Home » PSApedia

Market capitalization

Discover Insights on Market Capitalization. Optimize Investment Strategies – Your Guide to Informed Financial Decision-Making!

What Is Market Capitalization?

Market Capitalization, often abbreviated as Market Cap, is a critical financial metric in the world of Professional Service Automation (PSA). It represents the total value of a company’s shares of stock. Simply put, it’s what the market thinks a company’s total value is.

For businesses in PSA, understanding market cap is vital as it reflects the company’s size, stability, and growth potential, impacting strategic decisions and investor relations.

The Importance of Market Capitalization in PSA

In the realm of PSA, market capitalization is more than just a number. It’s a reflection of a company’s market strength and stability. A higher market cap often indicates a company’s ability to fund development, attract top talent, and compete effectively. It’s a key indicator used by investors to gauge the health and potential of a company, influencing investment decisions and funding.

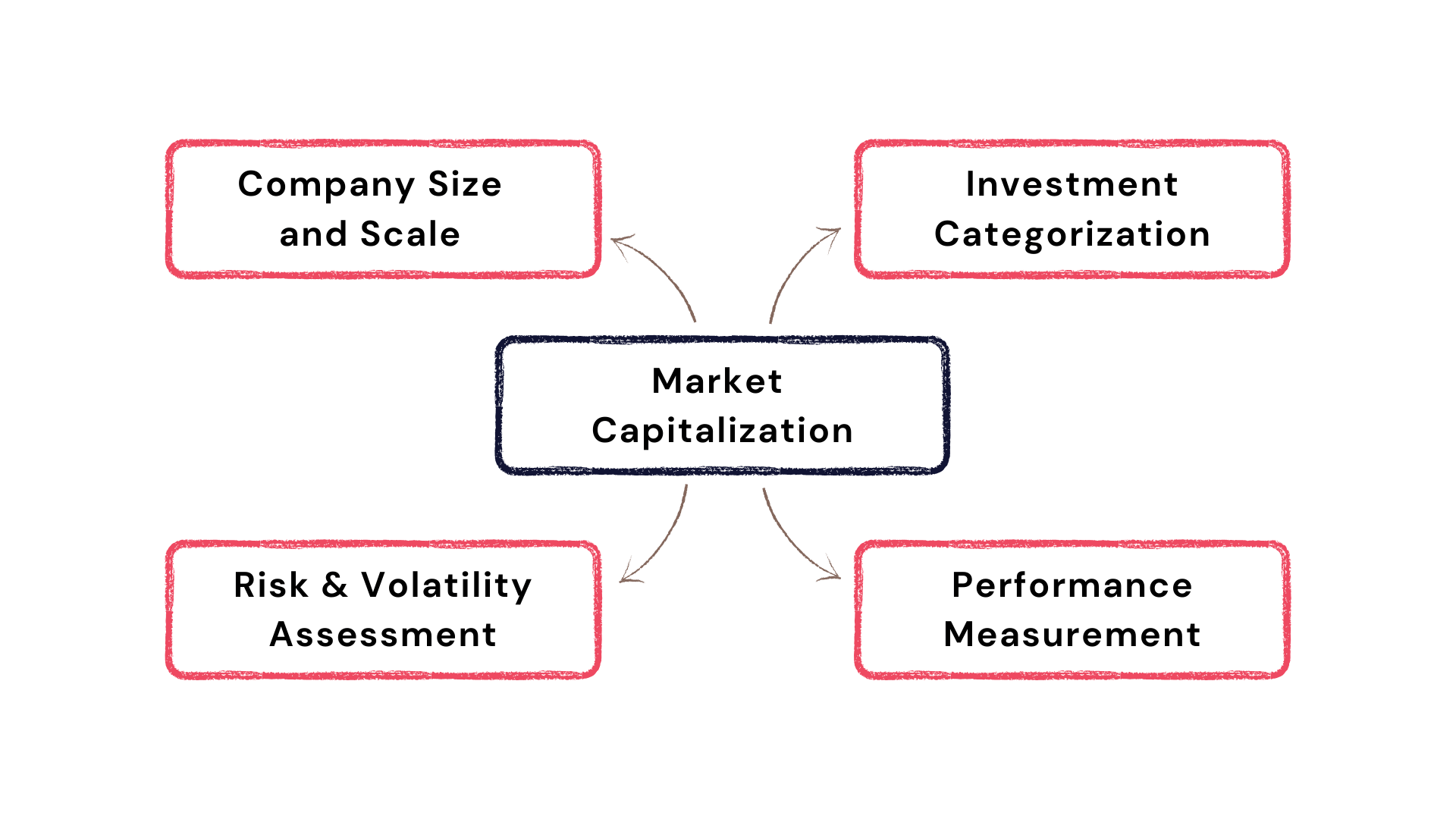

Market capitalization is vital for several reasons:

1. Investment Decisions: It helps investors assess the size and stability of a company.

2. Risk Assessment: Generally, larger companies with higher market caps are considered less risky than smaller companies.

3. Portfolio Diversification: Market cap is used to categorize stocks into large-cap, mid-cap, and small-cap, aiding in diversification strategies.

4. Benchmarking: It’s a standard metric for comparing companies within the same industry or sector.

The Importance of Market Capitalization

How to calculate Market Capitalization?

The formula for calculating market capitalization is straightforward:

Market Capitalization = Current Share Price × Total Number of Outstanding Shares

For instance, if a PSA company has 2 million shares outstanding, each priced at $30, the market cap would be $60 million. This simple calculation provides a quick snapshot of the company’s market value.

Differentiating Market Capitalization from Other Financial Metrics

Market capitalization is often compared with other financial metrics such as Enterprise Value (EV), Book Value, and Revenue. Unlike EV, which includes debt and excludes cash reserves, market cap focuses solely on equity value. Book value, representing the net asset value, can differ significantly from market cap, which is influenced by market perceptions and future growth prospects. Market capitalization is one of many metrics used to evaluate a company’s value. It’s different from:

1. Enterprise Value (EV): Includes debt and excludes cash in valuing a company.

2. Book Value: Based on the company’s balance sheet, representing the value of its total assets minus liabilities.

Each metric offers a different perspective on a company’s financial health and valuation.

| Metric | Definition | Relation to Market Capitalization |

|---|---|---|

| Market Capitalization | Total value of a company’s outstanding shares | Represents the overall valuation of a company based on its stock price |

| Earnings Per Share (EPS) | Net earnings divided by the total number of outstanding shares | Affects stock price and hence, market cap |

| Price-to-Earnings (P/E) Ratio | Ratio of a company’s stock price to its earnings per share | Influences the stock price and, subsequently, market capitalization |

| Price-to-Book (P/B) Ratio | Ratio of a company’s stock price to its book value per share | Impacts the market’s perception of the company’s worth and market cap |

Enhancing Market Capitalization Strategies in PSA

For PSA companies, strategies to enhance market capitalization often involve improving operational efficiency, innovation, and customer satisfaction. This includes effective project management, optimizing resource allocation, and enhancing service delivery. By focusing on these areas, PSA companies can improve their market standing, attract more investors, and increase their market cap.

Market cap plays a significant role in shaping investment strategies:

1. Asset Allocation: Investors use market cap to allocate assets across different sizes of companies.

2. Performance Analysis: Comparing companies of similar market caps can help investors identify over- or under-performing stocks.

Ready to Optimize Your Market Capitalization?

KEBS, a comprehensive PSA software, plays a crucial role in optimizing market capitalization. It streamlines various business processes, from project management to financial management, enhancing operational efficiency and profitability. Features like the KEBS timesheet system and proposal builder integrate essential business functions, supporting growth in market cap.

KEBS offers tools to efficiently manage client interactions and history, crucial for long-term value creation. With KEBS, businesses gain analytics for understanding market trends and client preferences, informing strategic decisions that can positively impact market cap.

KEBS Finance Management

For a deeper understanding of how KEBS can enhance your business market capitalization, explore our case studies, or contact us for a personalized demo.