What is Initial Mark-up?

Initial mark-up refers to the difference between the cost of a product or service and its selling price. In the context of PSA, it’s the difference between the cost of delivering a service and the price charged to the client.

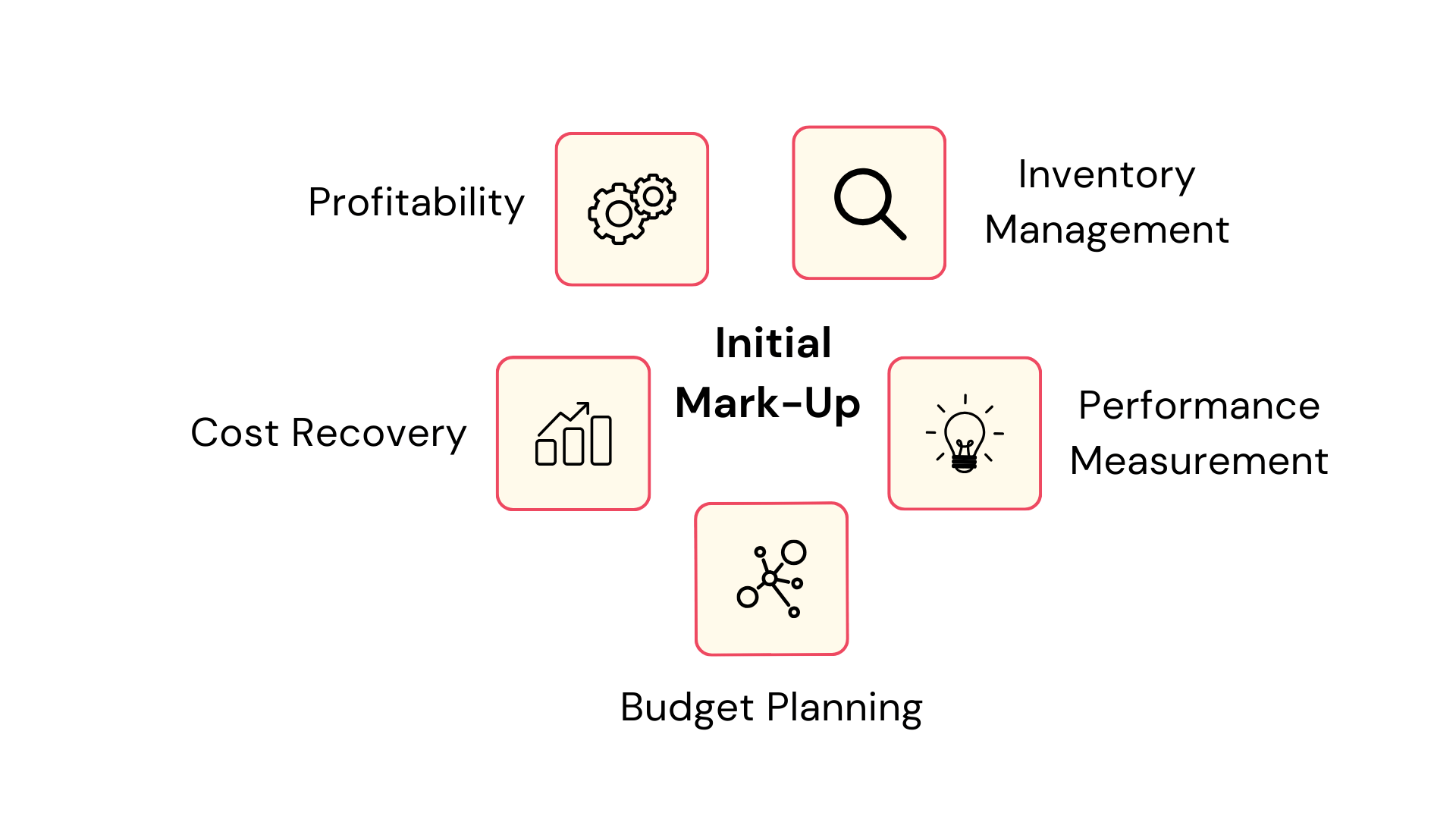

This metric is essential for businesses to ensure profitability and cover operational expenses.

Importance of Initial Mark-up

The significance of initial mark-up in PSA cannot be overstated. It:

1. Determines Profitability: A correct mark-up ensures that businesses cover their costs and earn a profit.

2. Informs Pricing Strategy: It helps in setting competitive prices while ensuring profitability.

3. Financial Planning: Understanding mark-up helps in forecasting revenue and planning budgets.

Importance of Initial Mark-up

Calculating Initial Mark-up

Formula:

Initial Mark-up = Selling Price − Cost of Service

Example:

Suppose a PSA firm offers a service costing $1000 to deliver. If they charge the client $1500, the initial mark-up is:

(Initial Mark-up) = $1500 – $1000 = $500

Initial Mark-up vs Other Financial Metrics

While initial mark-up focuses on the difference between cost and selling price, other metrics like Gross Profit Margin or Net Profit Margin consider additional operational costs and net profit respectively. For instance, Gross Profit Margin takes into account the direct costs associated with service delivery, while Net Profit Margin considers all operational expenses.

Understanding the distinction between these metrics is crucial for efficient financial management.

| Metric | Definition | Use in PSA |

|---|---|---|

| Initial Mark-up (IMU) | The difference between the cost and selling price of services at the start. It represents the initial profit margin. | Used to assess the profitability of individual projects or service contracts, helps in pricing strategies. |

| Gross Profit Margin | The percentage difference between revenue and the cost of services. It accounts for all direct costs, not just the initial ones. | Measures overall profitability, considers all direct costs, including labor and materials. |

| Net Profit Margin | The percentage difference between revenue and all costs, including indirect costs (overheads) and taxes. | Provides a comprehensive view of profitability, considering all costs and taxes. |

| Contribution Margin | The percentage difference between the selling price and variable costs. It helps understand the contribution of each service to covering fixed costs. | Useful for assessing the impact of individual services on covering business overheads. |

Application of Initial Mark-up in PSA

In PSA, initial mark-up plays a pivotal role:

1. Project Budgeting: By understanding the mark-up, firms can set project budgets that ensure profitability.

2. Resource Allocation: Firms can allocate resources more efficiently, ensuring that high-cost projects have higher mark-ups.

3. Client Negotiations: With a clear understanding of costs and desired mark-ups, firms can negotiate client contracts more effectively.

For a deeper dive into resource allocation, check out this article.

Ready to Optimize Your Initial Mark-up?

KEBS, a leading PSA software, offers tools that can help businesses optimize their initial mark-up. KEBS provides detailed insights from resource management to project management.

Using KEBS, businesses can forecast future costs and revenues, helping them set mark-ups that ensure profitability in the long run.

KEBS Finance Management

For businesses looking to streamline their financial processes, KEBS offers a comprehensive finance management solution. Additionally, for those keen on understanding the intricacies of project financials, this whitepaper can be an invaluable resource. Ready to take your financial management to the next level? Contact us or request a demo today!