Home » PSApedia

Customer Concentration Risk

Minimize business vulnerabilities and foster stability with Customer Concentration Risk solution.

What Is Customer Concentration Risk?

Customer Concentration Risk refers to the potential vulnerability a business faces when a substantial portion of its revenue or success relies on a limited number of customers. This risk arises when a company becomes overly dependent on a few key clients, impacting its stability and growth.

In Professional Service Automation (PSA), Customer Concentration Risk refers to the potential negative impact that arises when a significant portion of a company’s revenue is reliant on a limited number of clients. This risk can pose a threat to the financial stability and sustainability of the business.

Importance of Customer Concentration Risk

Assessing Customer Concentration Risk is crucial as it highlights the potential impact on a company’s financial health. Heavy reliance on a small customer base increases vulnerability to changes in their buying behavior, affecting revenue streams and profitability.

1. Revenue Volatility: High dependence on a few clients can lead to revenue instability if any of these key clients are lost.

2. Negotiation Leverage: A heavy reliance on certain clients may weaken a firm’s negotiating position.

3. Business Continuity: The loss of major clients could severely disrupt business operations.

Importance of Customer Concentration Risk

How to calculate Customer Concentration Risk?

This risk is typically assessed by analyzing the percentage of total revenue derived from each client. A higher percentage from a few clients indicates a higher concentration risk.

Determining this risk involves assessing the percentage of revenue generated from key customers compared to the total revenue. The formula is simple:

Customer Concentration Ratio = Revenue from Key Customers / Total Revenue × 100%

- Revenue from Key Customers represents the sales or income derived from significant clients.

- Total Revenue signifies the overall sales or income generated by the business within a specific period.

Example:

Suppose a company earns $1,000,000 in total revenue, with $700,000 coming from its top two clients. Applying the formula:

Customer Concentration Ratio= 700,000/1,000,000×100%=70%

Therefore, the Customer Concentration Ratio in this scenario is 70%.

Customer Concentration Risk vs Market Diversification

Unlike market diversification, which involves expanding into new markets or sectors to reduce risk, customer concentration risk specifically addresses the dependency on a few clients. Market diversification aims to spread the risk across various industries or markets, while customer concentration risk focuses on balancing revenue streams among different customers.

1. Market Risk: While market risk involves external economic factors, customer concentration risk is specifically related to client dependency.

2. Operational Risk: Operational risks are associated with internal processes, differing from the external client-revenue relationship focus of customer concentration risk.

| Metric | Definition | Importance / Use |

|---|---|---|

| Customer Concentration Risk | Risk arising from reliance on a small number of customers for revenue | Indicates vulnerability if a few customers contribute a significant portion of revenue |

| Customer Retention Rate | Percentage of customers retained over a specific period | Reflects the ability to retain customers and indicates satisfaction |

| Revenue Diversity | Spread of revenue across different customer segments | Indicates the distribution of revenue sources among various customer segments |

| Customer Lifetime Value (CLV) | Total value a customer brings over the entire relationship | Helps assess the worth of retaining a customer and informs marketing |

Strategies to Mitigate Customer Concentration Risk

Customer concentration risk is critical in the financial sector, such as banking or investing. To ensure stability and protect against prospective defaults or economic downturns, banks, for example, must avoid overexposure to certain borrowers.

1. Client Diversification: Actively pursuing new clients and markets to reduce dependency on a few key clients.

2. Building Strong Relationships: Developing deep, multi-faceted relationships with existing clients to enhance loyalty and retention.

3. Risk Monitoring: Regularly monitoring client revenue distribution using tools like KEBS analytics.

Ready to Optimize Your Risk Management?

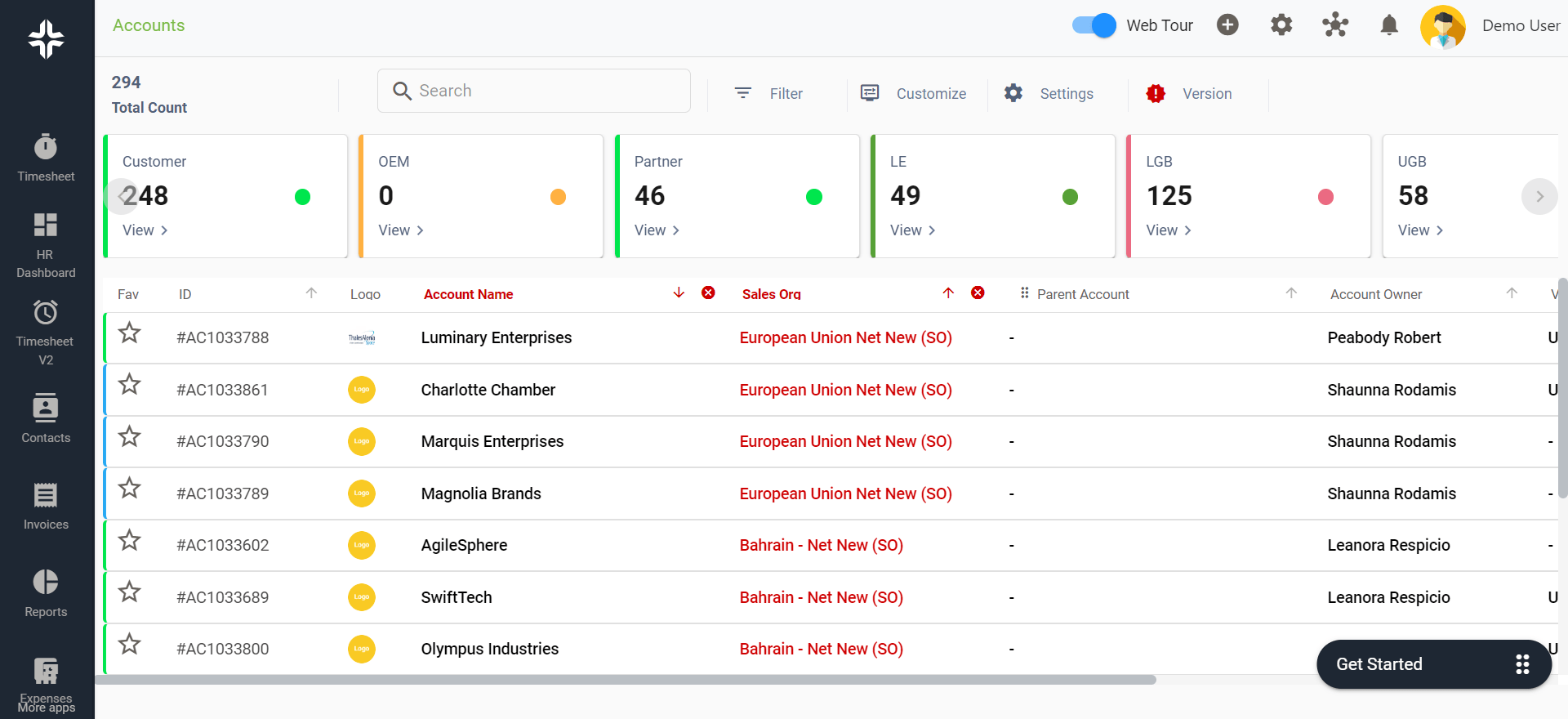

KEBS provides PSA tools that assist in managing customer concentration risk. Employing KEBS CRM software to manage client relationships and identify opportunities for diversification.

Using KEBS financial management tools to forecast and prepare for potential revenue fluctuations. Leveraging KEBS software to gain insights into customer trends and revenue dependencies.

KEBS Deal Management

To explore how KEBS can assist in mitigating customer concentration risk in your business, contact us or request a demo.