Home » PSApedia

Client profitability index

Discover the Client Profitability Index. Maximize Revenue and Optimize Client Relationships.

What Is Client Profitability Index?

Client Profitability Index (CPI) is a crucial metric in understanding the value a client brings to a business. It goes beyond traditional revenue analysis, focusing on the profitability and cost-effectiveness of maintaining relationships with specific clients. In the realm of Professional Service Automation (PSA), CPI plays a vital role in strategic decision-making.

It evaluates the profitability of each client by comparing the profits generated to the resources expended. This index is crucial for determining the long-term value and sustainability of client relationships.

The Importance of Client Profitability Index

Effectively managing CPI is key to enhancing the financial performance of service-oriented businesses. CPI is essential for businesses to identify which clients are most profitable and which may be costing more than they contribute. This understanding is crucial for resource allocation, pricing strategies, and long-term business planning. In the context of PSA, where resource optimization is key, understanding CPI can lead to more efficient operations and improved financial management.

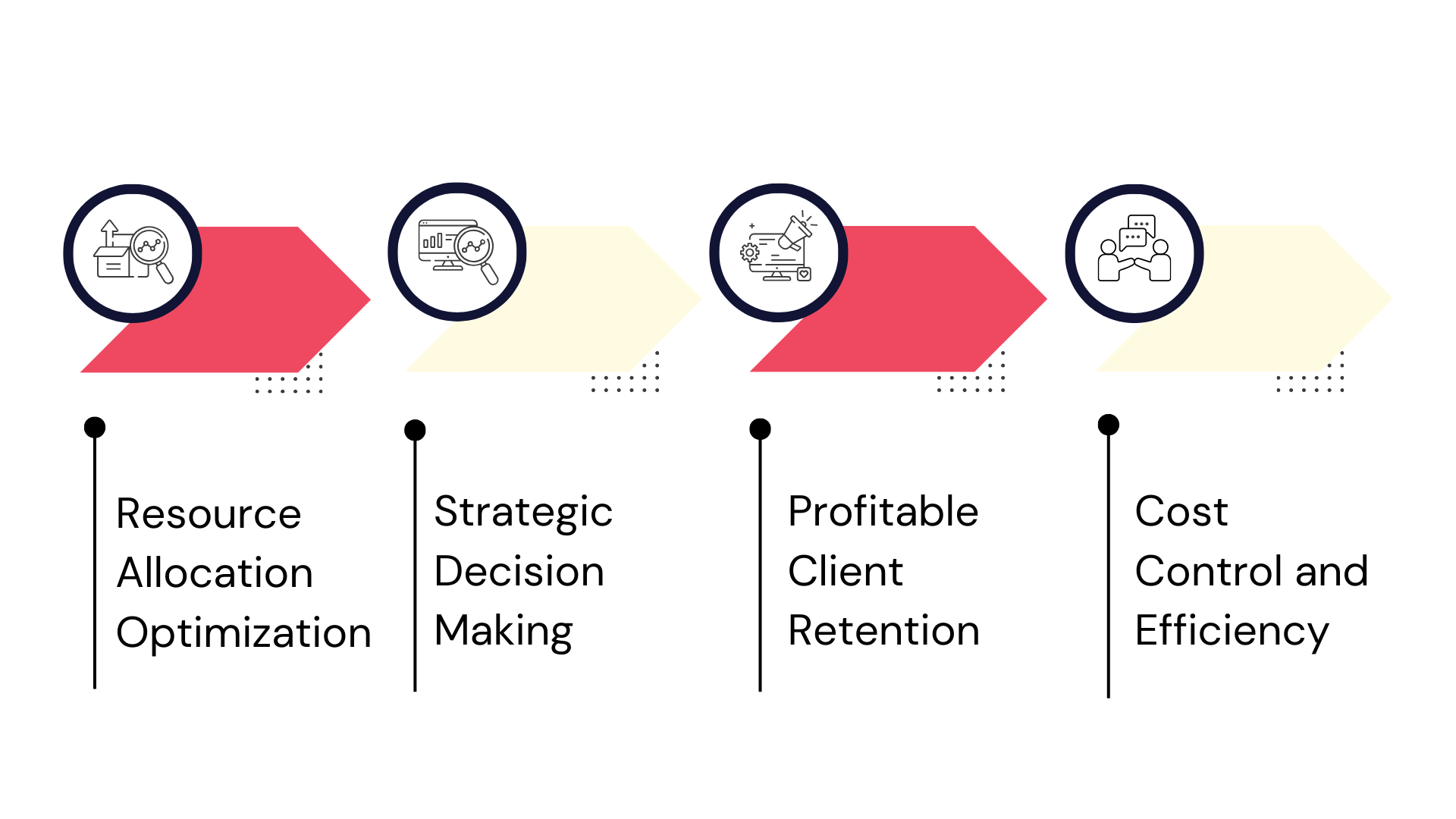

CPI is vital in PSA for several reasons:

1. Resource Allocation: Helps where to allocate resources for maximum profitability.

2. Strategic Planning: Aids in making informed decisions about pursuing or continuing client relationships.

3. Financial Optimization: Helps in identifying more profitable client segments.

4. Client Relationship Management: Assists in tailoring service offerings based on profitability analysis.

The Importance of Client Profitability Index

How to calculate CPI?

To calculate CPI, businesses need to consider the revenue generated from a client and the direct and indirect costs associated with servicing them. The formula is:

Formula: CPI = Total Profit from Client / Total Resources Expended on Client

Example: If the total profit from a client is $15,000 and the resources expended are valued at $10,000, the CPI would be:

CPI = $15,000 / $10,000 = 1.5

This suggests that for every dollar spent on the client, the firm gains $1.50 in return.

CPI vs Other Profitability Metrics

While CPI focuses on client-specific profitability, other metrics like Gross Margin or EBITDA offer a broader view of a company’s financial health. Unlike these metrics, CPI provides a granular view, essential for resource management and client-centric strategies. It’s important to distinguish CPI from metrics like:

1. Net Profit Margin: Measures overall business profitability, not specific to individual clients.

2. Return on Investment (ROI): A broader metric that can apply to a variety of investments beyond client relationships.

| Metric | Definition | Importance / Use |

|---|---|---|

| Client Profitability Index (CPI) | Measures the profitability of individual clients or segments | Evaluates the return on investment and resources allocated to serving each client |

| Return on Investment (ROI) | Ratio of net profit to the cost of investment | Measures the efficiency of an investment relative to its cost |

| Gross Margin | Percentage of revenue retained after direct costs | Indicates profitability and efficiency in production or service delivery |

| Net Profit Margin | Ratio of net profit to total revenue | Measures overall profitability as a percentage of revenue |

Applications of Client Profitability Index

CPI is used in various business applications, including:

1. Client Segmentation: Identifying high and low-profit clients for tailored service strategies.

2. Resource Allocation: Directing resources to more profitable clients for maximized returns.

3. Performance Measurement: Evaluating the effectiveness of client service teams.

4. Service Customization: Tailoring services to enhance profitability in less lucrative client segments.

5. Cost Management: Continuously seeking ways to optimize costs associated with client servicing.

Ready to Optimize Your Client Profitability Index?

KEBS, as a PSA software, offers tools to enhance CPI management. Features like real-time analytics, client management modules, and integrated financial reporting provide insights into client profitability. Additionally, KEBS resource management capabilities ensure optimal allocation of resources to the most profitable clients.

KEBS offers detailed insights into profitability and resource utilization per client. Helps in optimizing resource allocation based on profitability insights. Manages client relationships effectively, contributing to higher profitability.

Enables tailored reports for better tracking and understanding of client profitability.

KEBS Finance Management

To explore how KEBS can enhance your CPI management, contact us for more information or try our demo to see the software in action.