Home » PSApedia

Account Payable Turnover Ratio

Account Payable Turnover Ratio measures a company's efficiency in paying its suppliers and managing its outstanding liabilities.

What is Account Payable Turnover Ratio (APTR)?

The Account Payable Turnover Ratio (APTR) is a financial metric that provides insight into how a company manages its payables or money owed to suppliers. It measures how frequently a business pays off its suppliers within a certain period—typically a year. The higher the ratio, the more often the company is paying its suppliers.

To calculate APTR, you divide the total cost of sales (or purchases) by the average accounts payable during the period.

Why Is APTR So Important?

APTR is a key barometer of a company’s financial health, revealing how efficiently it’s managing its short-term obligations. A higher APTR indicates that the company is paying off its suppliers at a quicker pace, which could mean it has robust cash flow management.

However, it could also signify that the company is not taking full advantage of credit terms offered by suppliers, which might affect its cash flow. Conversely, a low APTR might indicate that a company is struggling to pay its bills on time, which could signal cash flow problems or poor relationships with suppliers.

Importance of ATPR

How to Calculate the APT Ratio

Calculating the APT Ratio is relatively simple, as we discussed earlier. But let’s walk through a practical example to illustrate the process:

APT Ratio = Average Accounts Payable/Net Credit Purchases

Example: XYZ Corporation had net credit purchases of $500,000 during the year. Their average accounts payable balance was $75,000.

APT Ratio=75,000/500,000 =6.67

In this case, XYZ Corporation’s APT Ratio is 6.67, which means they turned over their accounts payable approximately 6.67 times during the year.

APTR vs. Cash Conversion Cycle

While APTR shows how often a company pays its suppliers, the Cash Conversion Cycle (CCC) provides a broader view of the company’s cash flow management. CCC measures the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

Although both are important liquidity metrics, they offer different insights. While a shorter CCC is generally better, the ideal APTR can vary depending on industry standards and the specific credit terms with suppliers.

How is APTR Used?

APTR is primarily used by management and investors to assess a company’s liquidity and cash management efficiency. It can also be used to benchmark a company against industry peers or track its performance over time.

For instance, a sudden drop in APTR could signal potential cash flow issues, prompting further investigation. On the other hand, a steady or improving APTR could indicate that the company is managing its cash effectively.

APTR vs. Debtor Turnover Ratio

| Aspect | Average Payment Turnover Ratio (APTR) | Debtor Turnover Ratio |

| Definition | Measures how quickly a company pays its suppliers | Measures how quickly a company collects payments from its customers |

| Formula | Total Credit Purchases / ((Opening Accounts Payable + Closing Accounts Payable) / 2) | Total Credit Sales / ((Opening Accounts Receivable + Closing Accounts Receivable) / 2) |

| Focus | Focuses on accounts payable and supplier relationships | Focuses on accounts receivable and customer relationships |

| Interpretation | Higher APTR indicates quicker payment to suppliers | Higher Debtor Turnover Ratio indicates faster collection of receivables |

| Importance | Helps assess a company’s liquidity and supplier management | Helps evaluate a company’s cash flow and credit management |

| Benchmark | Industry-specific benchmarks vary | Industry-specific benchmarks vary |

| Usage | Useful for suppliers and creditors | Useful for lenders, investors, and shareholders |

| Aspect | Average Payment Turnover Ratio (APTR) | Debtor Turnover Ratio |

| Definition | Measures how quickly a company pays its suppliers | Measures how quickly a company collects payments from its customers |

| Formula | Total Credit Purchases / ((Opening Accounts Payable + Closing Accounts Payable) / 2) | Total Credit Sales / ((Opening Accounts Receivable + Closing Accounts Receivable) / 2) |

| Focus | Focuses on accounts payable and supplier relationships | Focuses on accounts receivable and customer relationships |

| Interpretation | Higher APTR indicates quicker payment to suppliers | Higher Debtor Turnover Ratio indicates faster collection of receivables |

| Importance | Helps assess a company’s liquidity and supplier management | Helps evaluate a company’s cash flow and credit management |

| Benchmark | Industry-specific benchmarks vary | Industry-specific benchmarks vary |

| Usage | Useful for suppliers and creditors | Useful for lenders, investors, and shareholders |

While APTR focuses on the money a company owes, the Debtor Turnover Ratio (DTR) looks at the money owed to the company by its customers. DTR measures how quickly a company collects payment from its customers after a sale has been made.

Just like APTR, DTR is a crucial liquidity metric. However, while a higher APTR might not always be ideal, a higher DTR is generally preferable as it indicates faster collection of accounts receivable, improving the company’s cash flow.

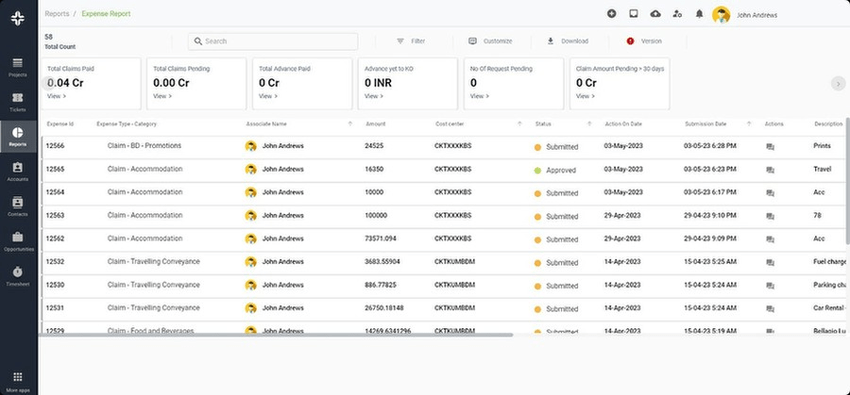

Leveraging APTR with KEBS

KEBS, a leading Professional Services Automation Software, can help companies optimize their APTR by providing real-time insights into their accounts payable. By integrating all financial data into a single platform, KEBS allows for easy tracking and analysis of APTR.

KEBS Finance Management

Moreover, with its advanced analytics capabilities, KEBS can help identify trends, detect potential issues, and facilitate strategic decision-making. So, are you ready to optimize your APTR with KEBS?

Achieve Budget Optimization and Revenue Maximization. Take control of your finances and streamline financial processes using KEBS.

Try KEBS Demo, If you have any questions, need assistance, or want to get in touch with KEBS, don’t hesitate to contact us.