Home » PSApedia

Total Number of Accounts

Discover Insights on Total Number of Accounts. Optimize Customer Engagement – Your Guide to a Diversified Client Base!

What is Total Number of Accounts?

The term “Total Number of Accounts” typically refers to the aggregate count of all individual accounts or memberships held within a particular system, platform, or institution. This metric is often used in various industries, including banking, finance, technology, and memberships-based services.

In the context of Professional Service Automation (PSA), the total number of accounts typically refers to the sum of all client or customer accounts that a firm manages. This metric is crucial for understanding the scope of a firm’s client base and service reach.

Relevance of Account Quantification in PSA

The Total Number of Accounts reflects the scale and reach of a system or institution, indicating its customer base, market penetration, or user engagement. It’s a significant metric for assessing growth, customer retention, and overall market presence.

1. Client Base Analysis: Provides insights into the size and diversity of the firm’s clientele.

2. Service Demand Evaluation: Helps in assessing the demand for different services offered by the firm.

3. Resource Allocation: Influences how resources are allocated for client management and service delivery.

Relevance of Account Quantification in PSA

How to calculate Total Number of Accounts?

The total number of accounts is calculated by summing all active client or customer accounts within a given period. This count can vary based on the nature of services and client engagement models.

Calculating the Total Number of Accounts involves tallying the individual accounts or memberships registered within the system or platform. This includes both active and inactive accounts, as well as any duplicates or multiple accounts held by the same individual.

Example – Calculation of Total Number of Accounts

For instance, if a digital platform or service has:

- 50,000 active user accounts

- 10,000 inactive or dormant accounts

- 5,000 duplicate or secondary accounts

The Total Number of Accounts would be:

Total Number of Accounts=50,000+10,000+5,000=65,000

Total Number of Accounts=50,000+10,000+5,000=65,000

Therefore, the Total Number of Accounts within the system is 65,000.

Total Number of Accounts vs Other Financial Metrics

Compared to metrics like average account balance or account turnover rate, the Total Number of Accounts focuses on quantity rather than individual account value or turnover frequency, providing insights into the institution’s reach and clientele diversity.

1. Revenue Per Account: While revenue per account focuses on the income generated from each account, the total number of accounts measures the breadth of the client base.

2. Client Retention Rate: This metric measures the firm’s ability to retain clients over time, in contrast to the total number of accounts which is a snapshot metric.

| Metric | Definition | Importance / Use |

|---|---|---|

| Total Number of Accounts | The aggregate count of accounts managed or held by a company | Indicates the breadth of the customer base or accounts managed |

| Revenue | Total income generated by a company from its operations | Reflects the total earnings before expenses and other deductions |

| Average Revenue per Account | Average income generated per account or customer | Indicates the average contribution of each account to the company’s revenue |

| Customer Lifetime Value (CLV) | Total value a customer brings over the entire relationship | Helps assess the worth of retaining a customer and informs marketing |

Utilization of Total Number of Accounts

The Total Number of Accounts offers insights into market reach, customer engagement, and the potential user base for services or offerings. It’s instrumental in evaluating market share and devising growth strategies.

1. Client Segmentation: Categorizing clients based on various factors like service needs, profitability, and engagement level.

2. Customized Service Offerings: Tailoring services to meet the specific needs of different account segments.

3. Efficient Account Management Systems: Implementing robust account management systems for better tracking and service delivery.

Ready to Optimize Your Account Management?

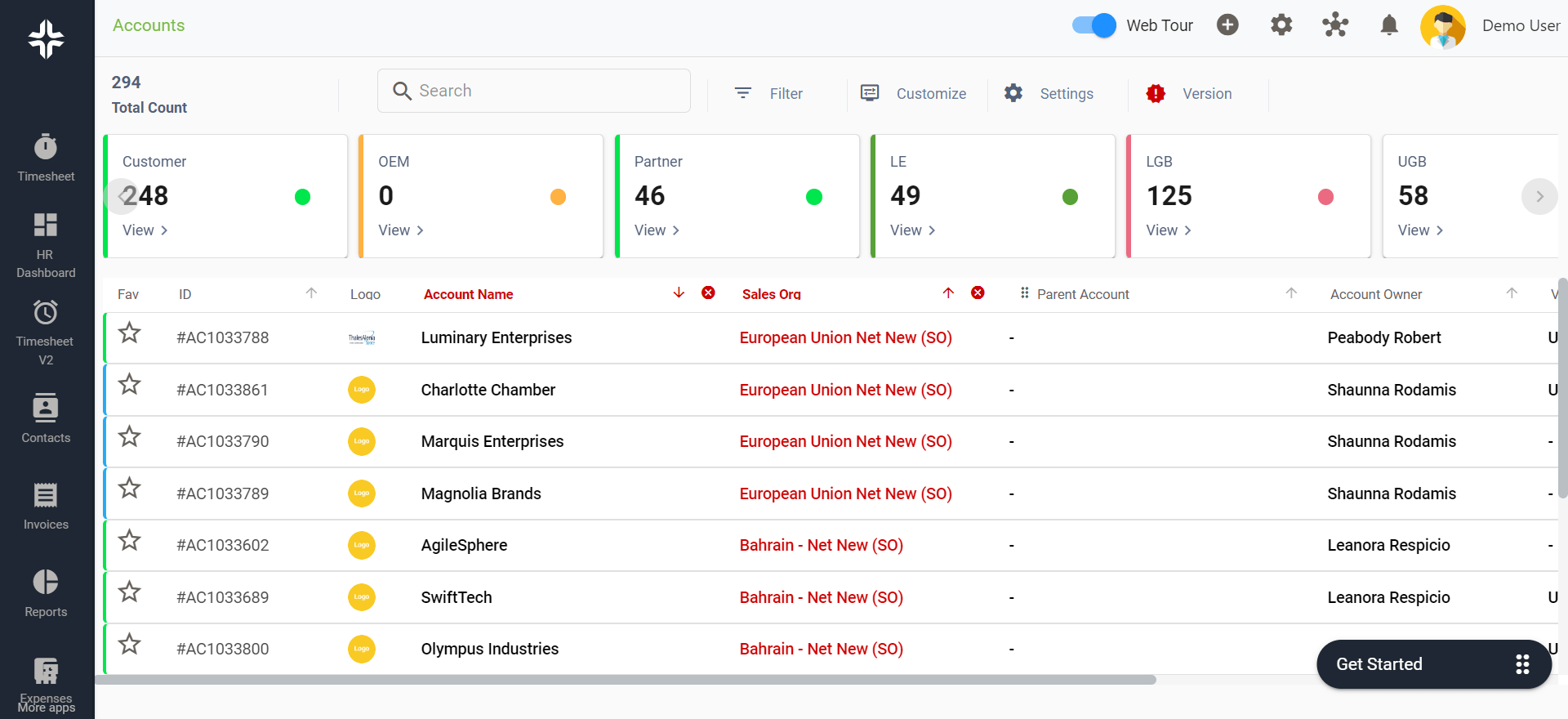

KEBS, a leading PSA software, offers tools that can help businesses optimize their Account Management. KEBS offers resource management software and CRM solutions that can significantly improve account management in PSA.

KEBS provides tools for effective tracking and analysis of client accounts.

With KEBS CRM capabilities, firms can manage client relationships more efficiently and personalize their services. KEBS analytical tools offer valuable insights for strategic decision-making in account management.

KEBS Deal Management

To learn more about how KEBS can assist in optimizing your account management and enhance client relationships in PSA, contact us or request a demo.