Home » PSApedia

Return on Investment

Explore Strategies, Tools, and Insights for a Higher Return on Investment (ROI). Make Informed Decisions and Maximize Profits.

What is Return on Investment(ROI)?

Return on Investment, often abbreviated as ROI, is a crucial financial metric used by businesses to evaluate the profitability of an investment or to compare the profitability of multiple investments. Simply put, it determines how much return (or profit) an investment has generated relative to its cost.

In the realm of Professional Service Automation (PSA), ROI is employed to assess the value derived from implementing PSA tools, such as project management, ticketing systems, and financial management platforms.

The Importance of ROI

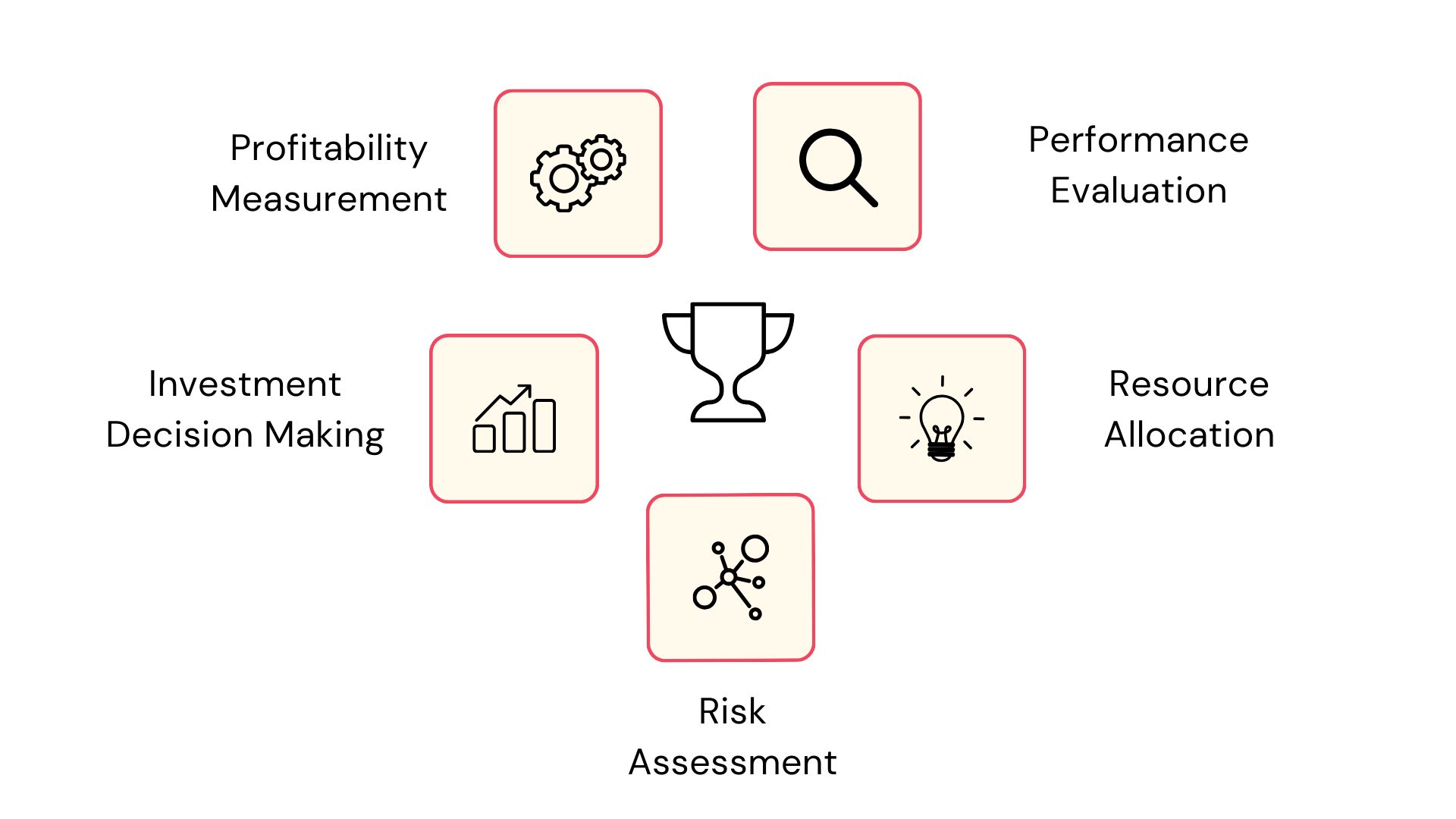

Understanding ROI is vital for several reasons:

- Decision-making: It aids companies in prioritizing investments, ensuring that funds are channeled into profitable ventures.

- Performance Measurement: Businesses can gauge the effectiveness of their actions and strategies by monitoring ROI.

- Budgeting & Forecasting: ROI helps in allocating resources effectively for future projects and ventures.

For businesses venturing into PSA, understanding the ROI can offer insights into how well the PSA tools are enhancing operational efficiency and client delivery.

Why Return on Investment is so important?

Calculating ROI

The formula for ROI is quite straightforward.

ROI = (Net Profit from the Investment − Cost of the Investment) / Cost of the Investment × 100%

Example:

Let’s assume a company invested $20,000 in a new project management software and as a result, realized a net profit of $50,000 from improved operational efficiencies and reduced labor costs.

Using the formula:

ROI = ($50,000 – $20,000) / ($20,000) x 100% = 150%

This means the company made a 150% return on its investment.

ROI vs Other Financial Metrics

ROI is often adjoined with other financial metrics, especially when evaluating the health and growth of a business. Some common comparisons include:

1. ROI vs ROE (Return on Equity): While ROI assesses the return on a specific investment, ROE evaluates a company’s profitability by measuring how much profit a company generates with shareholders’ equity.

2. ROI vs Project Profitability: Project profitability assesses how much profit a project is expected to make, considering all expenses. ROI, on the other hand, is broader and evaluates the effectiveness of an investment.

| Metric | Description | Importance in PSA Context |

|---|---|---|

| ROI (Return on Investment) | Measures the profitability of an investment relative to its cost. Formula: (Net Profit / Cost of Investment) x 100% | Directly indicates the value derived from implementing a PSA solution compared to its cost. |

| NPV (Net Present Value) | Represents the difference between the present value of cash inflows and outflows over a period. Used to estimate profitability of investments. | Can be used to determine the long-term value or profitability of implementing a PSA tool over a period. |

| Payback Period | The time it takes for an investment to generate a return equal to its original cost. | Indicates how long it will take to recoup the initial investment in the PSA solution. |

| IRR (Internal Rate of Return) | The discount rate at which the NPV of an investment becomes zero. Indicates the expected growth rate of an investment. | If the IRR is higher than the company’s required rate of return, the PSA solution can be considered a good investment. |

| Profit Margin | Ratio of net profit to revenues, indicating the profitability of projects. Formula: (Net Profit / Revenue) x 100% | Measures the efficiency and profitability of projects managed using the PSA tool. |

Utilization of ROI

In the world of PSA, ROI can demonstrate the efficacy of functions like ticket management systems or deal management platforms in enhancing service delivery and operational productivity. ROI is utilized in various facets of business, including:

- Project Evaluation: Before initiating a project, businesses might compute the potential ROI to determine if the project is worth pursuing.

- Performance Analysis: Businesses often use ROI to gauge the success of marketing campaigns, sales strategies, or new software implementations.

- Strategic Planning: Knowing which ventures yield the highest ROI can guide businesses in their future investment strategies.

Ready to Enhance your ROI?

KEBS, a renowned Professional Service Automation software, aids businesses in optimizing their ROI in various ways:

1. Streamlined Operations: With KEBS comprehensive project management tools and resource management features, businesses can streamline their operations, reducing inefficiencies and costs.

2. Data-Driven Decisions: KEBS financial management software offers actionable insights, enabling businesses to make decisions that bolster ROI.

3. Improved Client Relationships: By utilizing KEBS deal management and ticket management tools, businesses can enhance client relations, leading to increased sales and, consequently, a higher ROI.

KEBS Finance Management

For businesses seeking to leverage the power of PSA to optimize their ROI, KEBS offers a demo to witness the transformative capabilities of its platform firsthand.