Home » PSApedia

Gross Billings

Understand and Optimize Gross Billings. Explore Strategies for Financial Growth and Profitability!

What Are Gross Billings?

Gross billings refer to the total value of all invoices issued to clients before any deductions such as discounts, allowances, or returns. This metric offers a glimpse into the company’s sales activities, capturing the full value of transactions before accounting adjustments. For businesses that rely heavily on invoicing, such as those in project management, understanding gross billings is paramount.

It can provide insights into a company’s sales growth and overall revenue generation, but it may not reflect its actual profitability, as it doesn’t account for the costs of goods sold or other expenses. It is a fundamental metric in financial reporting and is frequently used to assess a company’s health and growth potential.

The Importance of Gross Billings in Business

It serve as a performance indicator. A surge in gross billings could indicate an increase in sales or higher-priced sales, whereas a dip could suggest problems in the sales process. This metric also provides insights into future cash flows. For instance, in industries where financial management is critical, regular tracking of gross billings helps businesses prepare for financial ebbs and flows.

Gross billings are a vital metric in business, serving as a barometer of a company’s financial health and growth. They represent the total revenue generated before deductions, providing a clear snapshot of a company’s top-line performance.

The Importance of Gross Billings

How to Calculate Gross Billings?

Formula:

Gross Billings = Total Invoiced Amount (before discounts, returns, and allowances)

Example:

Imagine a project management firm issued invoices worth $50,000 in a month. They offered discounts totaling $5,000 and had returns of $2,000.

Gross Billings = $50,000 (Total Invoiced Amount)

Adjusted Revenue = $50,000 – $5,000 (discounts) – $2,000 (returns) = $43,000

In this scenario, while the adjusted revenue stands at $43,000, the gross billings are $50,000.

Gross Billings vs Revenue

Although they might seem similar, gross billings and revenue are distinct. While gross billings encompass the total invoiced amount, revenue represents the actual money the business expects after accounting for deductions like returns or discounts. Revenue provides a more accurate reflection of a firm’s financial health, especially for those in deal management.

| Metric | Gross Billings | Revenue |

|---|---|---|

| Definition | Total amount billed to customers for goods or services, including any taxes and fees. | Total income generated from sales of goods or services, excluding any discounts, returns, or allowances. |

| Timing of Recognition | Recognized when the customer is billed or invoiced. | Recognized when goods or services are delivered, and payment is reasonably assured. |

| Adjustments | Gross Billings may include taxes, fees, and other charges. | Revenue represents the core sales amount after deducting discounts, returns, and allowances. |

| Financial Statement | Typically not directly reported on the income statement but may be disclosed separately in financial footnotes. | Reported as the top line on the income statement. |

| Importance | Indicates the total sales activity and billing to customers. | Represents the actual income earned from core business operations. |

| Example | If a company bills customers $100,000 for products and services, including $10,000 in taxes and fees, its Gross Billings are $110,000. | If the company later gives $5,000 in discounts and receives only $95,000 in actual payments, its Revenue is $95,000. |

Using Gross Billings in Financial Management

Gross billings can be a game-changer for companies when used in finance management. By analyzing gross billings alongside other metrics, businesses can:

- Forecast future cash flows and plan accordingly.

- Understand their sales trends and identify opportunities or threats.

- Make informed decisions on pricing strategies, discounts, or allowances.

- Leverage timesheet and billing for efficient billing processes.

Ready to optimize your billing processes?

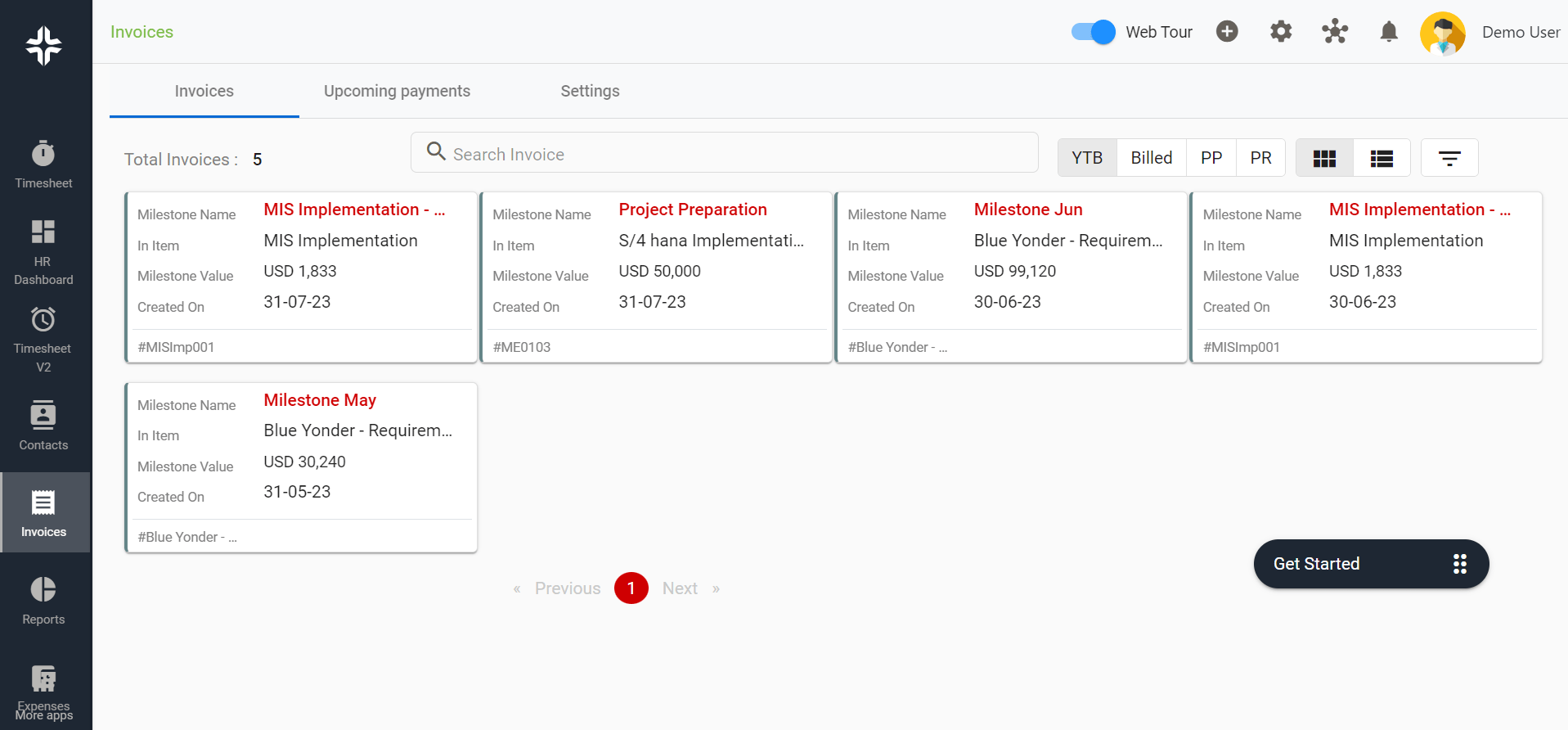

KEBS offers robust solutions to make this possible. With its comprehensive Professional Service Automation (PSA) software, businesses can automate, streamline, and optimize their billing processes for better financial management.

By integrating KEBS, companies gain insights into their billing patterns, enabling them to make strategic decisions. Whether it’s about efficient project financial management or streamlining timesheets, KEBS offers the tools and resources needed.

KEBS Invoices