Home » PSApedia

Operating Cash Flow Ratio

Enhance Your Business Stability with the Operating Cash Flow Ratio.

What is Operating Cash Flow Ratio?

The Operating Cash Flow Ratio (OCFR) is a financial metric that indicates a company’s ability to cover its short-term liabilities using the cash generated from its core operations. In essence, it measures the number of times a company can pay off its current liabilities using its operating cash flow.

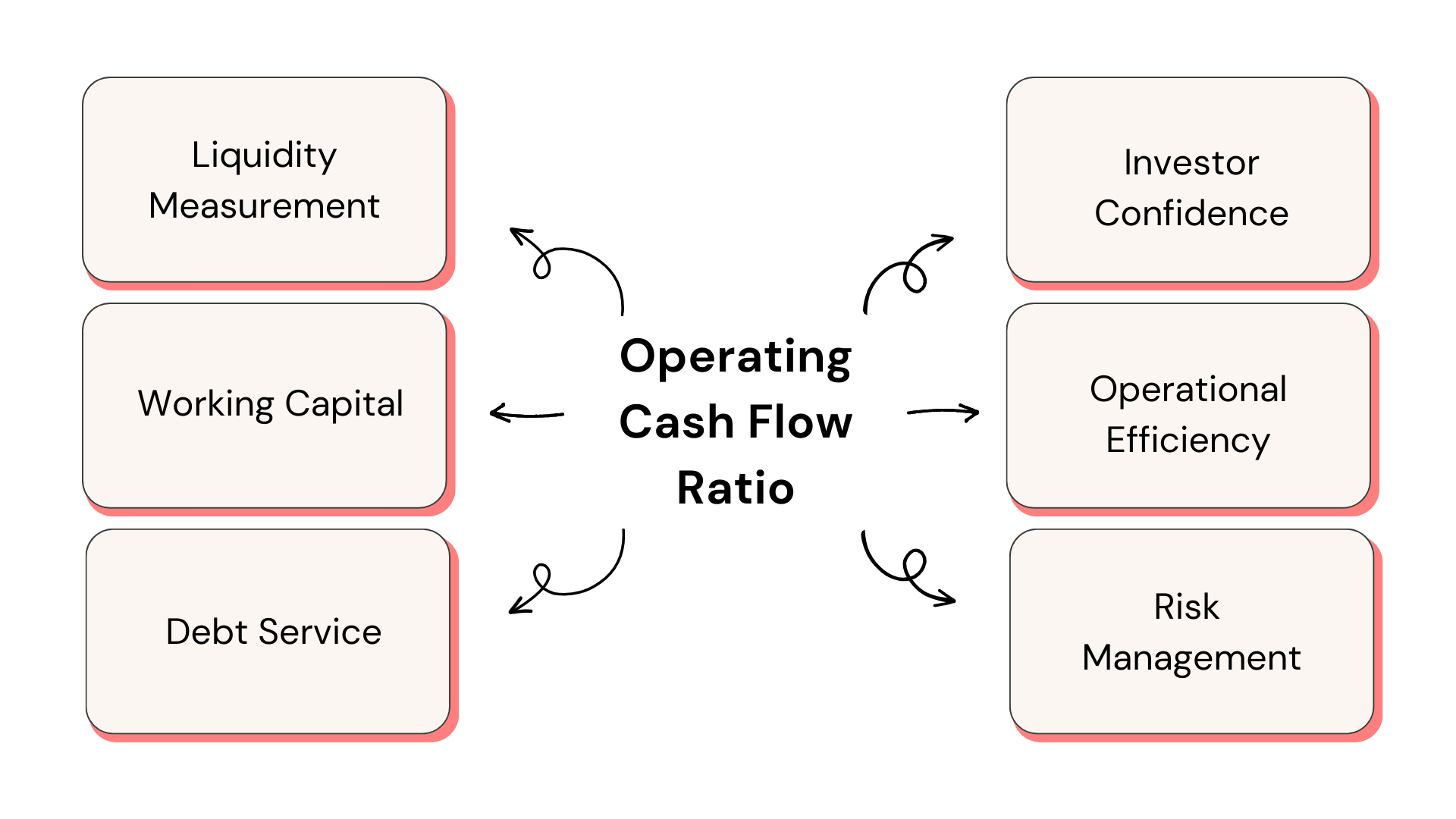

Importance of Operating Cash Flow Ratio

A healthy OCFR is crucial for businesses, especially in the Professional Service Automation (PSA) sector. Here’s why:

1. Liquidity Assessment: OCFR provides insights into a company’s liquidity position. A higher ratio indicates better liquidity, ensuring that the company can meet its short-term obligations.

2. Operational Efficiency: A consistent and positive OCFR highlights efficient operations. In the context of PSA, it signifies effective project management, resource allocation, and billing processes.

3. Investor Confidence: Investors and stakeholders often scrutinize this ratio. A favorable OCFR can boost investor confidence, as it indicates the company’s ability to generate cash from its primary activities.

Importance of Operating Cash Flow Ratio

Calculating Operating Cash Flow Ratio

Formula:

Operating Cash Flow Ratio = Operating Cash Flow / Current Liabilities

Example:

Let’s consider a PSA company, XYZ Corp. If its operating cash flow for the year is $500,000 and its current liabilities amount to $250,000, its OCFR would be:

OCFR=500,000/250,000=2

This means XYZ Corp can cover its current liabilities twice over with the cash generated from its operations.

Operating Cash Flow Ratio vs Other Financial Ratios

While OCFR focuses on cash from operations against current liabilities, other financial ratios offer different perspectives:

1. OCFR vs Current Ratio: While both assess liquidity, the current ratio uses current assets instead of operating cash flow. It provides a broader view of a company’s short-term financial health.

2. OCFR vs Quick Ratio: The quick ratio excludes inventory from current assets. It’s a stricter measure of liquidity, especially relevant for service-based sectors like PSA.

| Financial Ratio | Description | Relevance to Professional Service Automation |

|---|---|---|

| Operating Cash Flow Ratio | Measures the ability to generate cash from operations. A higher ratio indicates better cash flow efficiency. | Important for assessing the financial health and liquidity of a professional service automation firm. |

| Profit Margin | Measures the percentage of profit relative to total revenue. | Crucial for evaluating the profitability of professional service automation services. High-profit margins are indicative of effective cost management and service delivery. |

| Debt to Equity Ratio | Compares a firm’s debt to its equity, indicating its reliance on debt for financing. | Important for understanding the capital structure and risk associated with professional service automation companies. Lower debt ratios can signify financial stability. |

| Revenue Growth Rate | Represents the increase in revenue over a specific period. | Essential for tracking the expansion and market growth of professional service automation firms. A positive growth rate indicates a thriving business. |

Application of Operating Cash Flow Ratio

In the PSA domain, OCFR plays a pivotal role:

1. Project Financing: PSA companies often juggle multiple projects. A robust OCFR ensures they have enough cash to finance upcoming ventures without relying heavily on external funding.

2. Resource Allocation: Efficient resource management is vital in PSA. A healthy OCFR indicates that resources, both human and capital, are being utilized effectively.

3. Billing and Revenue Recognition: OCFR can highlight issues in the billing process. For instance, if a PSA company has a low OCFR despite high revenues, it might indicate delays in revenue recognition or inefficiencies in the billing system.

Ready to Optimize Your Operating Cash Flow?

KEBS, a leading PSA software, can be instrumental in enhancing a company’s OCFR. KEBS streamlines the billing process, ensuring timely invoicing and revenue recognition. This positively impacts the operating cash flow. Discover more about KEBS’s financial management capabilities here.

With tools like employee 360, KEBS ensures optimal resource allocation, driving operational efficiency and, consequently, cash flow. KEBS project management features ensure projects stay on track, reducing delays and cost overruns, which can strain cash flows.

KEBS Finance Management

With tools like KEBS, businesses can ensure they maintain a robust OCFR, positioning themselves for growth and profitability. Ready to optimize your cash flow? Contact us or request a demo today!