Home » PSApedia

Interest cost percentage

Calculate Interest Cost Percentage for Informed Decision-Making.

What is Interest Cost Percentage?

Interest Cost Percentage (ICP) is a financial metric that represents the proportion of interest costs to the total amount borrowed or invested.

In the context of Professional Service Automation (PSA), it can be used to measure the efficiency of financial management within a project or service, especially when leveraging borrowed capital.

Importance of Interest Cost Percentage

Understanding the ICP is crucial for businesses, especially those in the service sector. Here’s why:

1. Financial Health: A lower ICP indicates that a company is efficiently managing its debts and has a healthy financial standing.

2. Decision Making: It aids in making informed decisions about borrowing, investing, or even restructuring debts.

3. Performance Benchmark: Companies can compare their ICP with industry standards or competitors to gauge their financial performance.

Importance of Interest Cost Percentage

Calculating Interest Cost Percentage

Formula:

ICP = (Total Interest Cost / Total Amount Borrowed or Invested) × 100

Example:

Let’s say a PSA firm borrowed $100,000 for a project and incurred an interest cost of $5,000 over a year. Using the formula:

ICP=(5,000/100,000)×100=5%

This means 5% of the total amount borrowed was used to cover the interest cost.

Difference Between Interest Cost Percentage and Other Metrics

Comparing ICP with these metrics helps businesses get a comprehensive view of their financial obligations. While ICP focuses on the proportion of interest costs, there are other related metrics:

1. Annual Percentage Rate (APR): Represents the annual cost of borrowing. It includes both the interest rate and additional fees.

2. Effective Interest Rate: Takes into account the effects of compounding, providing a more accurate representation of total borrowing costs.

| Metric | Description | Key Differences |

|---|---|---|

| Interest Cost Percentage | A metric used in financial analysis to measure the cost of borrowing capital. It calculates the cost of interest payments as a percentage of the total borrowed amount. | Not directly related to PSA; typically used in financial analysis. |

| Utilization Rate | Measures how effectively employees time is used on billable projects. It’s the ratio of billable hours worked to the total hours available. | PSA-specific metric focused on resource allocation and efficiency. |

| Billable Utilization Rate | A subset of the utilization rate, it specifically measures the ratio of billable hours worked to total hours available. It excludes non-billable work. | PSA-specific metric emphasizing revenue generation. |

| Project Margin | Measures the profitability of individual projects. It’s the difference between the revenue generated by a project and the direct costs associated with it. | PSA-specific metric for project profitability assessment. |

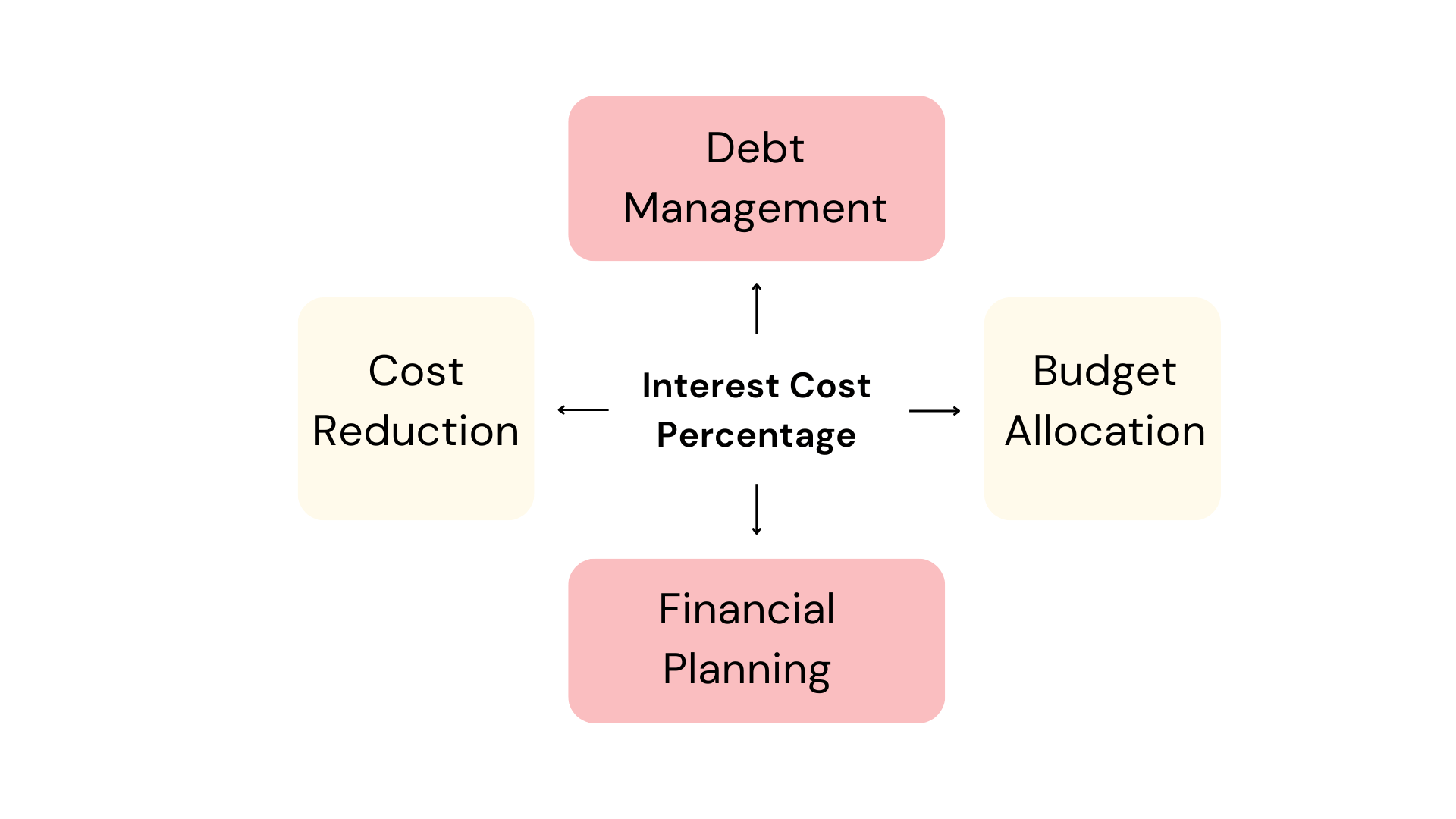

Applications of Interest Cost Percentage

In the realm of PSA:

1. Project Financing: Determine the feasibility of borrowing for a project by assessing potential interest costs.

2. Budgeting & Forecasting: Incorporate interest costs in financial projections, ensuring realistic and achievable targets.

3. Risk Management: Identify projects or services that might be incurring high-interest costs, signaling potential financial risks.

Ready to Optimize Your Interest Cost Percentage?

KEBS, a leading PSA Software, offers tools that can help businesses optimize their ICP. With KEBS finance management software, businesses can track and manage their debts efficiently.

Using tools like Gantt charts, firms can ensure timely completion of projects, reducing the duration of borrowed capital usage. Efficient allocation of resources using KEBS resource management software ensures that projects remain financially viable.

KEBS Finance Management

Ready to Optimize Your ICP with KEBS? Dive deeper into how KEBS can transform your financial management. Contact us today or request a demo to see the platform in action.