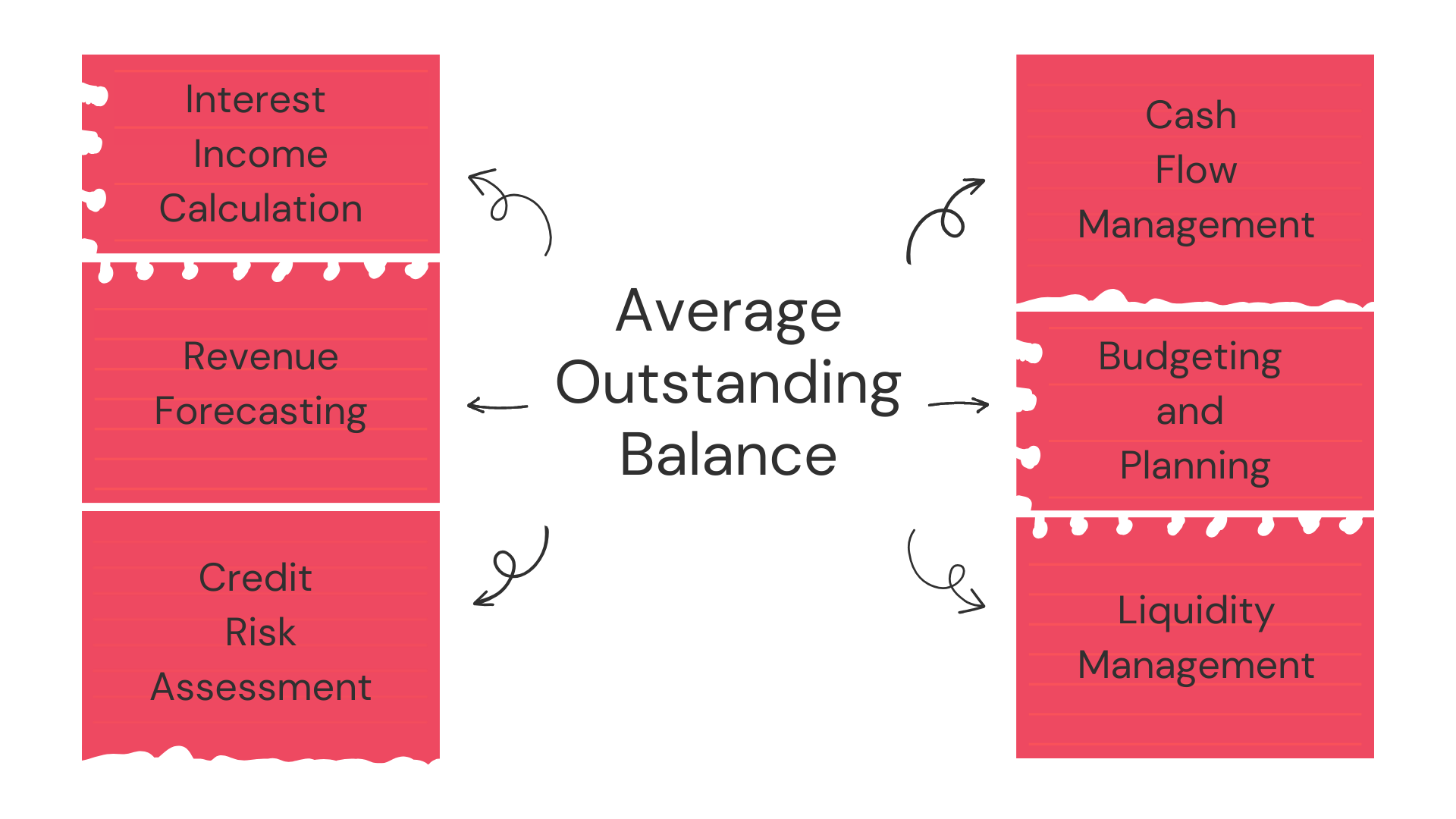

Usage of Average Outstanding Balance

This metric is crucial in financial management for individuals and businesses. It helps in budgeting and forecasting, assessing financial health, and making informed financial decisions. For businesses, it’s particularly important in managing working capital and maintaining liquidity.

Businesses use the Average Outstanding Balance to gauge the financial health of their customers, especially in sectors like banking or credit services. It assists in credit scoring, loan provisioning, and understanding the credit utilization patterns of customers.

Ready to Optimize Your Average Outstanding Balance?

KEBS provides tools and software solutions that can help optimize the management of your average outstanding balance. By integrating finance management software, you can gain insights into your financial status, automate calculations, and make data-driven decisions for better financial management.

For instance, their project management software can help in aligning financial goals with project outcomes. Similarly, insights from their case studies offer practical examples of successful financial management strategies. In addition to these, KEBS resource management software and timesheet billing software can be valuable in tracking and managing expenses and revenues, contributing to a more accurate calculation of your average outstanding balance.

KEBS Finance Management

For more information on managing financial health and optimizing credit management, contact us or explore KEBS capabilities through a comprehensive demo.