Home » PSApedia

Payroll Cost as a Percentage of Revenue

Gauge Business Performance with Payroll Cost as a Percentage of Revenue.

What is Payroll Cost as a Percentage of Revenue?

Payroll Cost as a Percentage of Revenue is a financial metric that represents the proportion of a company’s revenue that is spent on employee salaries, wages, and benefits.

It provides insights into how efficiently a company is managing its human resources in relation to its revenue generation.

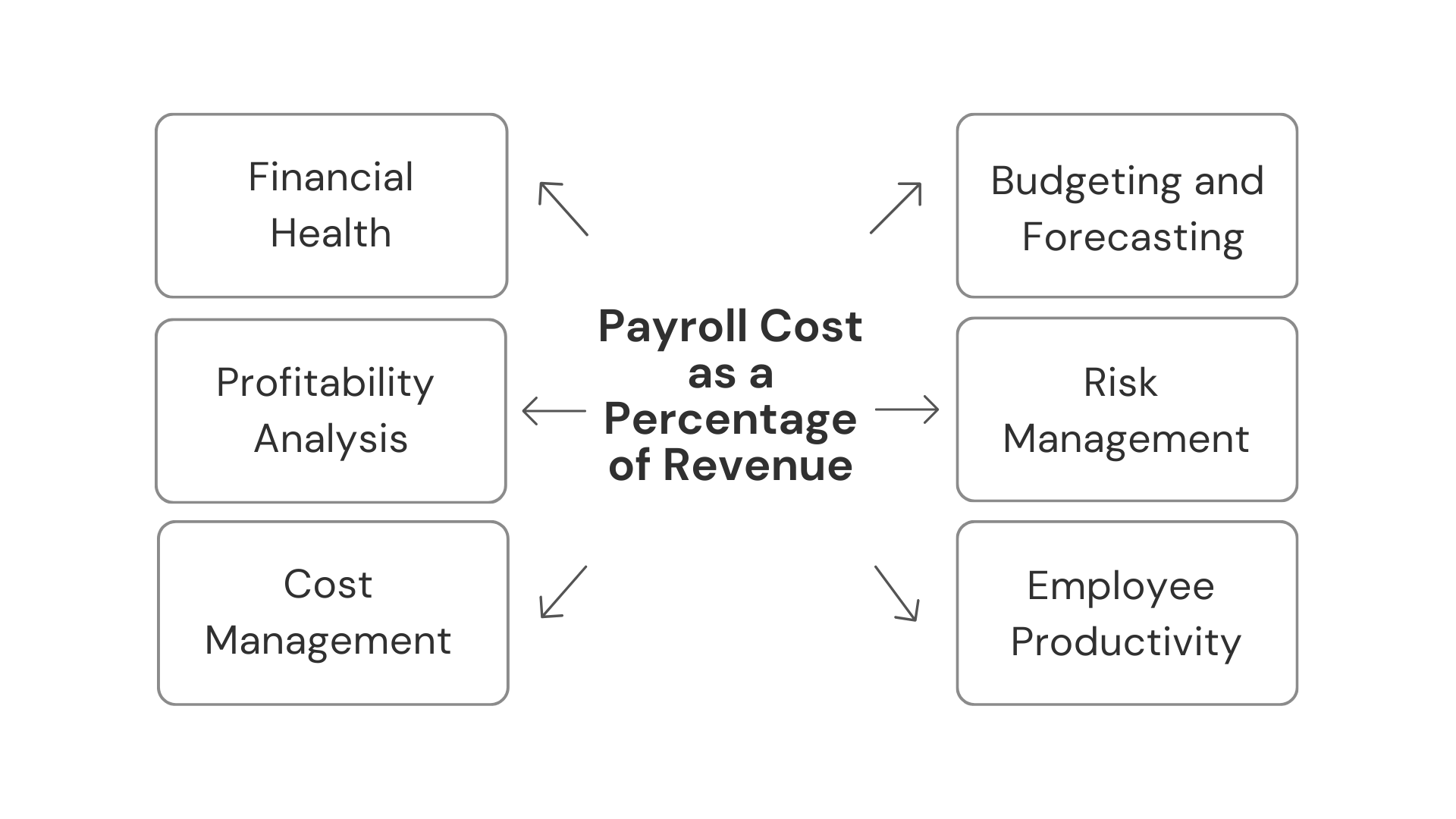

Importance of Payroll Cost as a Percentage of Revenue

Understanding this metric is crucial for businesses, especially those in the Professional Service Automation (PSA) sector. Here’s why:

1. Budgeting and Forecasting: It aids in budgeting and forecasting by providing a clear picture of the company’s largest expense relative to its income.

2. Operational Efficiency: A lower percentage indicates that the company is generating more revenue for each dollar spent on payroll, suggesting operational efficiency.

3. Competitive Benchmarking: Companies can compare their metrics with industry standards or competitors to gauge their performance.

Payroll Cost as a Percentage of Revenue

How to Calculate Payroll Cost as a Percentage of Revenue?

Formula:

Payroll Cost as a Percentage of Revenue = (Total Payroll Cost / Total Revenue) × 100

Example:

Let’s assume a company has a total payroll cost of $500,000 and total revenue of $2,000,000.

Payroll Cost as a Percentage of Revenue=(500,000/2,000,000)×100=25%

This means 25% of the company’s revenue is spent on payroll.

Difference Between Payroll Cost as a Percentage of Revenue and Other Metrics

While this metric focuses on payroll costs relative to revenue, other metrics like Gross Profit Margin or Operating Margin consider other costs. For instance, Gross Profit Margin considers the Cost of Goods Sold (COGS), which might include raw materials but not payroll. It’s essential to understand the nuances of each metric to make informed financial management decisions.

| Metric | Payroll Cost as a Percentage of Revenue | Billable Utilization Rate |

|---|---|---|

| Definition | Measures the percentage of a company’s revenue that is spent on payroll and employee-related costs. It reflects how much of the revenue is allocated to paying employees. | Measures the percentage of time employees spend on billable, revenue-generating tasks compared to their total available working hours. |

| Purpose | Evaluates the cost efficiency and financial sustainability of a professional service organization. High payroll costs as a percentage of revenue may indicate financial strain. | Evaluates the productivity of employees by measuring how effectively they utilize their time for billable work. |

| Key Insights | High payroll cost as a percentage of revenue may suggest that a company is spending a significant portion of its income on labor, which could impact profitability. | A lower billable utilization rate may indicate underutilized employees, leading to reduced revenue potential. |

| Management Focus | Management may aim to optimize workforce size and compensation structures to reduce payroll costs relative to revenue while maintaining quality. | Management may focus on improving employee scheduling and workload management to increase billable utilization and maximize revenue. |

How Payroll Cost as a Percentage of Revenue is Used?

1. Strategic Planning: Companies can set targets for this metric in their strategic plans, aiming to reduce it over time by increasing revenue, optimizing payroll, or both.

2. Resource Allocation: By understanding this metric, businesses can make informed decisions about hiring, salaries, and benefits. For instance, if the percentage is high, it might indicate overstaffing or high salaries relative to revenue.

3. Performance Evaluation: Managers can use this metric to evaluate the performance of departments or teams, especially in sectors like PSA where resource management is crucial.

Ready to Optimize Your Payroll Cost?

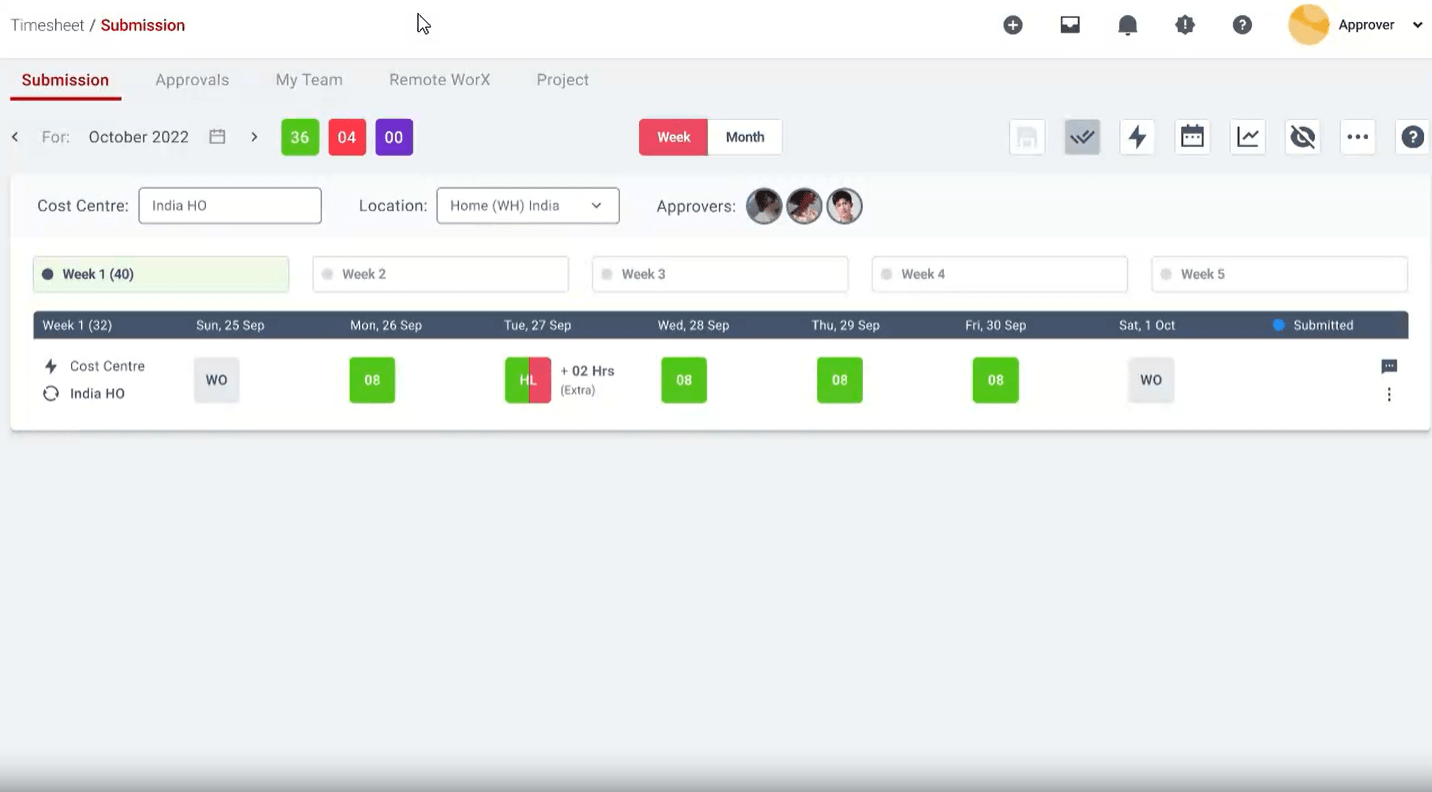

KEBS, a leading PSA Software, offers tools that can help businesses optimize their payroll costs. With features like timesheet management, employee 360, and financial management, KEBS provides insights and automation to ensure that businesses are getting the most out of every dollar spent on payroll.

Moreover, with KEBS project management tools, businesses can ensure that their projects are completed efficiently, leading to increased revenue and a lower payroll cost as a percentage of that revenue.

KEBS Time Tracking

Ready to optimize your payroll costs? Contact us today or request a demo to see how KEBS can transform your business.