Home » PSApedia

Deposit Account Growth Rate

Explore Insights on Deposit Account Growth Rate. Optimize Strategies and Maximize Financial Health.

What is Deposit Account Growth Rate?

Deposit Account Growth Rate is a key financial metric that measures the rate at which a company’s deposit balances grow over a specific period.

This indicator is crucial in the Professional Service Automation (PSA) industry, as it reflects a firm’s financial health and its ability to generate and manage cash flows effectively. It essentially showcases the pace of increase or decrease in these accounts within a given timeframe.

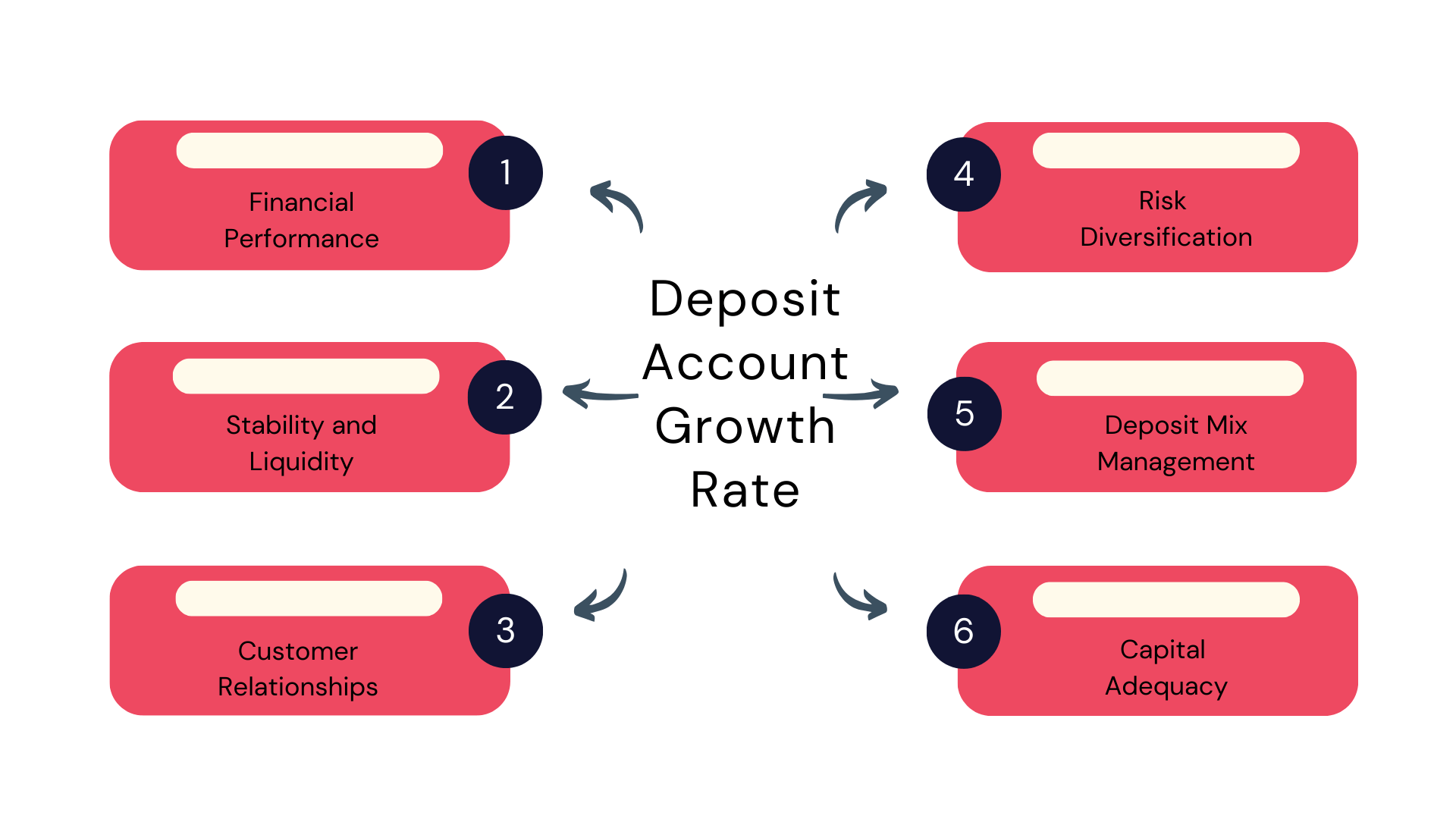

Importance of Deposit Account Growth Rate

Understanding and monitoring the Deposit Account Growth Rate is essential for several reasons:

1. Financial Stability: A steady growth rate indicates a robust financial position, ensuring the company can meet its operational needs and invest in growth opportunities.

2. Investor Confidence: High growth rates in deposit accounts can be a positive signal to investors and stakeholders, showcasing the company’s profitability and growth potential.

3. Strategic Decision-Making: This metric aids in making informed decisions regarding investments, expansions, and other strategic moves in the context of PSA.

Importance of Deposit Account Growth Rate

How to calculate Deposit Account Growth Rate?

Formula:

Deposit Account Growth Rate = (Ending Balance − Beginning Balance/ Beginning Balance) × 100

Example:

Assume a PSA company, starts the year with a deposit account balance of $100,000 and ends the year with $150,000. The growth rate would be calculated as:

Growth Rate=(150,000−100,000/100,000)×100=50%

Deposit Account Growth Rate vs Other Financial Metrics

While this metric primarily focuses on the increase or decrease in deposit accounts, it’s crucial to distinguish it from related metrics:

1. Annual Recurring Revenue (ARR): While ARR focuses on the predictable revenue from subscriptions or contracts, the deposit account growth rate measures the actual increase in cash deposits.

2. Profit Margins: Profit margins reflect the percentage of revenue that turns into profits, whereas the deposit account growth rate shows how effectively the company is growing its cash reserves.

3. Cash Flow Metrics: Cash flow metrics assess the inflows and outflows of cash, but the deposit account growth rate specifically tracks the growth in deposit balances.

| Metric | Definition | Importance/Use |

|---|---|---|

| Deposit Account Growth Rate | Rate of increase in the number or value of deposit accounts | Indicates the growth in the customer base or deposits held by an institution |

| Return on Assets (ROA) | Ratio of net income to total assets | Measures profitability relative to the total assets held |

| Net Interest Margin (NIM) | Difference between interest income and interest expense, divided by total interest income | Reflects the profitability of a financial institution’s lending operations |

Application of Deposit Account Growth Rate in Business

It is extensively used in various aspects:

1. Financial Planning: Companies can use this rate to plan future expenditures and investments.

2. Risk Assessment: A declining growth rate might indicate potential financial risks that need addressing.

3. Performance Benchmarking: Comparing growth rates with industry standards helps in assessing the company’s performance.

Ready to Optimize Your Deposit Account Growth Rate?

KEBS, a comprehensive PSA software, plays a crucial role in optimizing the Deposit Account Growth Rate. KEBS offers finance management software that helps in better managing and forecasting financial outcomes.

With KEBS project management tools, businesses can make informed decisions that positively impact their financial growth. The use of KEBS analytics tools aids in understanding and improving deposit account growth trends.

KEBS Finance Management

Ready to optimize your Deposit Account Growth Rate for better financial health and growth? Contact us at KEBS or request a demo to see how our solutions can transform your financial management strategies.