Home » PSApedia

Expense reporting accuracy

Ensure Expense Reporting Accuracy for Your Business. Streamline Processes and Eliminate Errors.

What is Expense Reporting Accuracy?

Expense reporting accuracy refers to the precision and correctness of financial reports detailing the expenses incurred by an organization.

In the context of Professional Service Automation (PSA), it ensures that all costs related to services, projects, and operations are captured, categorized, and reported without errors.

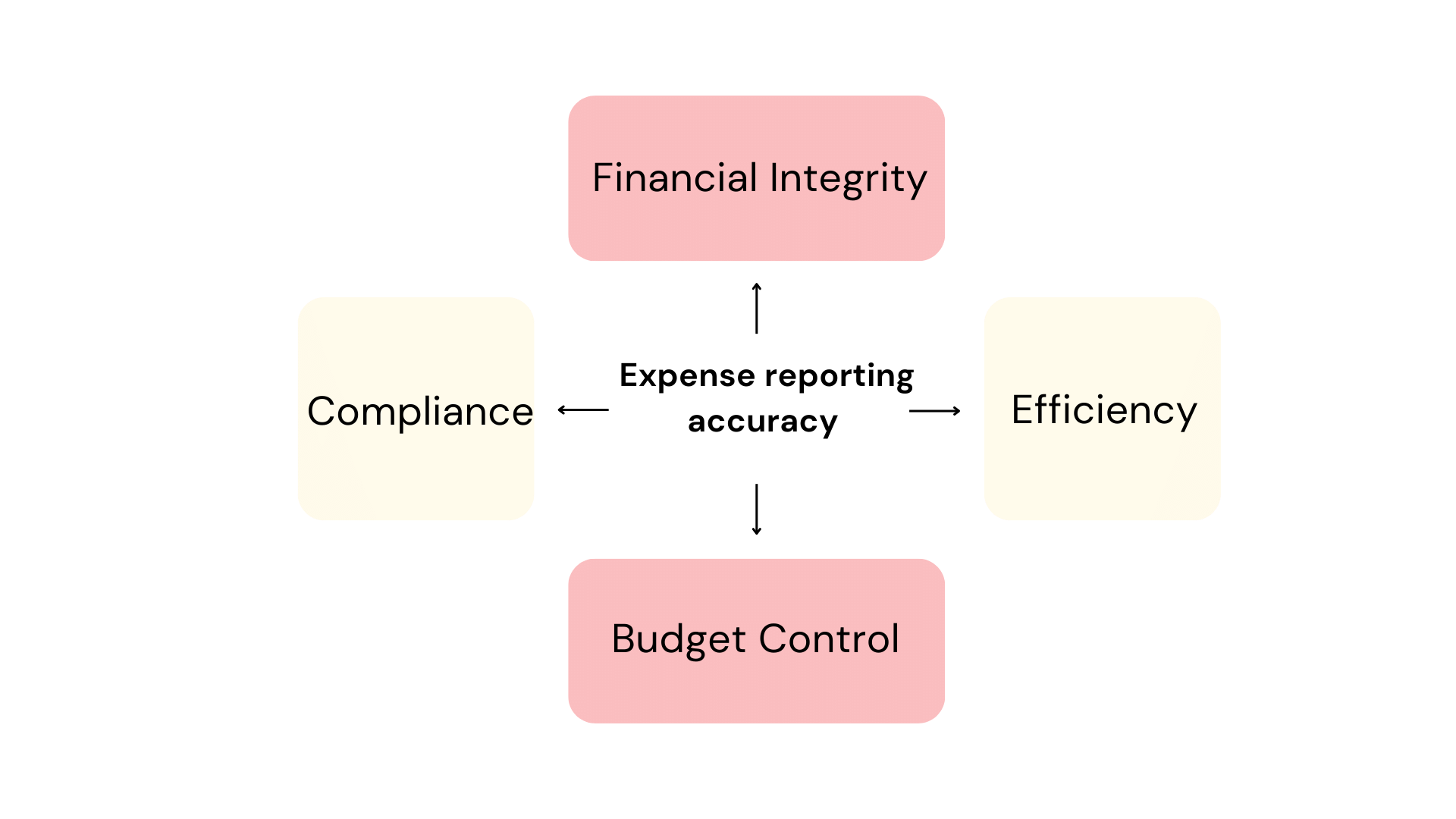

Importance of Expense Reporting Accuracy

Accurate expense reporting is crucial for several reasons:

1. Financial Integrity: It ensures the company’s financial statements reflect the true state of its expenses, essential for stakeholders and investors.

2. Budgeting and Forecasting: Accurate reports aid in financial planning and allocation of resources.

3. Regulatory Compliance: Inaccurate reporting can lead to legal consequences and penalties.

4. Operational Efficiency: It helps in identifying unnecessary expenses and areas of cost-saving, crucial for streamlining business processes.

Why Expense reporting accuracy is so important?

Calculating Expense Reporting Accuracy

Formula:

Expense Reporting Accuracy = (Number of Accurate Expense Entries/Total Number of Expense Entries) × 100

Example:

Let’s say a company has made 100 expense entries in a month. Upon review, 95 of those entries are found to be accurate. Using the formula:

Expense Reporting Accuracy=(95/100)×100=95%

This means the company’s expense reporting accuracy for the month is 95%.

Expense Reporting vs Other Financial Metrics

Expense reporting is just one facet of a company’s financial health. It’s essential to differentiate it from other metrics:

1. Expense Reporting vs Revenue: While expense reporting details the costs incurred, revenue focuses on the income generated. Both are crucial for determining a company’s profitability.

2. Expense Reporting vs Annual Profit: Annual profit is the net income after all expenses are deducted from the total revenue. Accurate expense reporting ensures that the annual profit figure is correct.

3. Expense Reporting vs Cash Flow Management: Cash flow looks at the inflow and outflow of cash within a business. Accurate expense reports contribute to effective cash flow management.

| Metric | Description | Purpose | Key Differences |

|---|---|---|---|

| Expense Reporting | Tracking and reporting of project-related expenditures | Monitor project costs, allocate expenses, and bill clients | Focuses specifically on expenses incurred during projects |

| Revenue Recognition | Accounting method for recognizing revenue | Ensure revenue is recognized when earned and realized | Pertains to revenue, whereas expense reporting deals with costs |

Utilizing Expense Reporting in Professional Service Automation

In PSA, expense reporting plays a pivotal role:

1. Project Costing: By accurately tracking expenses, businesses can determine the actual cost of projects, essential for efficient project financial management.

2. Resource Allocation: Understanding expenses helps in resource allocation, ensuring that resources are used optimally.

3. Billing and Invoicing: Accurate expense reports ensure that clients are billed correctly, enhancing client relationships through transparent billing.

Ready to Optimize Your Expense Reporting Accuracy?

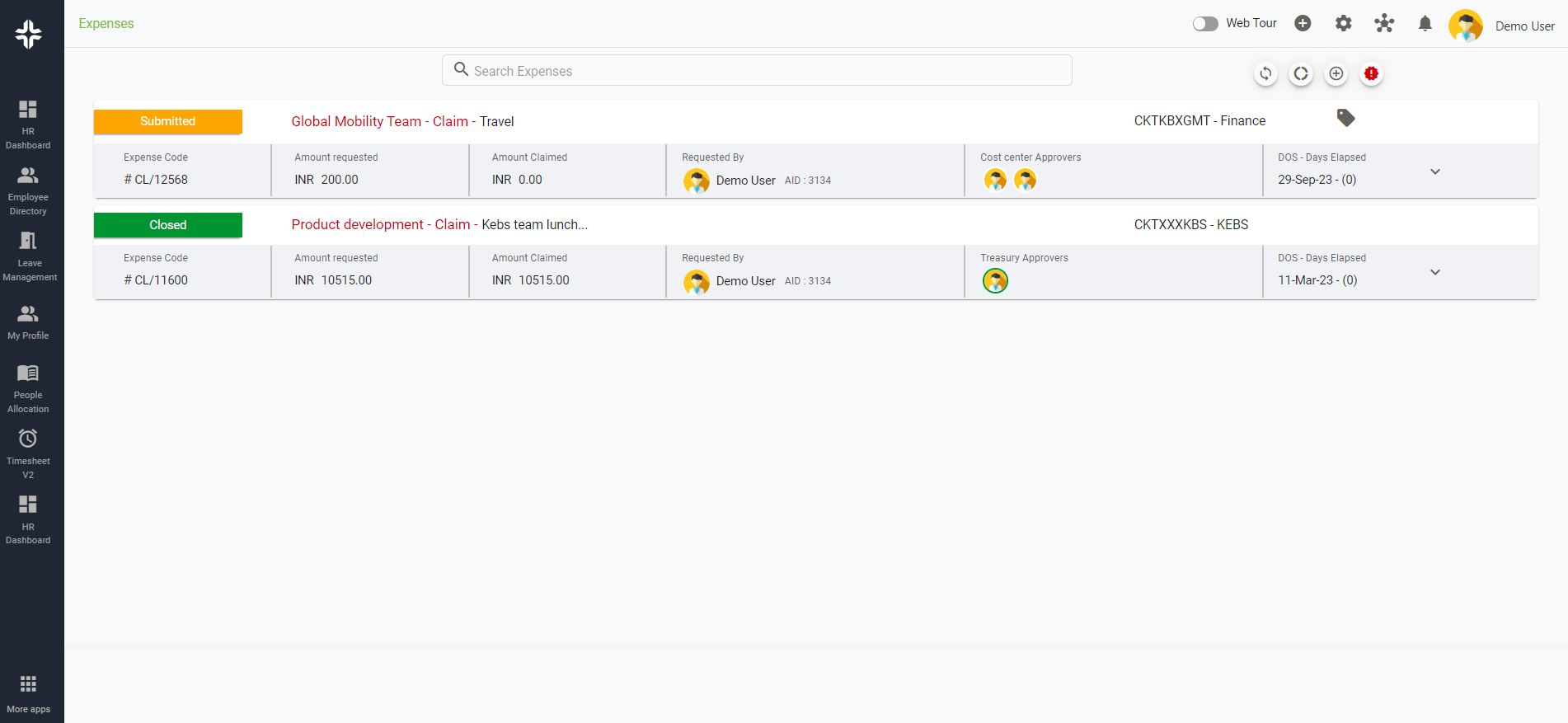

KEBS, a leading PSA software, offers tools that can significantly enhance expense reporting accuracy. KEBS seamlessly integrates with finance management software, ensuring that all financial data is synchronized.

KEBS offers real-time reporting analytics, allowing businesses to review and correct expense entries promptly. Tailor-made workflows in KEBS ensure that expense reporting processes align with a company’s unique needs.

KEBS Expense Management

Ready to optimize your expense reporting accuracy? Contact KEBS today or request a demo to see how KEBS can transform your financial reporting processes.