Home » PSApedia

Percentage of non-billable hours

Analyze Your Workforce's Productivity with Percentage of Non-Billable Hours.

What is the Percentage of Non-Billable Hours?

The percentage of non-billable hours refers to the proportion of hours worked by employees that cannot be directly billed to clients. These hours encompass tasks that are essential for business operations but do not generate direct revenue.

Examples include administrative tasks, internal meetings, training, and research. Understanding this metric is crucial for businesses, especially those in the service sector, as it impacts profitability and operational efficiency.

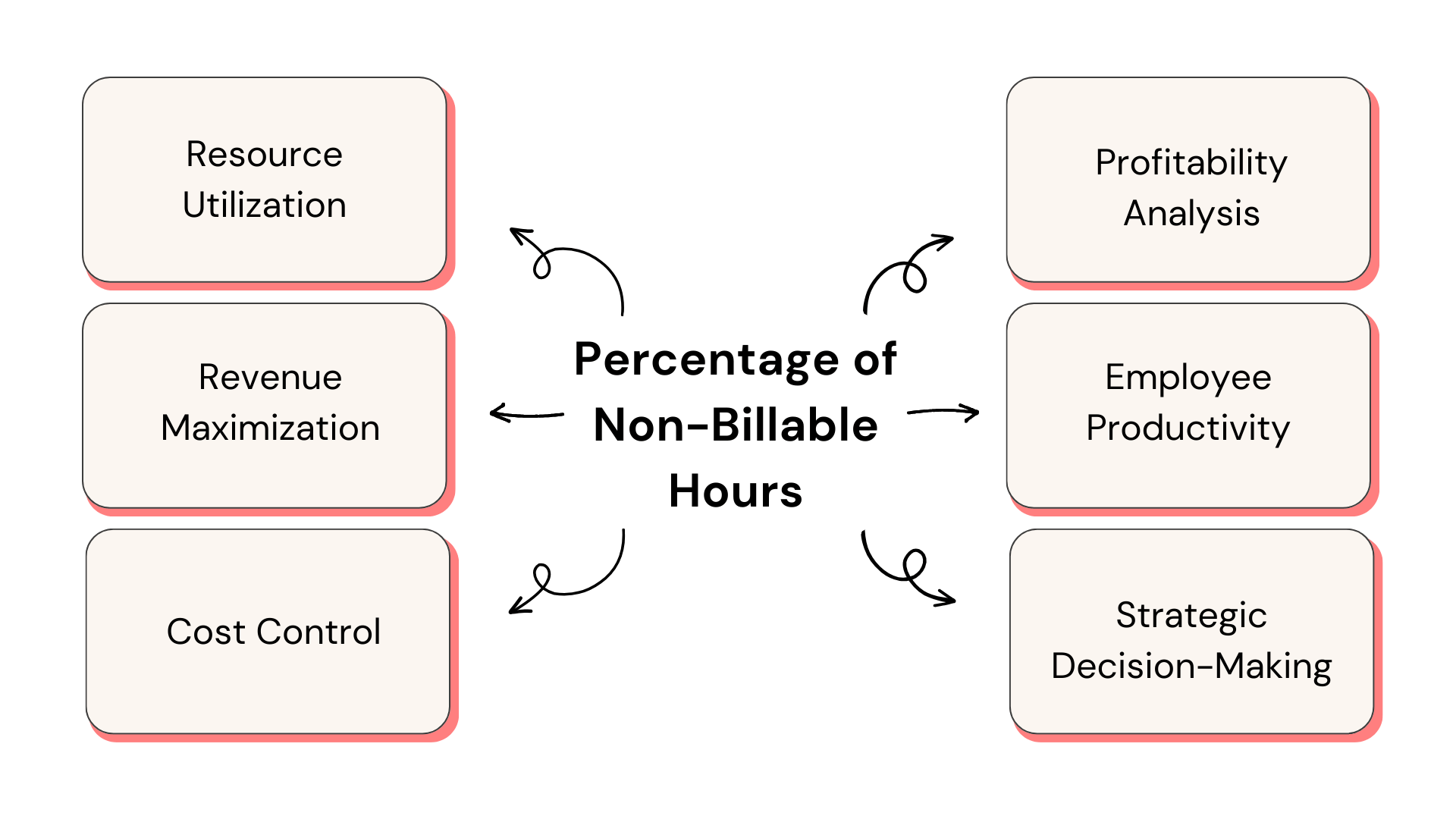

Importance of Percentage of Non-Billable Hours

Non-billable hours, though not directly revenue-generating, play a pivotal role in a company’s success. They:

1. Ensure Operational Efficiency: Tasks like team meetings or training sessions ensure that the team is aligned and equipped with the necessary skills.

2. Aid in Business Growth: Research and strategy sessions, which fall under non-billable hours, can lead to new business opportunities.

3. Enhance Client Relationships: Time spent understanding a client’s needs or preparing for a pitch, though non-billable, can lead to long-term client relationships and future billable projects.

However, a high percentage of non-billable hours can indicate inefficiencies. This is where tools like Professional Service Automation (PSA) come into play, helping businesses optimize these hours.

Importance of Percentage of Non-Billable Hours

How to Calculate Percentage of Non-Billable Hours?

Formula:

Percentage of Non-Billable Hours = (Total Non-Billable Hours / Total Worked Hours) × 100

Example:

If an employee works 40 hours a week and spends 10 hours on non-billable tasks, the percentage of non-billable hours is:

(10/40)×100=25%

Thus, 25% of the employee’s hours are non-billable.

Difference between Percentage Non-Billable Hours vs Billable Hours

While non-billable hours are essential for internal operations, billable hours directly generate revenue. Billable hours are the hours worked on client projects or tasks that a client is billed for. The balance between these two is crucial.

Too many non-billable hours can reduce profitability, while too few can impact the quality of service and operational efficiency. Tools like timesheet software can help businesses track and manage these hours effectively.

| Metric | Percentage Non-Billable Hours | Percentage Billable Hours |

|---|---|---|

| Definition | The percentage of hours spent on activities that are not directly billable to clients or projects. These hours are typically used for internal tasks, administrative work, training, or non-client-related activities. | The percentage of hours spent on activities that can be billed to clients or projects. These hours are directly associated with revenue generation and client work. |

| Tracking and Management | It’s important to track and minimize non-billable hours to improve overall efficiency and profitability. PSA software helps in monitoring and optimizing these hours. | PSA tools are used to monitor and maximize billable hours to ensure that resources are utilized effectively to increase revenue. |

| Examples | Non-billable hours may include internal meetings, training, administrative tasks, and business development efforts. | Billable hours include client consultations, project work, and tasks directly tied to delivering services to clients. |

How Non-Billable Hours are Used in Businesses?

Non-billable hours are utilized in various ways:

1. Training and Skill Development: Ensuring that the team is up-to-date with the latest trends and skills.

2. Internal Operations: Tasks like HR, finance, and project management.

3. Strategy and Planning: Time spent on business growth, market research, and resource allocation.

4. Client Relationship Management: Building and maintaining relationships, which can lead to future billable projects.

Ready to Optimize Your Non-Billable Hours?

KEBS, a leading PSA Software, offers tools to help businesses optimize non-billable hours. With features like Gantt charts for project planning, employee 360 for comprehensive employee insights, and finance management, KEBS ensures that businesses can strike the right balance between billable and non-billable hours.

With timesheet software, businesses can differentiate between billable and non-billable hours seamlessly. Ensure that resources are utilized optimally, reducing idle time and maximizing billable hours. By understanding the cost associated with non-billable hours, businesses can make informed decisions.

KEBS Time Tracking

Ready to optimize your non-billable hours? Contact KEBS or request a demo to see how KEBS can transform your business operations.