Home » PSApedia

Current ratio

Understand Your Company's Current Ratio. A Key Metric for Sound Business Management – Learn More Now!

What is the Current Ratio?

The Current Ratio is a liquidity metric that measures a company’s ability to cover its short-term obligations with its short-term assets. It’s a snapshot of a company’s financial health, indicating whether it has enough resources to pay off its debts over the next year.

Current Ratio =Current Assets/Current Liabilities. For instance, a Current Ratio of 2 means that for every dollar of liability, the company has two dollars of assets.

Importance of the Current Ratio

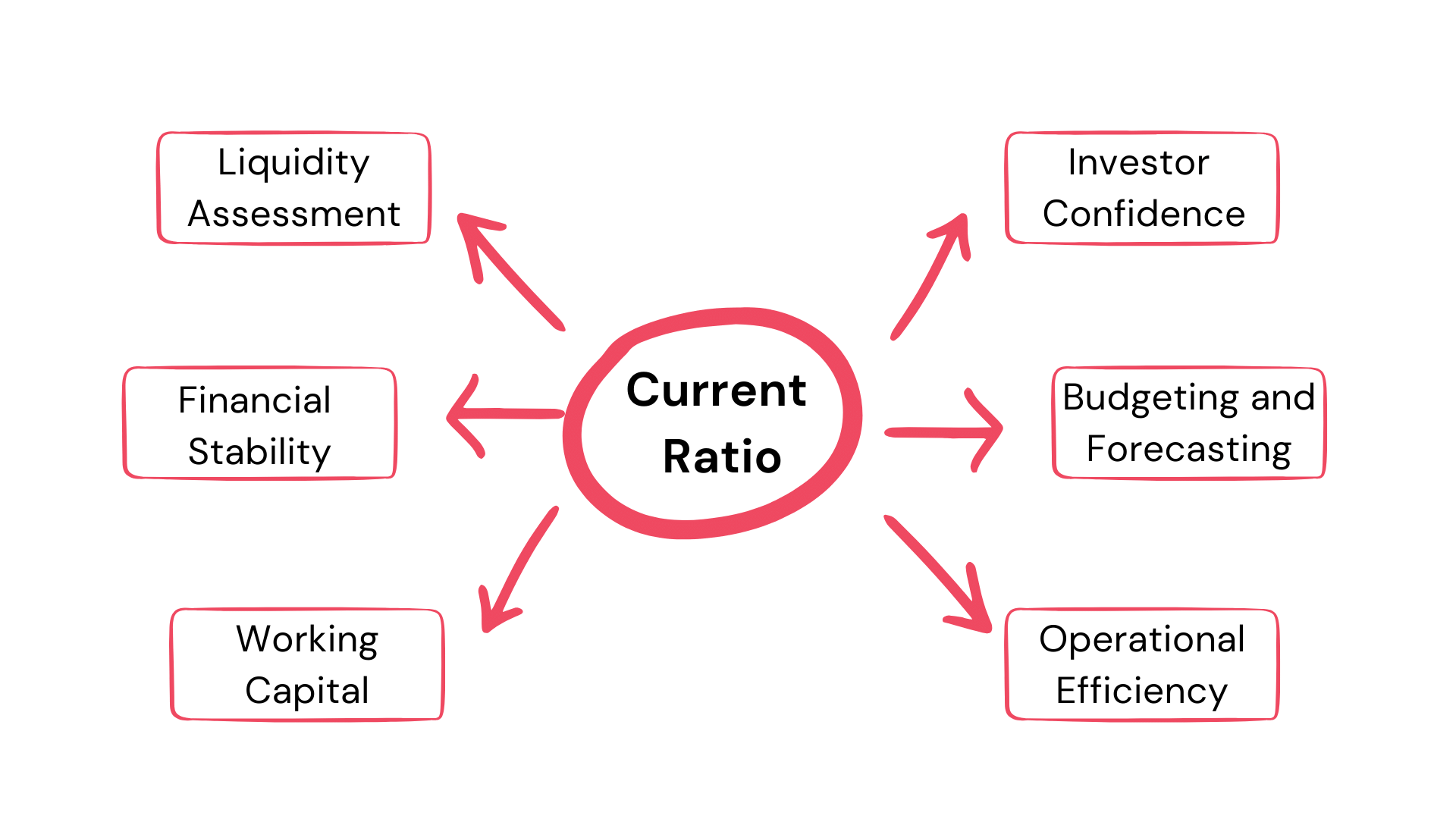

Understanding the Current Ratio is crucial for several reasons:

1. Liquidity Assessment: It helps stakeholders gauge a company’s liquidity, ensuring that it can meet short-term obligations.

2. Financial Health: A higher ratio indicates better financial health, while a lower ratio might signal potential solvency issues.

3. Investor Confidence: Investors and creditors often scrutinize this ratio to determine the risk associated with their investments or loans.

4. Operational Efficiency: A consistent Current Ratio can indicate efficient operations and effective financial management.

Why Current ratio is so important?

Calculating the Current Ratio

Current Ratio = Current Assets / Current Liabilities

Example: Let’s say Company X has current assets worth $200,000 and current liabilities of $100,000.

Current Ratio=200,000/100,000=2

This means Company X has twice the assets needed to cover its short-term liabilities.

Current Ratio vs Other Financial Ratios

1. Quick Ratio: While the Current Ratio considers all short-term assets, the Quick Ratio excludes inventories. It’s a stricter measure of liquidity.

2. Debt to Equity Ratio: This measures a company’s total liabilities against its shareholder equity. It’s more about long-term solvency than short-term liquidity.

3. Gross Profit Margin: This ratio indicates the percentage of revenue exceeding the cost of goods sold. It doesn’t directly relate to liquidity but provides insights into operational efficiency.

For a deeper dive into financial metrics, consider reading this whitepaper on optimizing project financials.

| Ratio | Purpose | Formula |

|---|---|---|

| Current Ratio | Measures a company’s short-term liquidity and ability to cover immediate liabilities with current assets. | Current Assets / Current Liabilities |

| Debt to Equity Ratio | Assesses the company’s financial leverage and risk by comparing its long-term debt to shareholders equity. | Total Debt / Shareholders’ Equity |

| Gross Profit Margin | Evaluates the profitability of a company’s core operations by comparing gross profit to revenue. | (Gross Profit / Revenue) x 100% |

| Return on Investment | Measures the return generated from investments made in the business. | (Net Profit / Investment) x 100% |

Applications of the Current Ratio

- Benchmarking: Companies often compare their Current Ratio to industry standards or competitors to gauge performance.

- Financial Planning: It aids in financial management strategies and planning.

- Investment Decisions: Investors might use it to assess the risk and health of a potential investment.

For more on how to leverage financial data, explore financial analytics in PSA.

Ready to Optimize Current Ratio?

KEBS, a leading Professional Service Automation (PSA) software, can play a pivotal role in enhancing your Current Ratio. With KEBS, get real-time insights into your assets and liabilities, aiding in better decision-making. From project management to deal management, KEBS ensures efficient operations, positively impacting your Current Ratio. Efficiently allocate resources with KEBS, ensuring optimal utilization and profitability.

Dive deeper into resource management with KEBS. Automate and optimize financial processes, from ticket management to timesheet billing, ensuring timely payments and improved liquidity.

KEBS Finance Management

Ready to optimize your financial health? Contact KEBS or request a demo to see how it can transform your business operations.