Home » PSApedia

Cash Conversion Cycle

Duration from purchasing inventory to receiving cash conversion cycle

What is Cash Conversion Cycle (CCC)?

Cash conversion cycle (CCC) refers to the length of time (number of days) that it takes for a company to convert its resources (inventory and other short-term commitments like accounts receivable) into cash. It is a measure of how efficiently a company manages its balance sheet and generates cash through its operations.

The Cash Conversion Cycle (CCC) is a vital metric that measures the time it takes a company to convert its investments in inventory and other resources into cash flows from sales. In simpler terms, CCC helps businesses understand how long they are tied up in each stage of the production and sales process before it turns into cash.

Why Is CCC So Important?

The significance of Cash Conversion Cycle lies in its ability to reveal how efficiently a company is managing its working capital. A shorter cycle indicates that a company quickly recovers its investments, which can be beneficial for liquidity.

Conversely, a longer cycle could imply potential problems with inventory turnover, receivables management, or payables. Therefore, tracking CCC helps companies identify areas of improvement in their operations.

Benefits of Cash Conversion Cycle

How to Calculate CCC with Formula and Example

Calculating the Cash Conversion Cycle involves three components: Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO). Here’s the formula:

CCC = DIO + DSO – DPO

DIO measures how long it takes a company to sell its inventory.

DSO determines how long it takes to collect cash from credit sales.

DPO calculates how long the company takes to pay its suppliers.

Let’s illustrate this with an example. Suppose Company A has a DIO of 30 days, DSO of 40 days, and DPO of 20 days. The CCC would be:

CCC = 30 (DIO) + 40 (DSO) – 20 (DPO) = 50 days

This means it takes Company A 50 days to turn its inventory purchases into cash.

The Difference Between CCC and Operating Cycle

The Cash Conversion Cycle is often compared with the Operating Cycle, but they are not the same. The Operating Cycle only considers the time taken to sell inventory and collect receivables, whereas the CCC also takes into account the time taken to pay suppliers. Thus, CCC provides a more comprehensive view of a company’s liquidity and operational efficiency.

In contrast, the Operating Cycle focuses solely on the time it takes to convert inventory into accounts receivable, providing a narrower view of a company’s liquidity and efficiency. While CCC offers a more comprehensive picture, the Operating Cycle provides a quicker snapshot of a company’s working capital management.

How CCC Is Used?

Businesses use the Cash Conversion Cycle to identify inefficiencies and potential cash flow problems. For instance, a long CCC may indicate that a company has too much money tied up in inventory or is not collecting receivables quickly enough.

By identifying these issues, companies can take steps to improve their CCC, such as better inventory management or tightening credit terms.

CCC vs ROI vs Profit Margin

While CCC, ROI (Return on Investment), and Profit Margin are all important financial metrics, they serve different purposes.

CCC measures the efficiency of a company’s working capital management, ROI evaluates the profitability of an investment, and Profit Margin shows the percentage of sales that has turned into profits.

Therefore, while CCC can influence ROI and Profit Margin, it’s essential to consider all three for a holistic view of a company’s financial health.

| Metric | Definition | Key Points |

| CCC (Cash Conversion Cycle) | Measures the time it takes to convert investments in inventory and other resources into cash flow. | – Reflects efficiency in managing working capital. – Lower CCC is better for liquidity and cash flow. |

| ROI (Return on Investment) | Evaluates the return generated from an investment relative to its cost. | – Expressed as a percentage. – Higher ROI indicates better investment performance. |

| Profit Margin | Represents the percentage of profit earned relative to revenue or sales. | – Key indicator of profitability. – Higher margin implies better profitability. |

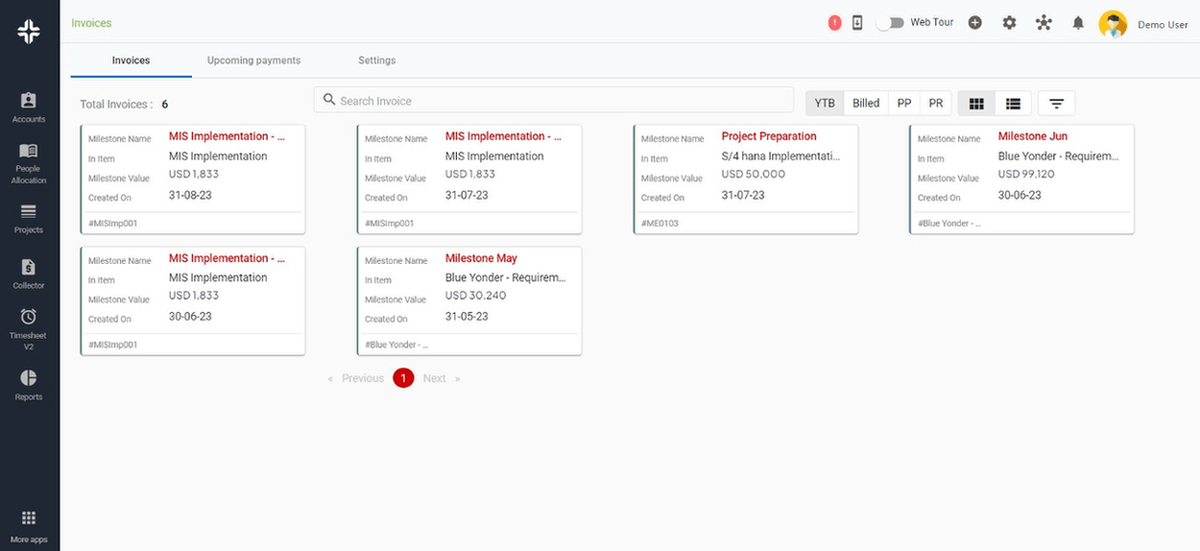

Ready to Update Your CCC with KEBS

KEBS, a top-tier PSA software, can help businesses optimize their Cash Conversion Cycle. By offering tools for inventory management, receivables tracking, and payable scheduling, KEBS empowers businesses to reduce their CCC, thereby improving liquidity and operational efficiency.

KEBS Invoices