Home » PSApedia

Client lifetime value

Unlock the Potential with Insights into Client Lifetime Value. Maximize Loyalty and Optimize Business Growth.

What Is Client Lifetime Value?

Client Lifetime Value (CLV) is a key metric in Professional Service Automation (PSA). It represents the total revenue a business can expect from a single client throughout their relationship. Understanding and optimizing CLV is essential for long-term business growth and profitability.

It represents the total revenue a company can expect from a single customer account throughout the business relationship. The focus on CLV shifts the perspective from short-term gains to long-term profitability and customer relationships.

Significance of Client Lifetime Value in PSA

Understanding and optimizing CLV is crucial for businesses, especially in the context of “Cost of Salaries Share.” It helps in making informed decisions about how much to invest in acquiring new customers and retaining existing ones. A higher CLV indicates a more profitable and sustainable business model. CLV is crucial in PSA for several reasons:

1. Revenue Forecasting: Helps predict future revenue streams from existing clients.

2. Resource Allocation: Informs decisions on where to invest resources for maximum return.

3. Client Segmentation: Aids in identifying high-value clients for targeted service strategies.

4. Customer Relationship Management: Guides strategies to maintain and enhance client relationships, thereby increasing their lifetime value.

Effective management of CLV is fundamental to achieving sustainable business growth.

Significance of Client Lifetime Value in PSA

Calculating Client Lifetime Value

Formula: CLV = Average Revenue per Client x Average Client Lifespan

Example: If a client typically spends $10,000 per year and remains active for an average of 5 years, the CLV would be:

$10,000 x 5 years = $50,000

This means, on average, each client is worth $50,000 over their lifecycle.

Distinguishing Client Lifetime Value from Other Client Metrics

Understanding these differences helps in comprehensive client relationship management and financial planning. CLV is often compared with other metrics like Customer Acquisition Cost (CAC) and Average Revenue Per User (ARPU). Unlike ARPU, which focuses on short-term revenue, CLV emphasizes long-term value. Understanding these differences is key to strategic business planning. It’s important to differentiate CLV from metrics like:

1. Customer Acquisition Cost (CAC): The cost of acquiring a new client, which does not reflect the revenue they generate over time.

2. Annual Contract Value (ACV): Reflects the value of a contract over a year, not the entire client relationship.

| Metric | Definition | Importance / Use |

|---|---|---|

| Client Lifetime Value (CLV) | Total value a client brings over the entire relationship | Helps assess the worth of retaining a customer and informs marketing |

| Customer Acquisition Cost (CAC) | Cost incurred in acquiring a new customer | Compares the cost of acquiring customers to their long-term value |

| Churn Rate | Percentage of customers who stop using services or products | Indicates the rate of losing customers and impacts CLV negatively |

| Average Purchase Frequency | Frequency at which customers make purchases | Impacts CLV by determining the overall value a customer brings |

Strategies to Enhance Client Lifetime Value in PSA

Incorporating CLV into business strategies leads to more customer-centric approaches. It influences marketing strategies, customer service policies, and product development, ensuring that efforts are aligned with long-term customer value.

1. Quality Service Delivery: Consistently delivering high-quality services encourages long-term client relationships.

2. Personalized Client Experiences: Tailoring services to meet individual client needs can significantly increase CLV.

3. Regular Client Engagement: Maintaining ongoing communication to understand and address client needs.

4. Feedback Implementation: Using client feedback to improve services and enhance satisfaction.

Ready to Optimize Your Client Lifetime Value?

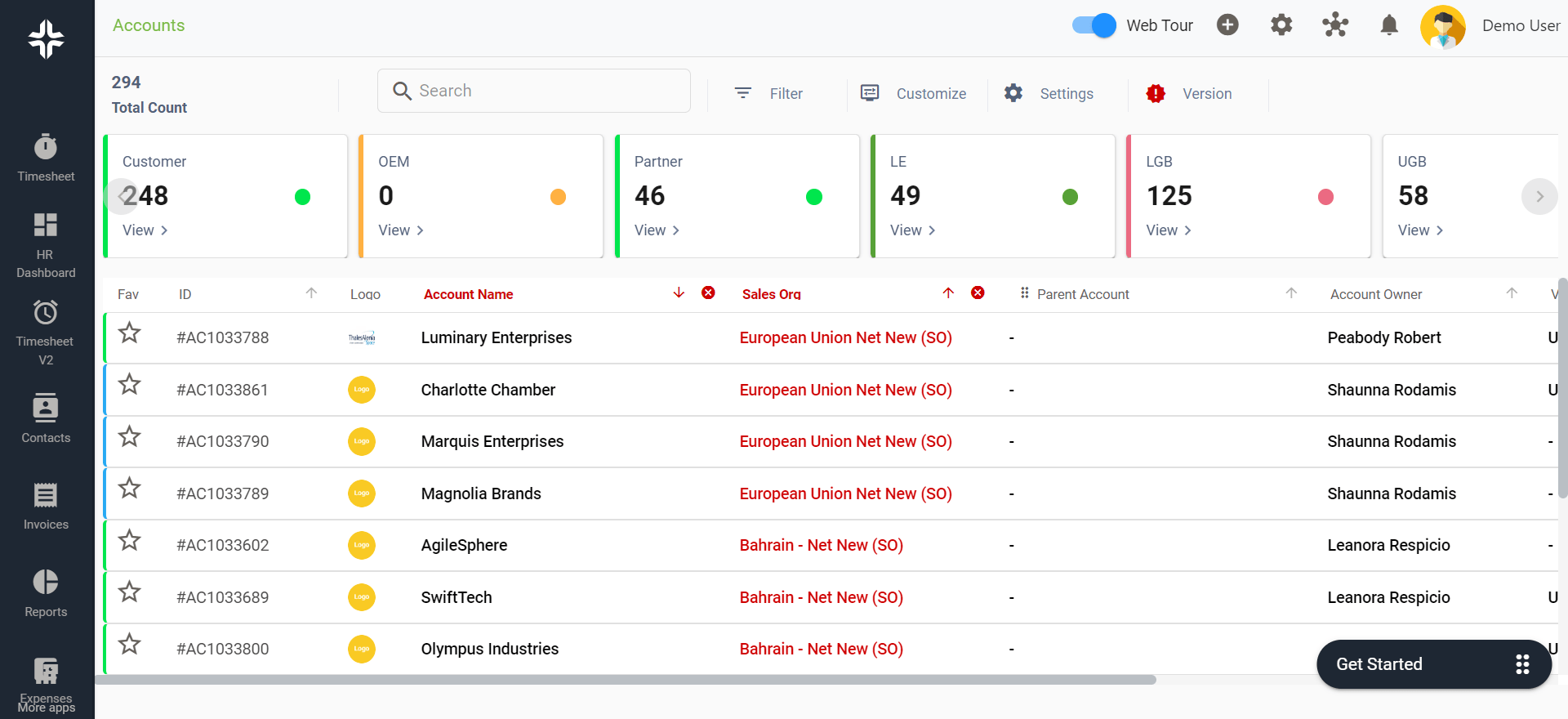

KEBS, a Professional Service Automation (PSA) software, plays a pivotal role in enhancing CLV. By streamlining processes like project management, resource allocation, and financial management. The KEBS timesheet system and proposal builder are just a few examples of how KEBS integrates essential business functions to support CLV growth.

KEBS Provides analytics for understanding client behavior and preferences. Enables tailoring services based on detailed client insights.

KEBS Deal Management

For a deeper understanding of how KEBS can enhance your business’s CLV, explore our resources and case studies, or contact us for a personalized demo.