Home » PSApedia

Total Deposits

Explore Insights on Total Deposits. Improve Financial Health and Optimize Deposit Strategies.

What is Total Deposits?

Total Deposits are the total amount of money that people or organizations put into a bank or credit union. People do this for safekeeping or investing. Understanding this metric is essential in assessing a financial institution’s stability and liquidity.

In PSA, ‘Total Deposits’ means all the money received from clients before starting services, including upfront payments and retainers. These deposits are essential for cash flow management in service-oriented businesses.

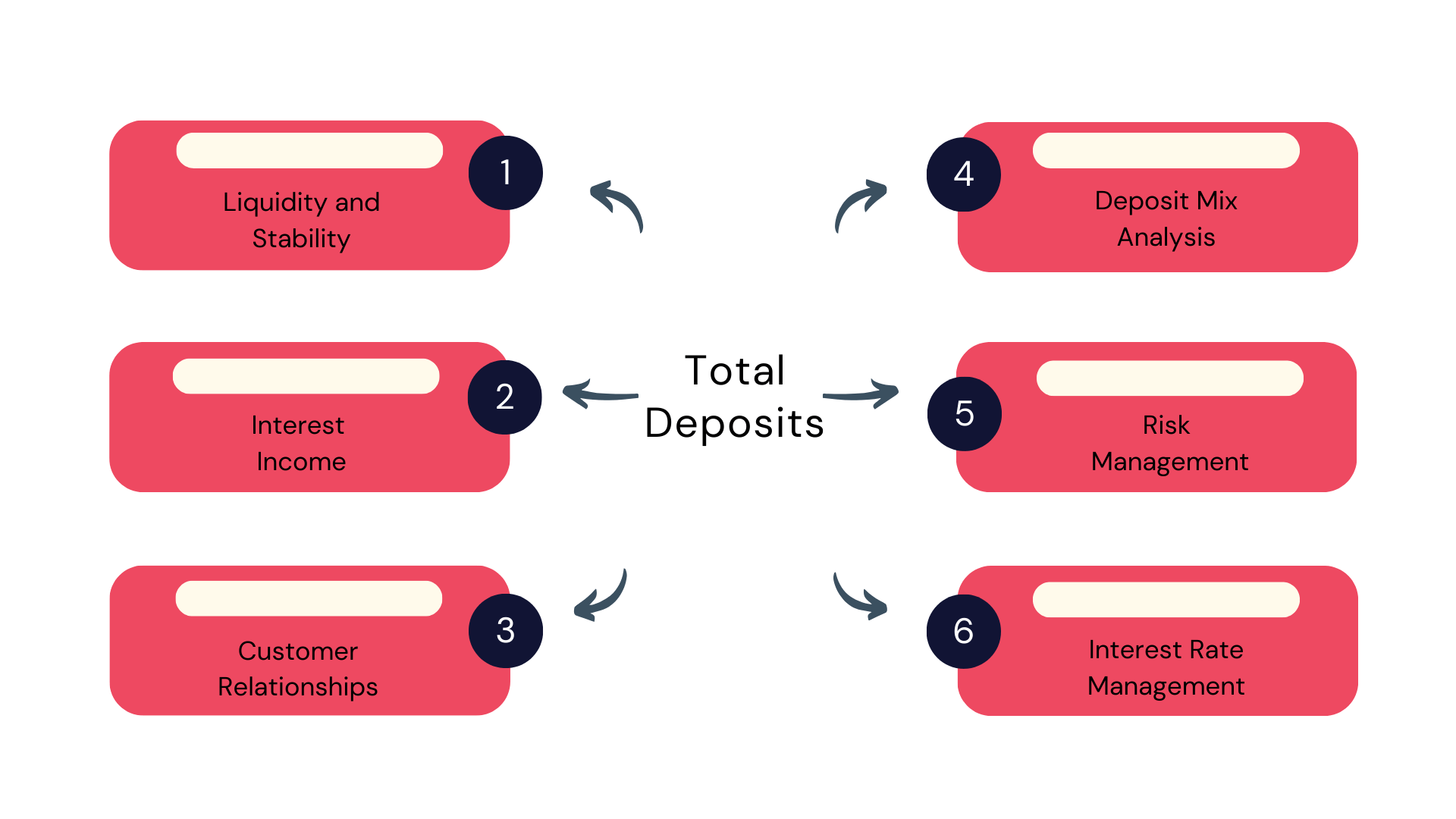

Importance of Total Deposits

Total Deposits form a significant portion of a bank’s funding base. They represent a stable source of funding used for lending activities, investments, and other operational functions. This metric is crucial for determining a bank’s ability to meet withdrawal demands and manage liquidity.

1. Cash Flow Management: Deposits provide an immediate cash flow, essential for the smooth operation of a PSA firm.

2. Client Commitment: They represent a client’s commitment, reducing the risk of cancellations or non-payment.

3. Resource Allocation: Deposits help in planning and allocating resources effectively for upcoming projects.

Importance of Total Deposits

How to calculate Total Deposits?

We calculate Total Deposits by adding all the initial payments clients have made for services to be rendered. You can track this over different time periods, like quarterly or annually, to assess cash flow trends.

The formula for Total Deposits is relatively straightforward:

Total Deposits = Sum of all types of deposits by customers

This includes all types of deposits such as savings accounts, checking accounts, certificates of deposit (CDs), money market accounts, and any other accounts where customers deposit funds with the bank.

Example Calculation of Total Deposits

Suppose a bank has the following deposits:

- Savings Accounts: $50 million

- Checking Accounts: $30 million

- Certificates of Deposit (CDs): $40 million

- Money Market Accounts: $20 million

To calculate the Total Deposits:

Total Deposits=50 million+30 million+40 million+20 million=140 million

Therefore, the Total Deposits held by the bank amount to $140 million.

Total Deposits vs Other Financial Indicators

1. Revenue: While revenue is recognized upon service delivery or over the course of a project, deposits are received beforehand and may be accounted for separately.

2. Accounts Receivable: Unlike accounts receivable, which represent sales that have been made but not yet paid for, deposits are payments received in advance.

| Indicator | Definition | Importance / Use |

|---|---|---|

| Total Deposits | Sum of funds held by a financial institution from customers | Indicates the total amount of customer funds held by the institution |

| Loan-to-Deposit Ratio | Ratio of a bank’s total loans to its total deposits | Measures a bank’s reliance on deposits for funding its lending activities |

| Net Interest Margin (NIM) | Difference between interest income and interest expense, divided by average interest-earning assets | Measures the profitability of lending operations |

| Capital Adequacy Ratio (CAR) | Ratio of a bank’s capital to its risk-weighted assets | Measures a bank’s capital adequacy and ability to cover risks |

How Is Total Deposits Used?

Total Deposits are important for banks. They provide funds for lending, investments, and earning money from interest on loans.

1. Deposit Policy: Establishing clear policies regarding deposit amounts and terms.

2. Client Communication: Effective communication with clients about the purpose and terms of deposits.

3. Financial Tracking: Utilizing financial software to track and manage deposits effectively.

Ready to Optimize Your Total Deposits?

KEBS, a leading PSA software, offers tools that can help businesses optimize their Deposit Management. KEBS offers finance management software that can significantly enhance the management of total deposits in PSA.

KEBS provides tools for tracking deposits, enabling better cash flow management. Efficient management of client accounts, including deposits, through KEBS deal management system.

Using KEBS tools, firms can forecast future cash flows based on the deposits and planned project delivery.

KEBS Finance Management

To understand how KEBS can assist in effectively managing total deposits in your PSA firm, contact us or request a demo to see our solutions in action.