Home » PSApedia

Days Sales Outstanding

Optimize Cash Flow and reduce Days Sales Outstanding (DSO) with Proven Strategies.

What Is Days Sales Outstanding (DSO)?

DSO, or Days Sales Outstanding, measures the time it takes for a company to receive payment after making a sale. This metric measures a company’s ability to convert its accounts receivable into cash. It provides insights into the company’s credit and collection practices.

For instance, consider a software development company that uses project management software to oversee its operations. If this company typically waits 45 days after a completed project to receive payment, its DSO would be 45.

Why Is DSO Important?

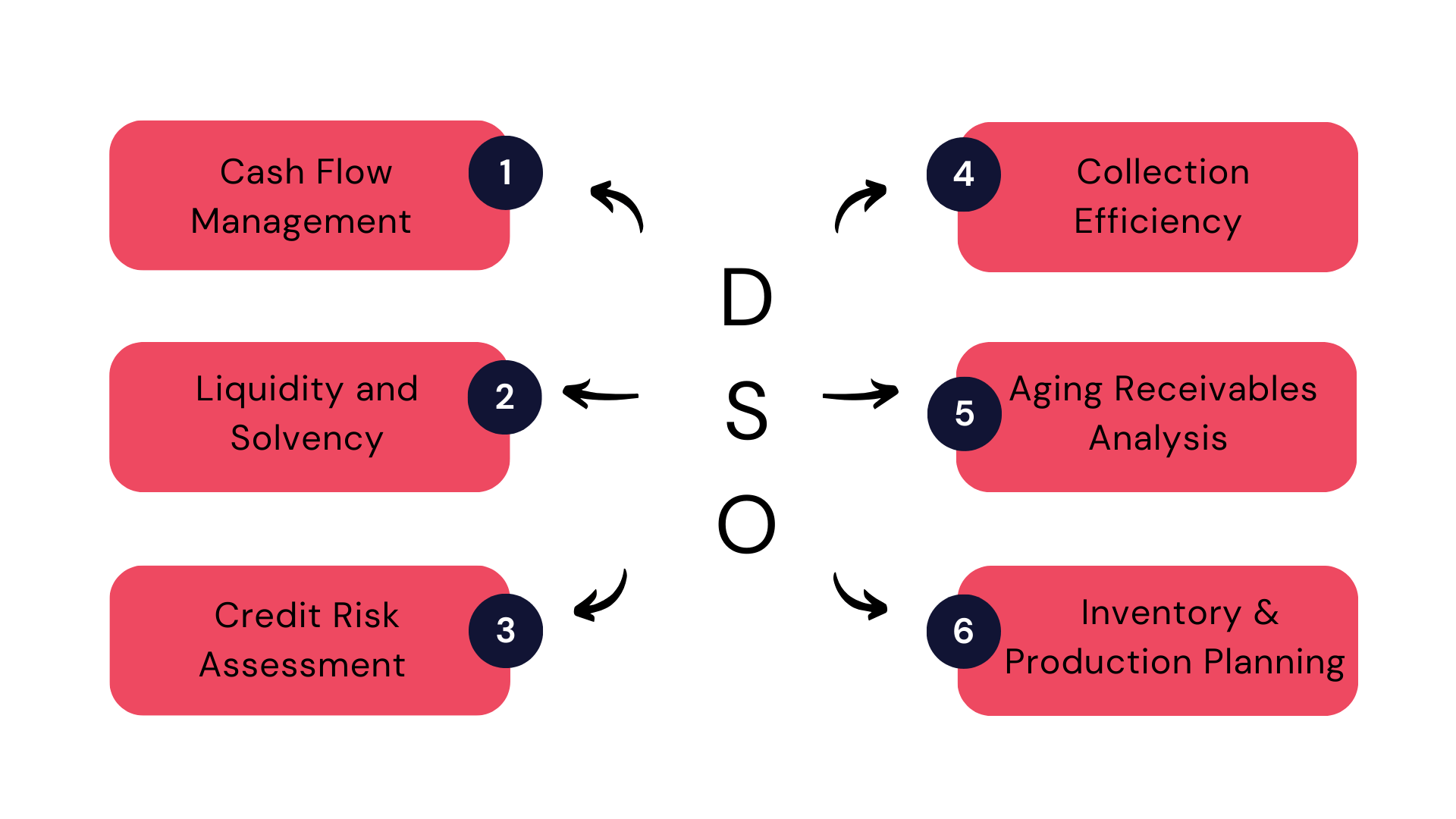

DSO is a vital metric for businesses as it directly impacts cash flow. A lower DSO suggests that a company collects its receivables quickly, which can be beneficial for its liquidity. On the other hand, a higher DSO may indicate potential issues in the company’s credit policies or challenges with certain customers.

Analyzing DSO can also help businesses in sectors like finance understand their operational efficiency. It can highlight areas where the company might need to refine its billing processes or reconsider its credit terms.

Why Is DSO Important?

Calculating DSO

Formula:

DSO=(Accounts Receivable/Total Credit Sales) × Number of Days

Example:

Imagine a company with an accounts receivable of $50,000, total credit sales of $500,000, and we’re considering a 30-day period.

DSO=(50,000500,000)×30=3 days

This means it takes the company, on average, 3 days to collect its receivables.

DSO vs Other Financial Metrics

While DSO provides insights into collection efficiency, it’s essential to view it alongside other financial metrics. For instance, comparing DSO with metrics like Days Payable Outstanding (DPO) can offer a comprehensive picture of a company’s financial health.

To understand DSO in a broader context, it’s helpful to compare it with other pivotal financial metrics. Below is a table highlighting the differences between DSO, Days Payable Outstanding (DPO), and Days Inventory Outstanding (DIO).

By analyzing these metrics in tandem, businesses can gain a comprehensive understanding of their operational efficiency. For instance, using tools like project management software with Gantt charts can help align sales and inventory processes, potentially influencing DSO and DIO values.

| Metric | Definition | Importance |

|---|---|---|

| DSO (Days Sales Outstanding) | Average number of days it takes a company to collect payment after a sale. | Indicates the efficiency of a company’s collection process. Affects liquidity and cash flow. |

| DPO (Days Payable Outstanding) | Average number of days a company takes to pay its bills and invoices to its trade creditors. | Reflects the company’s management of payables. A high DPO might indicate that a company is trying to conserve its cash. |

| DIO (Days Inventory Outstanding) | Average number of days a company holds its inventory before selling it. | Offers insights into inventory management. A high DIO might suggest overstocking or slow-moving products, while a low DIO could indicate strong sales or under-stocking. |

Using DSO for Financial Analysis

For companies using advanced financial management systems, DSO becomes an invaluable tool. By analyzing DSO trends over time, firms can forecast cash flows, ensure liquidity, and make informed investment decisions.

Moreover, DSO can be a benchmarking tool. Companies can compare their DSO to industry averages or competitors to gauge their collection efficiency. Businesses can use resource management software to align financial metrics like DSO with operational KPIs when scaling.

Ready to Optimize Your DSO?

Ready to take control of your receivables and optimize your DSO? KEBS offers a comprehensive suite of solutions tailored for businesses looking to streamline their financial processes. From deal management to project financials, KEBS can help you gain better visibility and control over your cash flows.

KEBS Finance Management

For businesses keen on diving deeper into optimizing their financials, KEBS offers a detailed eBook on PSA, shedding light on best practices and industry insights. Ready to transform your financial processes and optimize DSO? Don’t wait! Contact us today or book a demo to see how KEBS can make a difference in your business.