Home » PSApedia

Budget Iterations

Streamline Budget Iterations for Precise Control and Enhance Fiscal Management.

What Is Budget Iterations?

Budget iterations involve in repeatedly revising a budget to ensure that financial goals align with operational objectives. It involves evaluating and adjusting budgetary allocations based on real-time data, unforeseen expenses, and evolving in business priorities.

The process includes examining projected income and expenses, making necessary adjustments, and obtaining approval until reaching a final budget. This iterative process ensures that the budget aligns with the financial goals and constraints of an organization or individual.

Importance of Budget Iterations

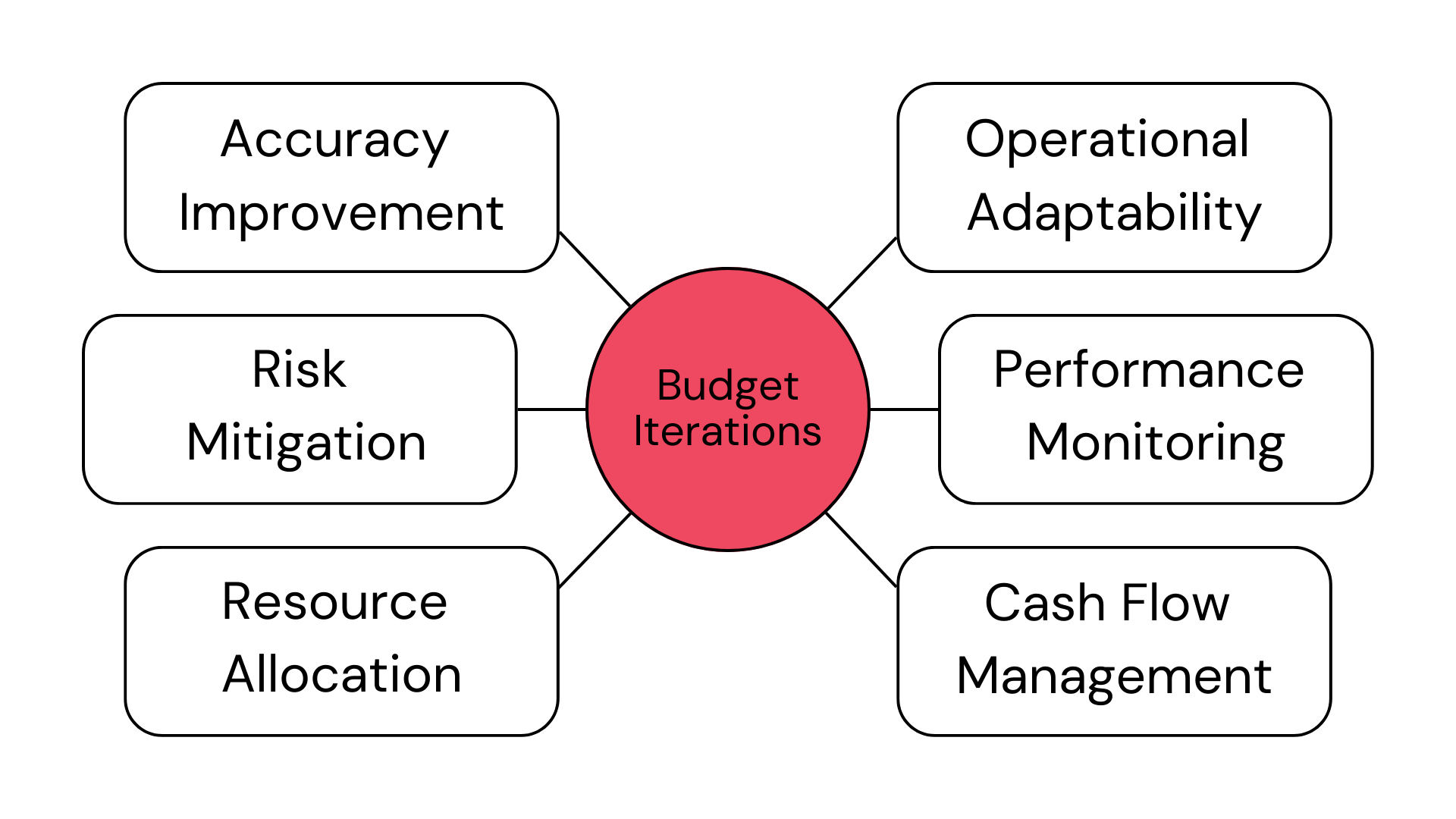

It are essential for several reasons:

1. Adaptability: It allows businesses to adapt to unforeseen financial challenges. Precision ensures that budgets align with the latest business objectives and data.

2. Resource Optimization: Maximizes return on investment by effectively allocating resources. For insights on resource optimization, check out this article on resource management in PSA.

3. Financial Health: Regular iterations can help a business stay on track financially and prevent overspending.

Why Budget Iterations is so important?

Calculating Budget Iterations

Contrast the real expenses against the projected ones to undertake the computation of BIs.

Formula:

Budget Iteration Index (BII) = (Actual Expenditure / Forecasted Budget) x 100

Example:

If a business had a forecasted budget of $10,000 but actually spent $9,500, the BII would be:

BII=(9,500/10,000)x100=95

A BII of 95 indicates that the business spent 95% of its forecasted budget. The business must then decide whether to reallocate or save the 5% underspend.

Budget Iterations vs Other Financial Frameworks

Budget iterations differ from other financial frameworks:

- Budget Iterations vs Fixed budgets are inflexible and set for a certain time. Budget iterations, on the other hand, are more flexible and updated often using current data.

- Zero-based budgeting starts from scratch each time, justifying every budget item. Budget iterations, on the other hand, involve making changes to existing budgets.

- To delve deeper into financial frameworks, consider exploring financial management strategies in professional services.

| Criteria | Budget Iterations | Zero-Based Budgeting | Rolling Forecasts | Activity-Based Budgeting |

|---|---|---|---|---|

| Objective | Improve and adjust budget over time | Start every budget from zero | Adjust forecasts continuously | Allocate costs based on activities |

| Frequency | Multiple times a year | Annually | Monthly or quarterly | Annually with regular updates |

| Focus | Refining budget estimates | Justifying every expense | Adjusting to current realities | Activity cost management |

| Effort Required | Moderate (iterative) | High (each expense is reviewed) | Moderate-to-high | High (activity analysis) |

| Flexibility | High (adjustments made frequently) | Low (annual reset) | High (regular updates) | Moderate (based on activities) |

| Best for | Dynamic businesses with changing needs | Organizations looking for deep cost cuts | Businesses in rapidly changing environments | Organizations looking to understand the cost drivers |

How should we use budget iterations?

Various ways use budget iterations.

- Strategic Planning: Iterative budgets can inform and shape strategic decisions. For more on strategic planning, see how deal management software boosts sales.

- Resource Allocation: Iterations help businesses allocate resources effectively, ensuring projects and departments are well-funded. Learn more about effective resource management.

- Performance Measurement: Comparing actual expenditure against iterative budgets can provide insights into the business’s financial performance.

Ready to Achieve Effective Budget Iterations?

KEBS, a renowned PSA Software, offers robust tools that can assist businesses in implementing effective budget iterations:

- Real-time Data Sync: KEBS provides two-way data sync that ensures your budget data is always up to date.

- Custom Reporting: With KEBS, businesses can generate custom reports on their budget iterations, ensuring financial transparency.

- Project Management: Streamline your budget allocation process for various projects using KEBS project management software.

- Financial Management: KEBS offers dedicated financial management software to ensure your iterative budgeting aligns with broader financial goals.

KEBS Expense Management

Ready to optimize your budget iterations with KEBS? Reach out for a personalized demo or contact us today.