Home » PSApedia

Billing Accuracy

Billing accuracy means how well the amount charged to a customer matches the services.

What is Billing Accuracy (BA)?

Billing accuracy means how well the amount charged to a customer matches the services or products they received. This concept goes beyond just avoiding overcharging or undercharging.

The whole invoice process is included. This includes sending the bill, ensuring its clarity, and correctly applying discounts or promotions.

Why is BA So Important?

Billing accuracy is crucial for several reasons. Firstly, it fosters trust between a business and its customers. When customers get correct bills, they see the company as reliable and trustworthy, which can make them more loyal.

Secondly, billing inaccuracies can lead to financial loss. Whether it’s a product that was sold but not billed, a service that was provided free of charge due to an error, or an overcharge that led to a customer refund request – all these scenarios directly impact a company’s bottom line.

Lastly, billing accuracy is key to maintaining regulatory compliance. In regulated industries, inaccurate billing can lead to severe penalties and tarnish the company’s reputation.

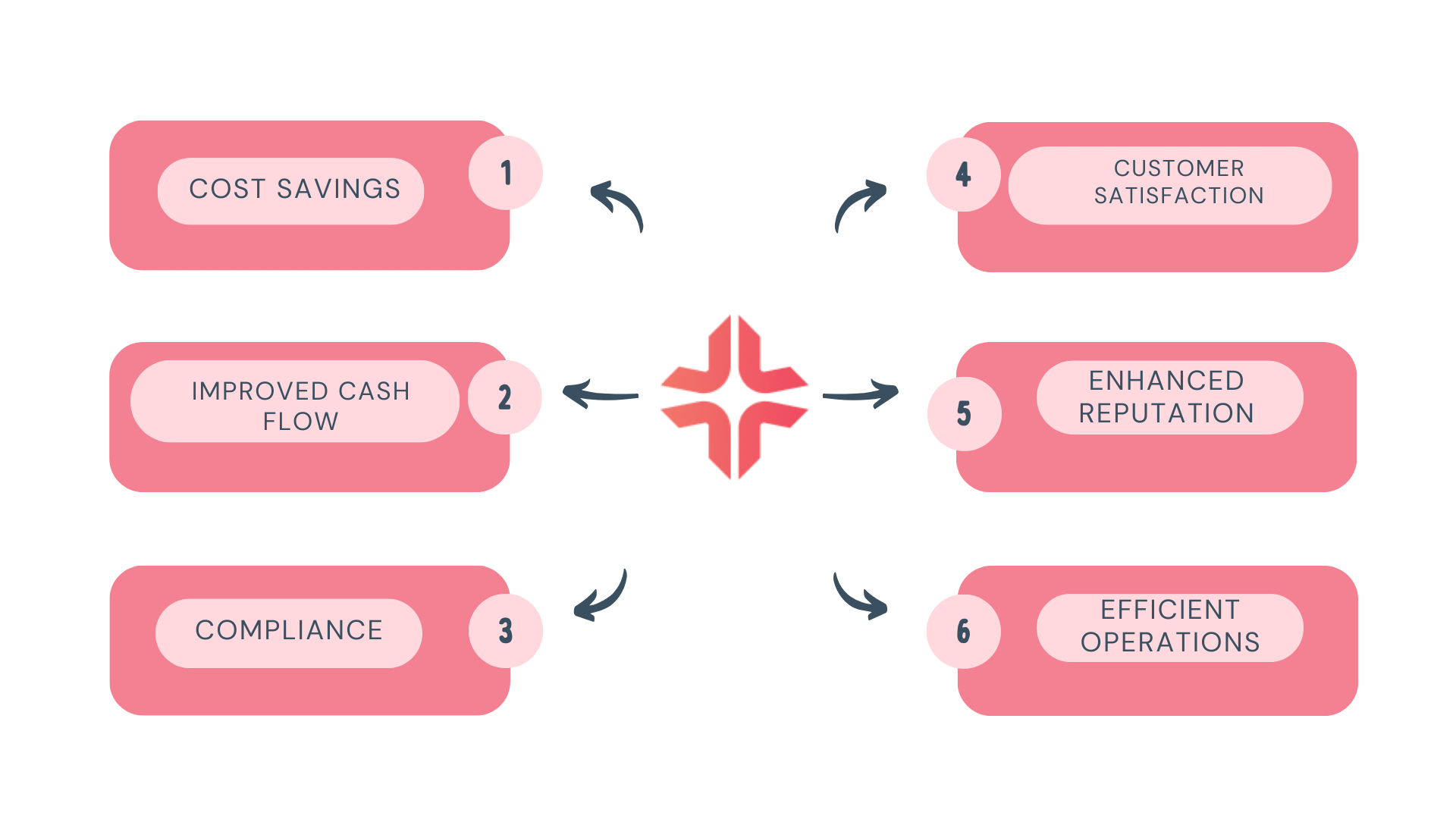

Importance of Billing Accuracy

Calculating Billing Accuracy

You can measure BA by comparing the total billed amount against the total correct billing amount. Here’s the formula:

BA (%) = (Total Correct Billing Amount / Total Billed Amount) * 100

For example, let’s say a telecom company billed its customers $10,000 in a month. However, upon review, we found that the total correct billing amount should have been $9,500. Using the above formula:

Billing Accuracy (%) = (9,500 / 10,000) * 100 = 95%

This means that the telecom company had a billing accuracy rate of 95%, implying that there were inaccuracies in 5% of the billing.

The Relationship Between Billing Accuracy and Revenue

Billing accuracy has a direct impact on a company’s revenue. When a company regularly undercharges its customers, it misses out on revenue. On the other hand, overcharging can lead to customer dissatisfaction, refunds, and even loss of customers, resulting in reduced revenue. Therefore, maintaining high billing accuracy is essential for optimizing revenue.

In the world of business, billing accuracy plays a pivotal role in driving consistent revenue. Mistakes in billing can result in financial loss.

Ensuring precise billing not only safeguards a company’s reputation but also optimizes its revenue streams. Removing errors helps businesses make customers happier, fix money problems, and ensure all transactions benefit the company’s profits. Embracing accurate billing practices is thus crucial for organizations aiming to achieve sustained financial growth and market credibility.

Billing Accuracy vs Revenue vs Profit

While they are related, billing accuracy, revenue, and profit are distinct concepts.

Billing accuracy – It refers to how correctly your invoices reflect the agreements with your clients.

Revenue – It is the total income generated from the sale of goods or services.

Profit – It is what remains from the revenue after deducting all the costs and expenses related to the business operation.

Without billing accuracy, your revenue might be lower than it should be (because of underbilling) or falsely inflated (because of overbilling). Either scenario can distort your understanding of your profits.

| Billing Accuracy | Revenue | Profit |

|---|---|---|

| It is typically measured as a percentage and reflects the ratio of accurately billed amounts to the total invoiced amounts. | It is recorded as the total amount of money received or earned from sales before any deductions. | Profit is calculated as Revenue – Expenses. |

| High billing accuracy ensures that customers are charged correctly, which builds trust and prevents disputes. | Revenue is a critical financial metric as it represents a company’s top-line income. | Profit is a bottom-line indicator of a company’s financial health. It determines whether a business is operating efficiently and generating surplus income after covering all costs. |

How is BA Used in Business?

Businesses use billing accuracy in various ways. In customer service, companies employ it to improve customer satisfaction and retention rates. In finance, we use it to ensure that we accurately record and recognize all revenue.

Operations teams use billing accuracy metrics to identify process inefficiencies and areas for improvement. Additionally, compliance teams monitor billing accuracy to ensure adherence to industry regulations and standards

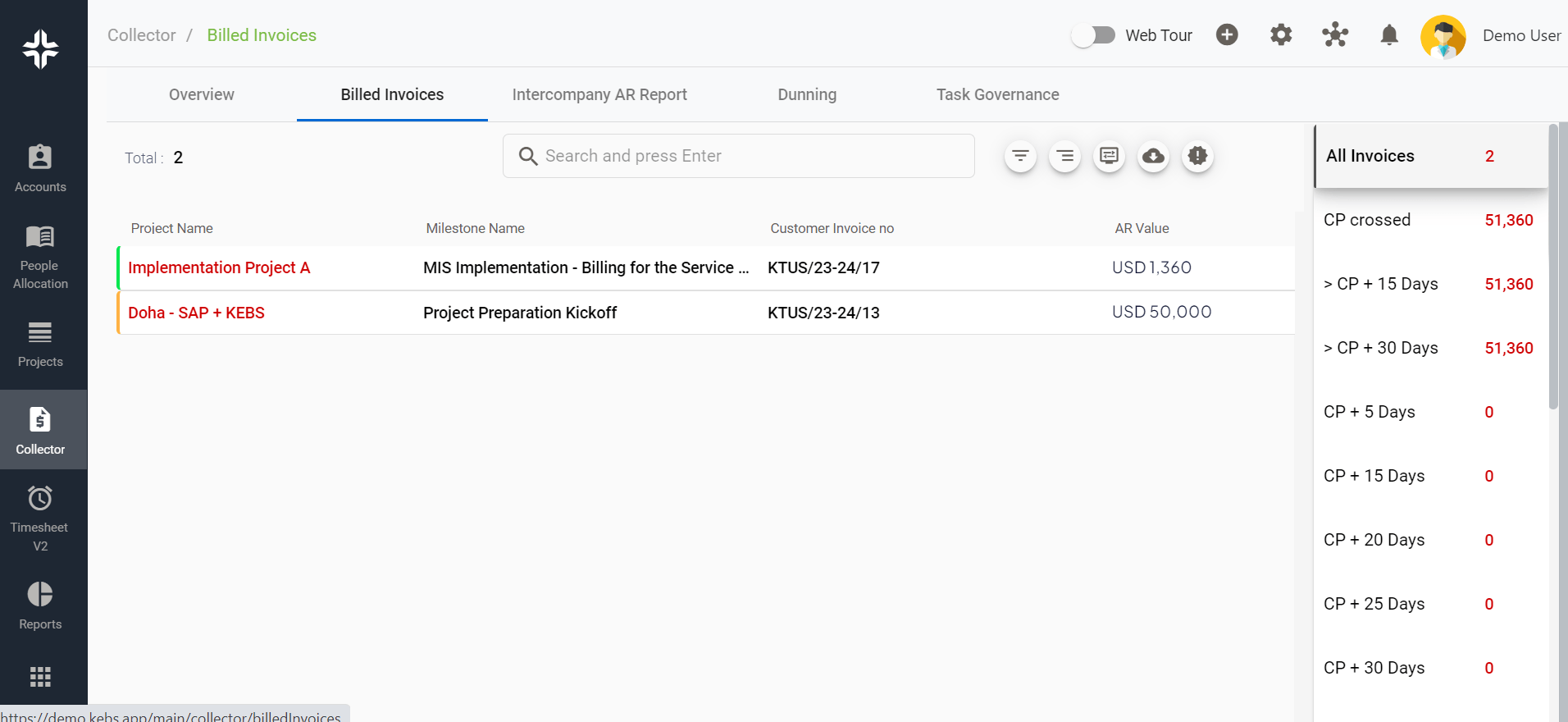

Take Control of Your Billing Accuracy with KEBS

KEBS, a leading PSA Software, can help businesses optimize their billing accuracy. By automating the billing process, KEBS reduces the risk of human error, which is a common cause of billing inaccuracies. It has strong reporting and analytics, giving businesses detailed insights into billing and helping them find areas to improve.

With KEBS, businesses can make sure that every invoice they send is correct, on time, and easy to understand. This keeps customers happy, increases profits, and follows regulations. If you’re ready to take your billing accuracy to the next level, consider integrating KEBS into your operations.

KEBS Finance Management

Book a Demo Today!