Home » PSApedia

Contribution margin

Enhance Profitability and Understand Contribution Margin's Impact on Your Business.

What Is Contribution Margin?

Contribution Margin shows how much money a business makes from sales after subtracting variable costs. It displays the amount of money remaining after deducting variable costs from sales revenue. This money helps pay for fixed costs and make a profit.

Contribution margin measures a company’s efficiency by finding the difference between sales and variable costs. The contribution margin is important for finance students. It shows how much a product or service contributes to a company’s profits. It also determines the amount of funds available for covering fixed expenses.

Why Is Contribution Margin So Important?

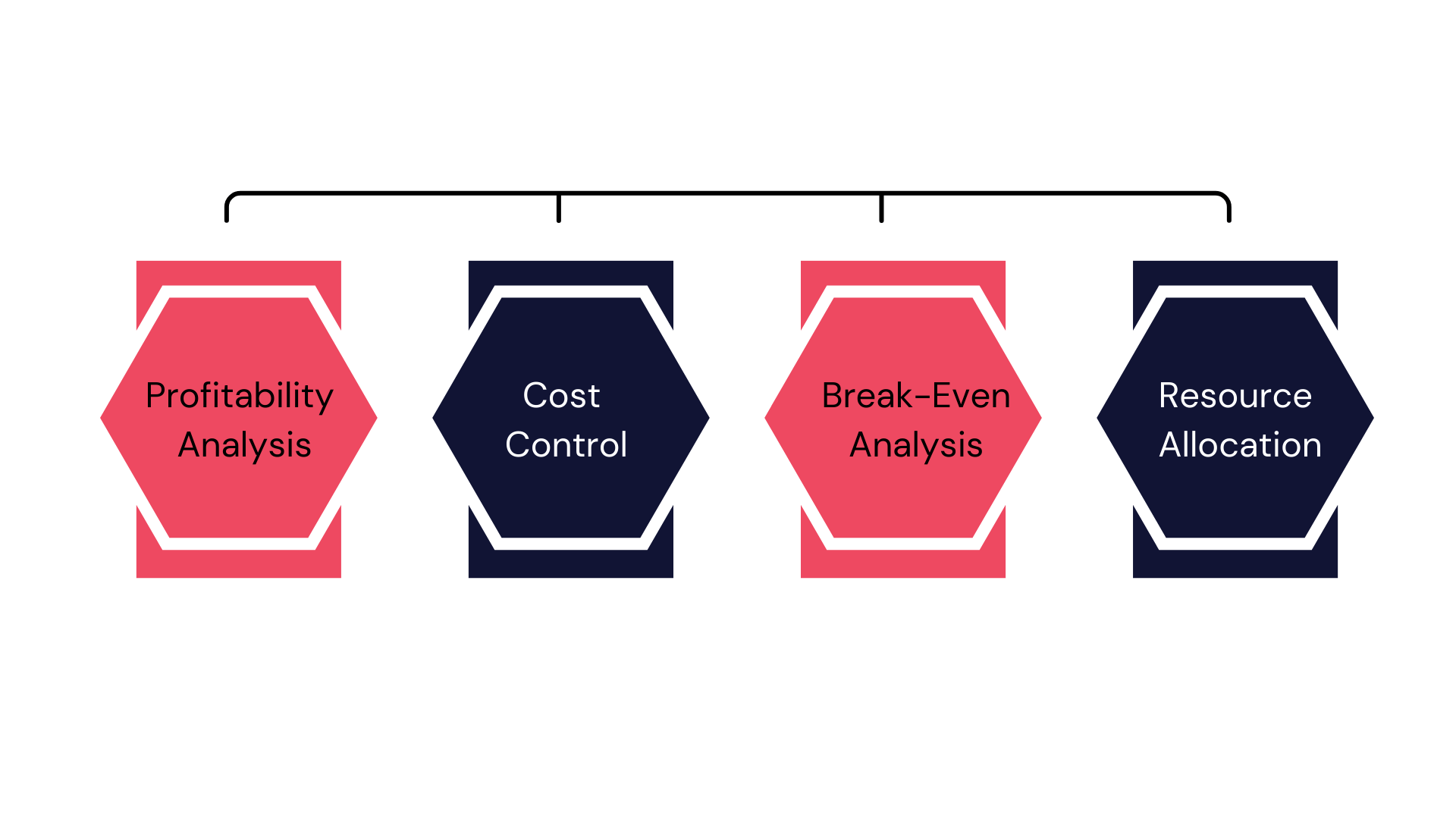

Understanding the Contribution Margin can offer invaluable insights into business operations. Key benefits include:

- Profitability Analysis: Determine which products or services yield the highest margin and prioritize them.

- Knowing your Contribution Margin: It helps you determine the number of sales required to cover fixed costs at the Break-even Point.

- Strategic Decision Making: Use the metric to decide on pricing strategies, product mix, and marketing investments.

Moreover, Professional Services Automation (PSA) relies on the Contribution Margin to ensure appropriate pricing of service offerings.

Why Is Contribution Margin So Important?

How to Calculate Contribution Margin?

Formula:

Contribution Margin = Sales Revenue − Variable Costs

Example:

Let’s assume Company A has a sales revenue of $100,000 and variable costs amounting to $40,000.

{Contribution Margin} = $100,000 – $40,000 = $60,000

Thus, Company A’s contribution margin is $60,000.

Differences Between Contribution Margin and Profit Margin

While both metrics are crucial in financial analysis, they serve different purposes:

- Contribution Margin: Focuses on covering variable costs and contributing to fixed costs.

- Profit Margin: Highlights the profitability after accounting for all costs, including both variable and fixed.

| Aspect | Contribution Margin | Profit Margin |

|---|---|---|

| Definition | It represents the portion of revenue that covers variable costs and contributes to covering fixed costs. | It represents the percentage of profit earned on total revenue after deducting all expenses, including both variable and fixed costs. |

| Focus | Emphasizes the relationship between variable costs and revenue. | Takes into account all costs, including both variable and fixed costs. |

| Calculation | Contribution Margin = (Total Revenue – Variable Costs) / Total Revenue | Profit Margin = (Net Profit / Total Revenue) x 100% |

| Usefulness | Useful for assessing the impact of changes in sales volume on covering fixed costs. | Provides an overall measure of profitability and is often used for evaluating a company’s financial health. |

| Variability | Tends to be more stable as it only considers variable costs. | Can fluctuate widely depending on changes in both variable and fixed costs. |

| Decision-making | Helps in pricing decisions, cost control, and break-even analysis. | Used for evaluating overall business performance and making investment decisions. |

| Common in Industries | Commonly used in manufacturing and retail industries. | Widely used in financial and investment analysis across various industries. |

| Example | If a product generates $1,000 in revenue with variable costs of $400, the contribution margin is 60% ($600 / $1,000). | If a company has a net profit of $50,000 on total revenue of $500,000, the profit margin is 10% ($50,000 / $500,000 x 100%). |

Practical Uses of Contribution Margin

This information helps in setting optimal pricing, identifying profitable product lines, and allocating resources efficiently. It enables businesses to make data-driven choices, whether it’s deciding to discontinue low-margin products, launching new offerings, or negotiating supplier contracts. Ultimately, contribution margin empowers organizations to maximize their profits and maintain financial health.

For businesses, especially those leveraging project management tools, understanding the Contribution Margin can:

- Help in optimizing project financials.

- Allow for more efficient project financial management.

- Aid in setting competitive prices using insights from deal management software.

Contribution Margin and Overall Business Health

This metric is not just a number; it’s an insight into business health. A higher contribution margin indicates that a company can easily cover its fixed costs, signaling strong financial health. Conversely, a lower margin might necessitate a review of resource management strategies or a reassessment of pricing in the deal pipeline.

A healthy contribution margin indicates that a business can cover its fixed costs and generate profits more effectively. By optimizing contribution margins, companies can enhance profitability and financial stability, making it a key factor in assessing and improving overall business health.

Ready to Optimize Your Contribution Margin?

Harness the power of KEBS to gain deeper financial insights, optimize your pricing strategies, and enhance profitability. KEBS provides various tools and solutions for businesses focused on growth, including deal management and finance management features.

KEBS Finance Management

If you’re eager to delve into the transformative power of KEBS, contact us today or take a quick demo to experience its capabilities firsthand!