Home » PSApedia

Gross margin

Optimize Profits with Gross Margin Analysis. Improve Financial Performance and Enhance Success.

What is Gross Margin?

Gross Margin is a key financial metric that represents the percentage of total sales revenue that exceeds the cost of goods sold (COGS). It essentially measures how efficiently a company is producing its goods or services. In the context of Professional Service Automation (PSA), it can be seen as a reflection of how effectively a business is managing its service-related costs against its service revenues.

For businesses using Professional Service Automation software, understanding Gross Margin is crucial. It provides insights into the profitability of projects, helping businesses make informed decisions.

Importance of Gross Margin

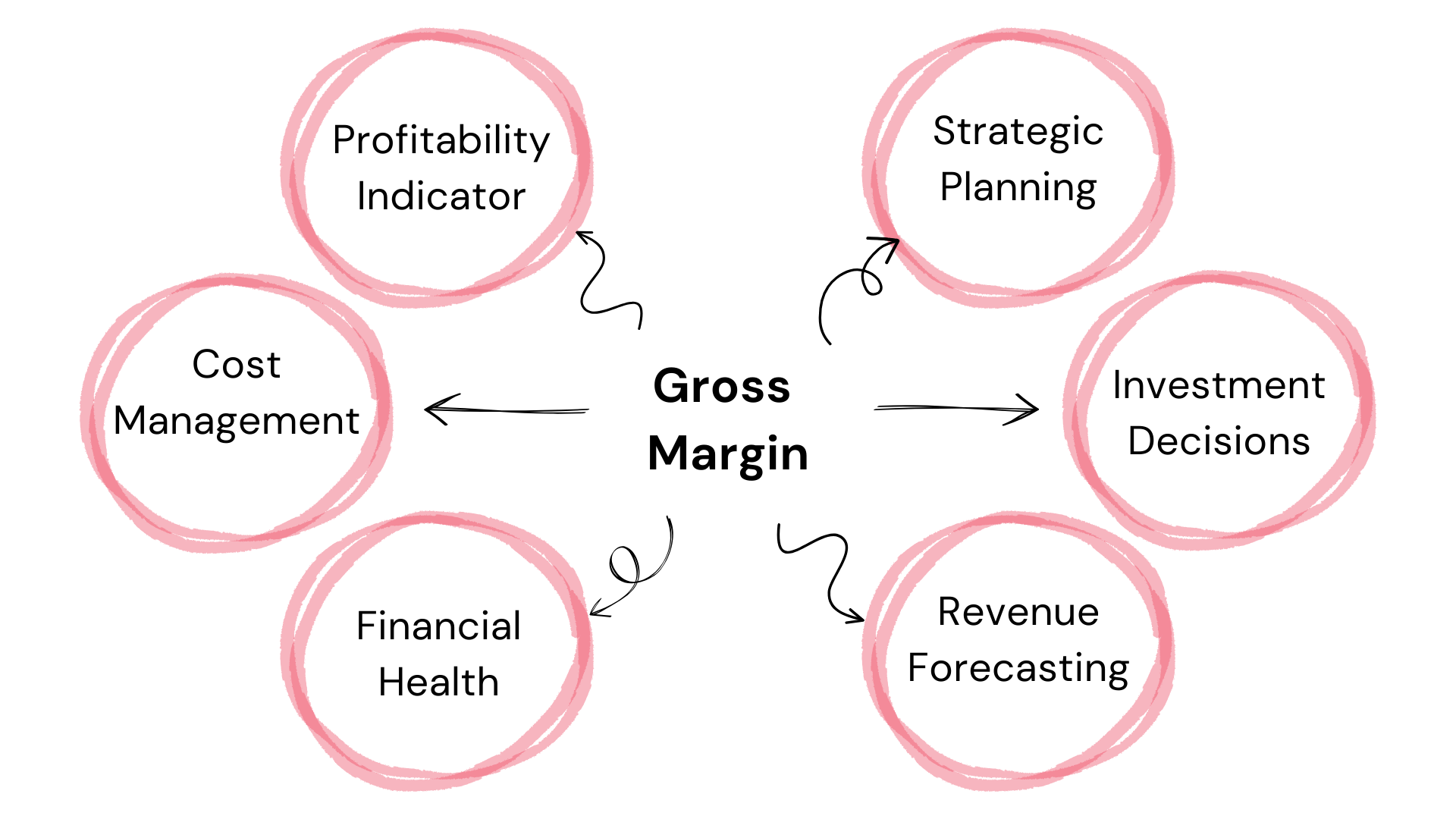

Gross Margin is a pivotal metric for several reasons:

1. Profitability Indicator: It provides a clear picture of a company’s profitability, excluding other operating expenses.

2. Pricing Strategy: Helps in determining pricing strategies. If the margin is too low, it might indicate the need for a price increase or a reduction in production costs.

3. Business Health: A consistently declining Gross Margin might indicate potential problems, such as rising production costs or pricing issues.

4. Investment Decisions: Investors often look at Gross Margin to gauge the health and potential profitability of a business.

In the realm of PSA, where services are the primary deliverables, efficient financial management is essential. A healthy Gross Margin indicates that the company is effectively managing its service delivery costs.

Why Gross margin is so important?

Calculating Gross Margin

Formula:

Gross Margin Percentage = (Total Revenue−Cost of Goods Sold (COGS)/Total Revenue) × 100

Example:

Let’s say a PSA company has a total revenue of $1,000,000 and the COGS (cost of delivering the services) is $600,000.

Gross Margin Percentage=(1,000,000−600,000/1,000,000)×100=40

This means for every dollar earned, 40 cents is gross profit, which can be used to cover other expenses or counted as net profit.

Gross Margin vs Other Financial Metrics

Understanding the difference between these metrics is crucial for financial management in professional services. Gross Margin should not be confused with other financial metrics:

1. Net Profit Margin: While Gross Margin focuses solely on COGS, Net Profit Margin takes all expenses into account, including operational, administrative, and other expenses.

2. Operating Margin: This considers only the cost of goods sold and operational expenses, excluding interest, taxes, and other non-operational costs.

| Financial Metric | Definition | Importance in PSA |

|---|---|---|

| Gross Margin | (Revenue – Cost of Goods Sold) / Revenue | Measures profitability on each sale |

| Net Profit Margin | (Net Profit / Revenue) * 100% | Indicates overall profitability |

| Operating Margin | (Operating Income / Revenue) * 100% | Shows profitability from operations |

| EBITDA Margin | (EBITDA / Revenue) * 100% | Evaluates operational efficiency |

Application of Gross Margin in Business

For PSA businesses, tools like KEBS resource management software can help in optimizing costs and improving Gross Margin. Gross Margin is not just a static number; it’s a tool for business growth:

1. Resource Allocation: By understanding which services or products have the highest Gross Margin, businesses can allocate resources more effectively, ensuring maximum profitability.

2. Budgeting and Forecasting: It aids in budgeting and forecasting, helping businesses plan for the future.

3. Strategic Decision Making: With insights from Gross Margin, businesses can make strategic decisions, such as entering new markets or discontinuing underperforming services.

Ready to Optimize Your Gross Margin?

KEBS, a leading PSA software, offers tools that can help businesses optimize their Gross Margin:

With KEBS finance management software, businesses can get a clear view of their revenues and costs, helping them make informed decisions. Ensure optimal resource allocation with tools like employee 360 and timesheet management. Using features like Gantt charts, businesses can ensure projects are completed within budget, positively impacting Gross Margin.

KEBS Finance Management

In the competitive world of professional services, understanding and optimizing Gross Margin is crucial. With the right tools and strategies, businesses can ensure profitability and growth. Ready to optimize your Gross Margin? Contact KEBS or request a demo today.