Home » PSApedia

Average Fee Per Hour

Dive into Insights on Average Fee Per Hour. Optimize Billing Strategies and Maximize Revenue.

What is the Average Fee Per Hour?

The Average Fee Per Hour is a critical metric in the realm of Professional Service Automation (PSA). It represents the average charge per hour for services rendered by a business or professional.

This metric is pivotal in understanding and optimizing the Cost of Salaries Share in a company, particularly in service-oriented sectors where time and expertise are the primary commodities.

Importance of Understanding Average Fee Per Hour

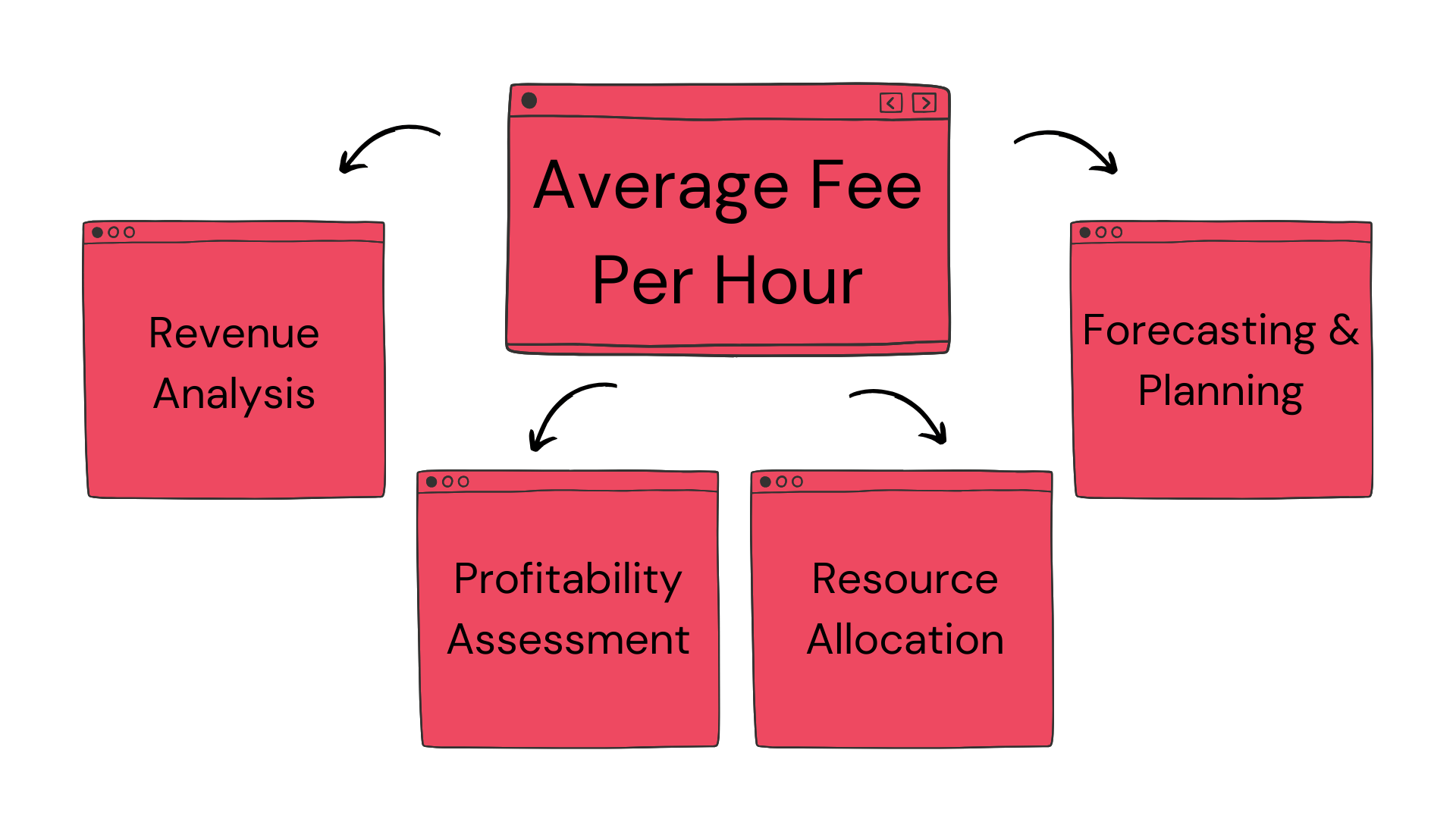

Understanding the Average Fee Per Hour is crucial for businesses, especially those in the service sector. It directly impacts profitability and efficiency. By analyzing this metric, companies can make informed decisions about pricing, resource allocation, and overall financial strategy. It’s a key component in maintaining competitive pricing while ensuring sustainable profit margins. The importance of this metric lies in:

1. Revenue Insight: Offers a clear picture of revenue generation per unit of service.

2. Pricing Strategy: Assists in developing competitive and profitable pricing models.

3. Resource Value: Helps in understanding the value generated by different resources or services.

Managing this metric effectively is key to the financial health of service-driven businesses, influencing everything from resource allocation to client billing.

Importance of Understanding Average Fee Per Hour

Calculating Average Fee Per Hour

To calculate the Average Fee Per Hour, divide the total fees earned by the total number of hours worked. For example, if a consultant earns $10,000 over 100 hours of work, their average fee per hour would be $100. This simple yet effective formula provides a clear view of earning efficiency and is essential for financial planning.

Formula: Average Fee Per Hour = Total Fees Earned / Total Hours Worked

Example: If a firm earned $10,000 over 100 hours of service, the Average Fee Per Hour would be:

Average Fee Per Hour = $10,000 / 100 = $100

This means, on average, the firm charges $100 for each hour of service.

Average Fee Per Hour vs Other Billing Metrics

Understanding these differences enhances financial management in PSA. While the Average Fee Per Hour is a valuable metric, it’s important to distinguish it from other billing metrics like fixed fees or retainer models. Unlike fixed fees, which are predetermined regardless of time spent, the average fee per hour fluctuates based on the actual hours worked. Understanding these differences is crucial for effective financial management. It’s essential to differentiate this metric from others like:

1. Billable Hours: The total hours billed to clients. Unlike Average Fee Per Hour, it doesn’t provide insight into revenue efficiency.

2. Utilization Rate: Measures the proportion of billable hours against total working hours. It focuses more on resource allocation than revenue.

| Metric | Definition | Importance / Use |

|---|---|---|

| Average Fee Per Hour | Average rate charged to clients per billable hour | Reflects pricing strategy and revenue generation |

| Utilization Rate | Percentage of billable hours compared to total available hours | Measures efficiency in utilizing available time for revenue generation |

| Billing Accuracy | Accuracy of invoicing and billing processes | Ensures correct charges to clients, reducing errors and disputes |

| Collection Period | Time taken to collect payments from clients | Measures cash flow efficiency and financial management |

Application of Average Fee Per Hour in Business

The Average Fee Per Hour is widely used in various business applications. It helps in setting billing rates, estimating project costs, and managing client expectations. In Professional Service Automation, this metric is integral to resource management, project financials, and overall business strategy.

1. Pricing Adjustments: Regular analysis allows for dynamic pricing strategies.

2. Resource Evaluation: Identifying which services or employees yield a higher average fee.

3. Client Negotiations: Informs discussions around contract terms and project management.

4. Performance Benchmarking: Sets benchmarks for efficiency and profitability.

Ready to Optimize Your Average Fee Per Hour?

KEBS, a leading PSA Software, plays a pivotal role in optimizing the Average Fee Per Hour. It offers tools for time tracking, resource allocation, and financial analytics, enabling businesses to maximize their earnings and efficiency.

By leveraging KEBS, companies can streamline their operations, from project management to client billing, ensuring a more profitable and sustainable business model.

KEBS Finance Management

For a more detailed exploration of how KEBS can enhance your business financial performance and optimize your Average Fee Per Hour, feel free to contact us or request a demo.