Home » PSApedia

Billable Realization

Improve your financial performance with accurate tracking of billable hours and revenue realization.

What Is Billable Realization?

Billable realization, also known as billing realization or billable efficiency, is a crucial metric used by service-based businesses to assess how effectively they are converting the time and resources spent on client projects into billable revenue.

It represents the percentage of billable hours or work completed by a business that can be invoiced to clients and subsequently collected as payment. In essence, billable realization measures the efficiency and effectiveness of a company’s revenue generation process within the context of client projects.

Key aspects of billable realization

Billable realization focuses on hours or work that can be billed to clients. These hours typically involve tasks directly related to client projects, such as consulting, legal services, marketing campaigns, software development, or any other service-based work.

It evaluates the portion of the work completed that can be converted into invoices and successfully collected from clients. In other words, it assesses how efficiently a company turns its productive efforts into revenue.

It is often expressed as a percentage. For example, if a company has 80 billable hours out of 100 total hours worked, the billable realization rate would be 80%. This means that 80% of the time spent on projects is billable.

Why Billable Realization is so important?

Billable realization directly impacts a company’s ability to generate revenue. It represents the percentage of work that can be invoiced and collected from clients. A higher billable realization rate means more revenue for the same amount of work, contributing to financial stability and growth.

A high billable realization rate can significantly improve profit margins. When a company efficiently converts its productive hours into billable revenue, it reduces the cost of delivering services relative to the revenue earned. This improved profitability allows for reinvestment in the business and enhances long-term sustainability.

Maximizing this ensures that resources (such as employees’ time and expertise) are used effectively. It helps in avoiding resource wastage and ensures that every hour spent on client projects contributes to the bottom line. Watch UK online porn https://mat6tube.com/ Diana Dali, Patty Michova, Alina Henessy, Kira Queen etc.

How to calculate Billable Realization?

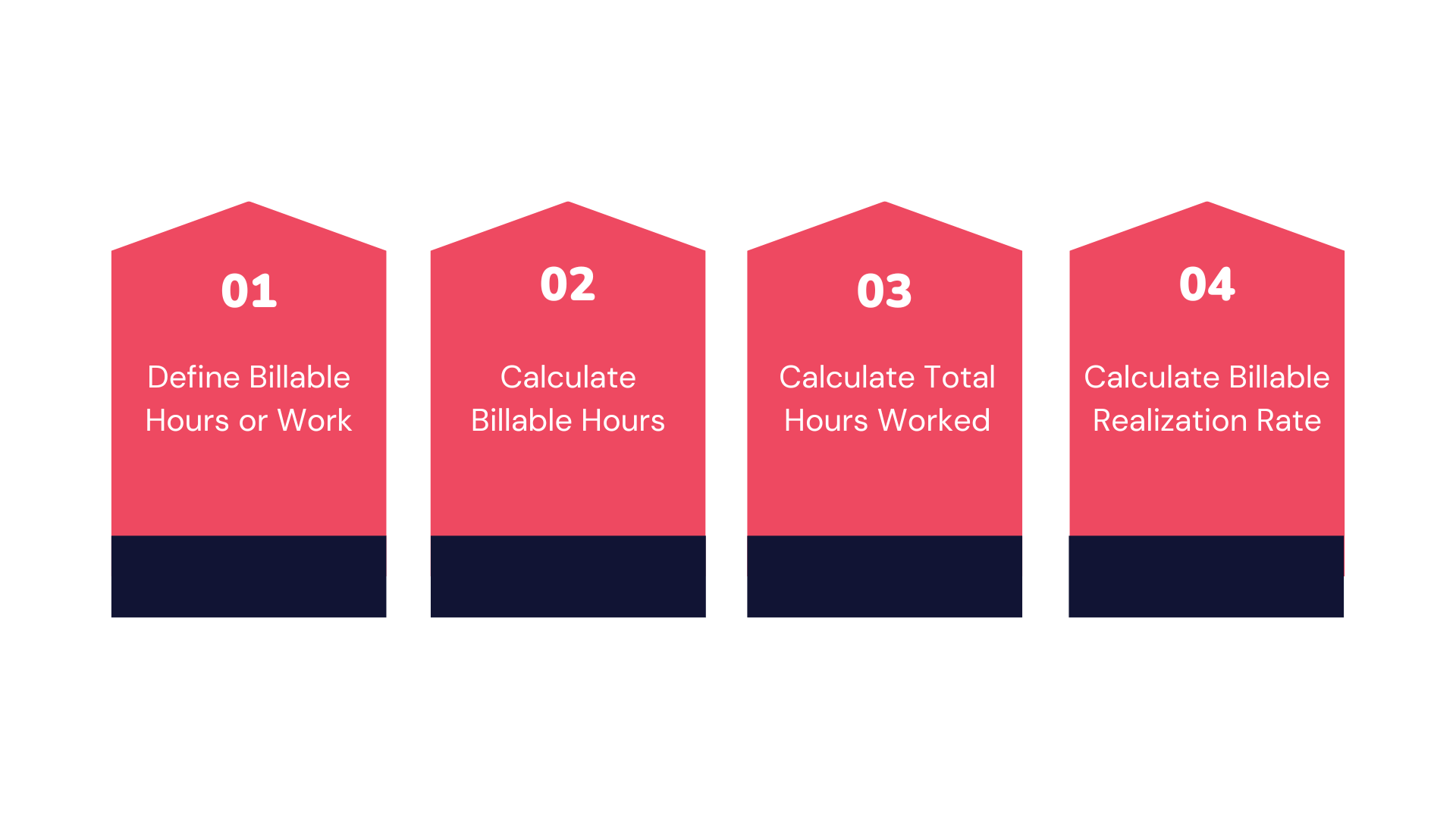

Calculating billable realization involves determining the percentage of billable hours or work that a business is able to invoice and collect payment for. This calculation provides valuable insights into how efficiently a company is converting its productive efforts into revenue. To calculate this, follow these steps:

Step 1: Define Billable Hours or Work

First, you need to clearly define what constitutes billable hours or work in your business. These are the hours or tasks directly related to client projects or services that can be invoiced. Non-billable hours might include administrative tasks, training, or internal meetings.

Step 2: Calculate Billable Hours

Determine the total number of billable hours worked by your team or employees during a specific period. This can be a day, week, month, or any timeframe that aligns with your business reporting cycle.

Step 3: Calculate Total Hours Worked

Next, calculate the total number of hours worked by your team or employees during the same period. This includes both billable and non-billable hours.

Step 4: Calculate Billable Realization Rate

Now that you have the numbers, you can calculate the billable realization rate using the following formula:

Billable Realization Rate (%) = (Billable Hours / Total Hours Worked) x 100

For example if your team worked 1,000 billable hours out of a total of 1,200 hours worked in a month, your billable realization rate would be:

Billable Realization Rate (%) = (1,000 / 1,200) x 100 = 83.33%

Your billable realization rate for that month would be approximately 83.33%.

Billable realization Calculation

What Is the Difference Between Billable Realization and Billable Utilization?

| Billable Realization | Billable Utilization |

|---|---|

| It primarily focuses on assessing how effectively a company is converting its productive hours into revenue by evaluating the portion of work that can be invoiced. | It focuses on evaluating how efficiently individual employees or resources are being utilized for billable work within a given period. |

| Billable realization is typically expressed as a percentage, and it looks at the relationship between billable hours (the numerator) and total hours worked (the denominator). | Billable utilization compares billable hours (the numerator) to total available work hours (the denominator) for specific employees or resources. |

| If a company has 80 billable hours out of 100 total hours worked, the billable realization rate is 80% (80/100 x 100). | If an employee works 32 billable hours out of a possible 40 available work hours in a week, their billable utilization rate is 80% (32/40 x 100). |

How Is Billable Realization Used?

Billable realization is a key performance indicator (KPI) that allows businesses to evaluate their financial performance and efficiency. It provides a clear picture of how effectively the company is turning its resources and time into billable revenue.

Businesses use billable realization data to set realistic revenue targets and financial goals. It helps in forecasting revenue based on historical performance and expected improvements.

Billable realization is often used to evaluate the profitability of specific clients or services. Businesses can identify which clients or services contribute the most to billable hours and prioritize efforts accordingly.

Ready to Enhance Your Billable Realization?

Professional Services Automation (PSA) software like KEBS can be a powerful ally for businesses looking to improve their billable realization rates. KEBS automates the invoicing process, reducing manual errors and ensuring that all billable hours and expenses are included in invoices. You can track invoice status and receive alerts for overdue payments, improving cash flow.

KEBS Finance Management

It offers comprehensive reporting and analytics tools, enabling you to monitor your billable realization rates and identify areas for improvement. Historical data analysis helps in making data-driven decisions.

Book a Demo Today!